CATEGORY

Water

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for Global Water Market

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Water.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

$110M is granted by New York for water quality improvements.

March 28, 2023Hyperion International Technologies is purchased by Integrated Water Services.

March 28, 2023The Industrial Water Service Business of the Former Bob Johnson & Associates is purchased by Evoqua Water Technologies from Kemco Systems.

March 20, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Water

Schedule a DemoWater Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoWater Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Water category is 8.10%

Payment Terms

(in days)

The industry average payment terms in Water category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

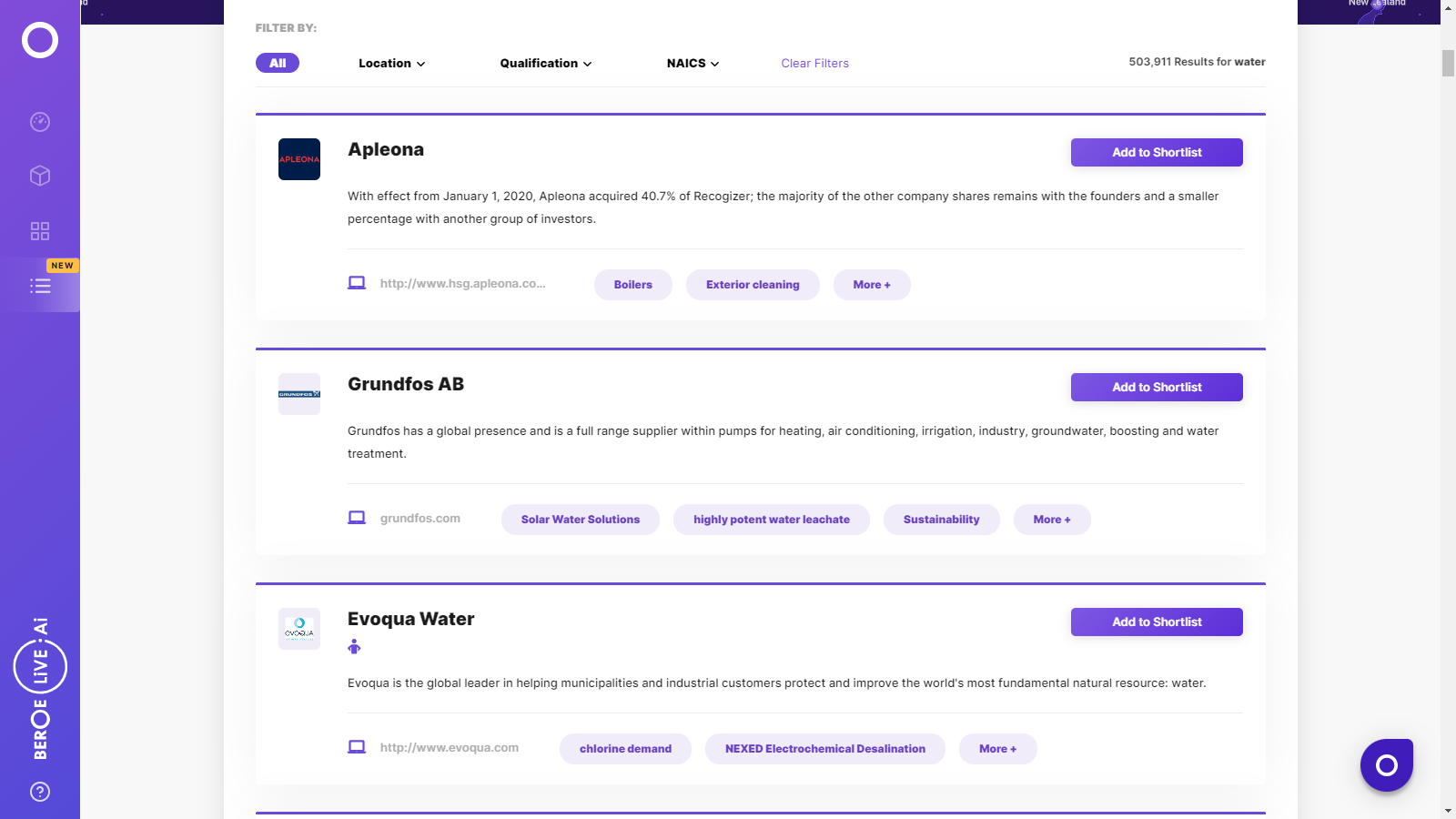

Water Suppliers

Find the right-fit water supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Water market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoWater market report transcript

-

Water is abstracted from ground or surface water resources by the water companies. The raw water collected is treated for drinking quality and distributed to the end users through supply network

-

The maintenance of water supply network is typically the responsibility of the water utility. Property owner might be responsible for some part of the pipelines in some cases

-

The wastewater from consumers is treated and then reused or disposed. If the consumers are connected to the sewage systems, water companies charges sewage

