CATEGORY

Australia Natural Gas

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for Australia Natural Gas

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Australia Natural Gas.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

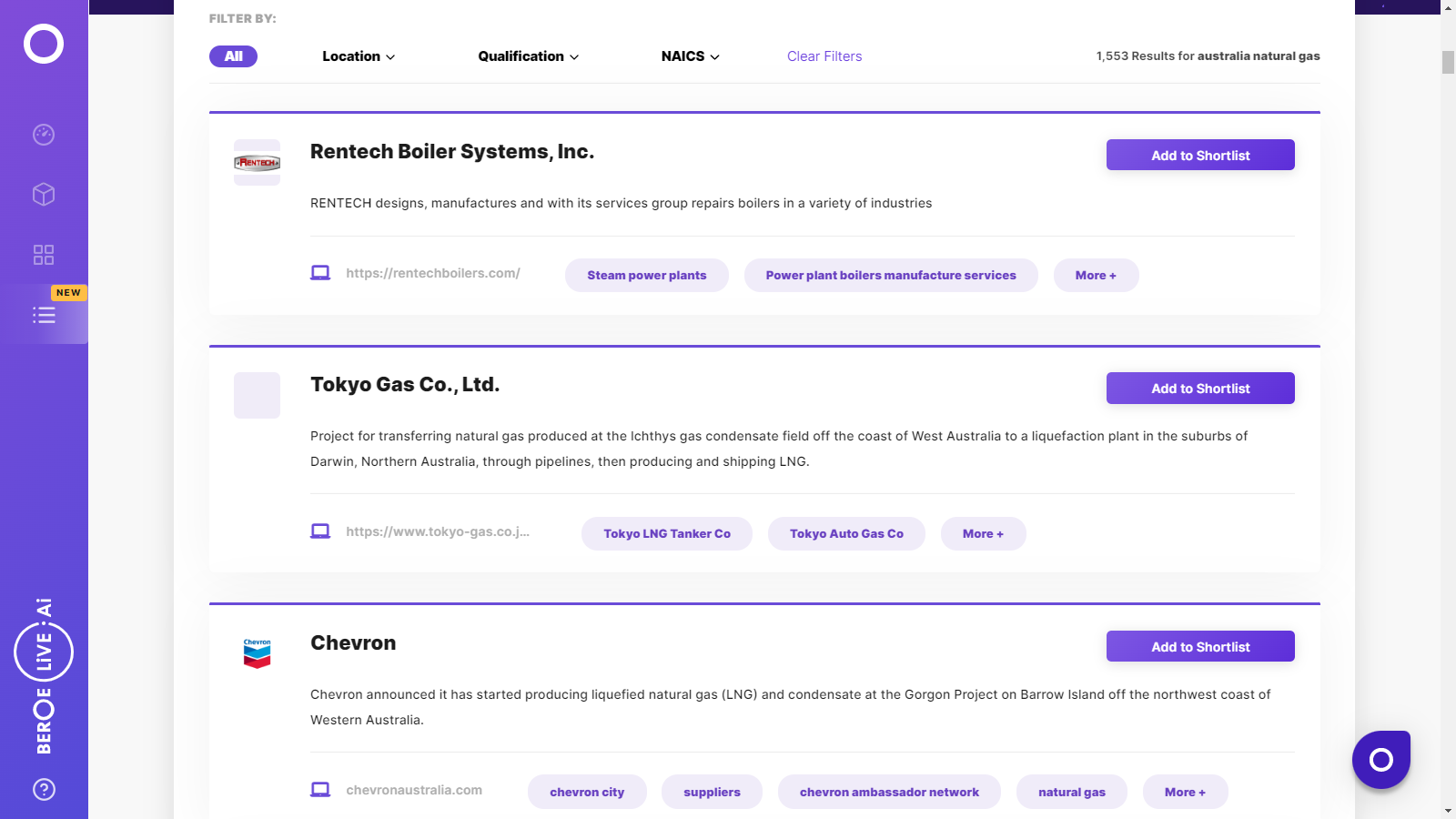

Australia Natural Gas Suppliers

Find the right-fit australia natural gas supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Australia Natural Gas market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAustralia Natural Gas market frequently asked questions

According to Beroe's analysis, Australian natural gas price history shows a clear growth for the prices. Initially, averaged at AUD 9.41/GJ, it showed an increase of nearly 13.49 percent. The increase is primarily attributed to the high summer demand for natural gas in power production across the APAC region. Other factors that influenced the cost of natural gas in Australia include ' insufficient coal supply, a decrease in crude production by OPEC, and a shortage of crude at a global level.

Beroe's analysis indicates that production in the Australian oil market increased by net 17.7 percent to reach 113.5 billion cubic meters and is further expected to increase at a CAGR of 3.2 percent. Australia's export is likely to increase at a CAGR of 23.6 percent mainly due to the supply of LNG (Liquified Natural Gas) to Asian economies.