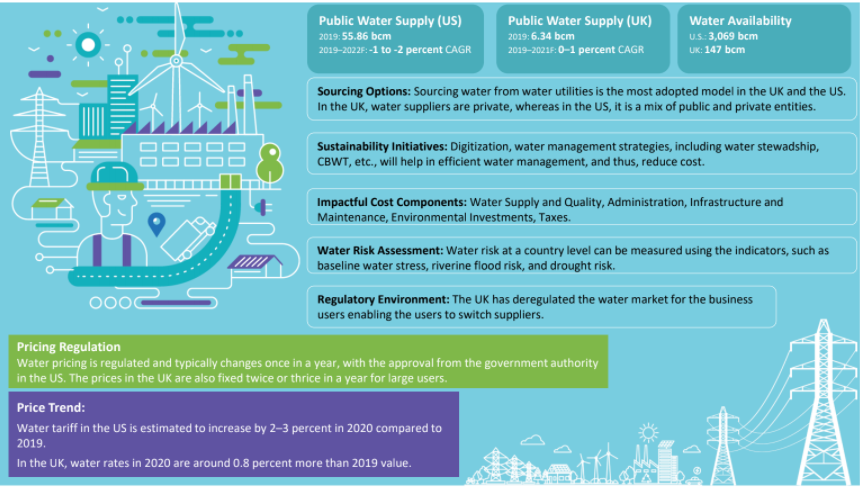

Global Market Outlook on Water Procurement

-

The water market operates within a country with utilities serving a specific area in the country. All the water utilities operate under the regulatory framework in a country

-

Water withdrawal rate from fresh water resources is witnessing a decline in the US. Water withdrawal could see a decline in the UK

Public Water Supply (US)

2022 E: 54.04 bcm

2022–2024F: 0 to -2 percent CAGR

Public Water Supply (UK)

2022 E: 6.38 bcm

2022–2024F: 0 to -1 percent CAGR

Price Trend:

-

In the US, the water boards typically sets water rates for one year. New York water rate was set at $4.3/ccf, effective from July 2022, until June 2023.

-

In the UK, water rates in 2023 were revised upward between 12 percent and 15 percent from the current prices for medium and large users.

Water Industry Structure : US

The water and wastewater market in the US is regulated both at Federal and state levels by EPA and respective State-level Public Utilities Commissions.

-

The water market in the US is tightly regulated at both Federal and state levels by EPA and PUCs, resulting in quality control, pricing, and environmental regulation

-

There are both public and privately owned water utilities, serving the end consumers with public-owned water utilities, having majority of the market share of 86 percent

-

Local authority is typically responsible for public water supply. Private players are present through contract from public institution (pubic–private partnership)

-

Water rates are regulated by state public utilities commissions. River basins acts as interstate administrative bodies, in terms of water usage

Water Industry Structure : UK

Separate regulatory authorities are established for the regulations in England, Scotland, Wales, and North through which the water industry is controlled.

-

Subsequent to the privatization of water companies in the UK, the federal states (England, Wales, Scotland, and North Oreland) regulate the water supply through different regulatory bodies

-

Environmental, economical, and drinking water regulations have separate regulatory authorities

-

The water and wastewater suppliers in England, Scotland, Wales, and Northern Ireland have created the association: Water UK and through which it engages with the regulatory bodies

-

The water prices are regulated by Ofwat (Water Services Regulation Authority) in England and Wales for the residential consumers

Cost Structure: Water Supply

Water treatment to maintain quality, distribution, infrastructure, maintenance, customer service etc., are major cost components of the supply charge.

-

Water cost factors include cost for water collection and pre-treatment distribution facilities, cost of treatment, operation and maintenance of pipe network, administrative and customer management services

-

Water quality and Supply: This involves the cost to treat water and supply

-

Infrastructure and Maintenance: Cost to operate and maintain infrastructure including pipelines. Cost for infrastructure replacement will also include under this

-

Administration and Security: This mainly involves all the administrative and security costs to run the systems

-

Customer Service: Water supply is a utility service and customer service to address issues including supply disruption, water quality etc., also require a certain percentage of the total water tariff

Supply Trends and Insights : Water

Supplier Types

-

Water utilities operates within a country and most companies serves a specific region or locality.

-

UK: In the UK. water market has 22 water suppliers. Each supplier is responsible for water supply in a particular region

-

Water market in the UK is deregulated for business users and hence the customers has the option to switch water suppliers in the retail market

-

In the UK (except in Scotland and Northern Ireland), private suppliers are responsible for water supply to the public. The companies either supply only water or they offer water and wastewater treatment services

-

US: In the US, water utilities typically operates under public municipal administration. Water companies can invest in water assets and increase their geographical reach and size

Suppler Trends

-

Water utilities are faced with reduced consumption from the commercial and industrial consumers due to the pandemic. Demand from residential consumers have witnessed increase with stay at home restrictions, and general population spending more time indoors

-

Water suppliers are also facing bad debts charge. Lower revenue from industrial and commercial users combined with bad debt charges are affecting the profitability of suppliers in the UK

-

Global water industry witnessed the acquisition of stake of Suez by Veolia. Veolia and Suez are top water service companies globally. Veolia purchased 29.9 percent stake of Suez from Engie

Engagement Trends

-

Bilateral contract signed with water utilities/suppliers is the predominant practice followed water sourcing in most countries. In the UK, business users engage in self-supply license helping them, to purchase water at wholesale rate, thus avoiding the retail margin. Customer can directly deal with wholesalers and avoid administrative cost and other direct cost

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now