The natural gas price forecast also shows that Australia is a major LNG exporter, and in case of a higher share of exports, the domestic supply shrinks leading to the high natural gas price in Australia. Reports also indicate that the rising natural gas demand from China, India, Africa, & the Middle East along with increasing demand from Eastern and Southeastern Australia can lead resource depletion further boosting the natural gas prices in Australia

Australia Natural Gas market report transcript

Australia Natural Gas Industry Outlook

-

Australia’s natural gas production increased by 1.1 percent in 2021, with a rise in East Coast and Queensland CSG production

-

The electricity generation sector is expected to decreased its share in natural gas consumption in the coming years, due to an increasing share of renewables in fuel mix

-

Australia was the largest exporter of LNG beating Qatar, with 108.1 BCM of LNG exports

-

Supplier Landscape: Buyers can choose from multiple suppliers (4–5 on an average), also buy from short-term natural gas markets providing a higher degree of flexibility.

-

Due to surplus natural gas production domestically, and the commoditized nature of natural gas, suppliers can introduce limited differentiation in their offerings.

Natural Gas Proved Reserves

Natural Gas Proved Reserves

Australia Natural Gas Industry Structure and Outlook

-

An interconnected gas grid connects all of Australia’s eastern and southern states and territories. While traditionally focussed on domestic sales, this market is undergoing structural changes as a gas export industry

-

The western gas market is heavily focused on exports, but also supplies domestic consumption in Western Australia

-

The northern gas market is Australia’s smallest producer. Its basins provide gas for export, and also for domestic consumption in the Northern Territory.

-

The eastern gas region has some wholesale markets for gas, which allow retailers or large customers to purchase gas without entering into long-term contracts.

-

Commissioning of the Northern Gas Pipeline in 2018 linked gas fields in the Bonaparte Basin having over 800PJ reserves (offshore of Darwin in the Timor Sea) to Queensland. A large quantity of the gas produced in this basin is converted to LNG for export

-

Australia is the world’s largest LNG exporter and most of its LNG is shipped to Asia, where it is stored, re-gasified and injected into local gas pipeline networks

Australia Natural Gas Cost Structure Analysis

Cost Break-up

Natural Gas Prices

-

Wholesale gas price is the major share of final price paid by consumers, and is at an average of 40 percent in Australia, however, it varies significantly by region

-

The retail sales expenditure is around 10–15 percent of the total cost and is a component, which can be negotiated with the supplier

Australia Natural Gas Price Drivers

-

Domestic gas consumption and LNG exports are the key drivers in determining the wholesale price component of the final industrial natural gas prices

-

At the industrial level, load factor and Take or Pay levels can alter gas bills significantly, and therefore should be optimized

Porter’s Five Force Analysis: Australia Natural Gas Market

-

Buyers have low to moderate buying power, due to a tight supply market and a medium level of choice of suppliers

-

Suppliers have low power, due to the medium level of competition and the degree of nature of the commodity

Supplier Power

-

Retail natural gas suppliers at the regional level have a medium market share, and buyers have an option of around 4-5 alternate suppliers on average

-

Due to surplus natural gas production domestically, and the commoditized nature of natural gas, suppliers can introduce limited differentiation in their offerings

Barriers to New Entrants

-

Large capital is required in exploration, production, pipeline, etc., which limits the entry of new players into the market

-

The recent dip in profit margins of many natural gas suppliers will discourage new players from entering the market

Intensity of Rivalry

-

In some places, there is competition coming up in terms of price, like Western Australia

-

The expected increase in crude oil price due to IMO regulation will increase the demand for natural gas in domestic and industrial consumption. This might serve as a suitable time for suppliers to establish their customer base

Threat of Substitutes

-

In the medium term, the only substitute is in the field of electricity generation, where renewables are replacing natural gas in Australia

-

Soaring LNG demand in Asia and Europe is creating enough demand for Australian natural gas, for the long term

Buyer Power

-

Buyers can choose from multiple suppliers, and also buy from short-term natural gas markets providing a higher degree of flexibility

-

Markets are highly regionalized, and therefore the buyer has to pay depending on the region, which limits the flexibility to freely negotiate the prices

Why You Should Buy This Report

- This report provides a detailed analysis of the Australia natural gas price forecast, the cost break-up, supply chain, the natural gas price drivers, and analysis.

- It lists out the natural gas industry trends in Australia and best procurement practices.

- The report does a SWOT analysis of major players such as AGL, Lumo Energy, Origin Energy, etc.

- This natural gas market analysis report breaks down the industry structure, supply-demand trends, and key regulations and policies affecting the Natural Gas Market.

- It provides Porter’s five force analysis of the natural gas market in Australia.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now