CATEGORY

Bunker Fuel

Bunker fuels are highly driven by crude oil cost and supply–demand balance in the region. The ease in COVID restrictions, tight supply conditions, and the current Ukraine–Russia tension would impact the diesel cost on a short-term basis.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Bunker Fuel.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

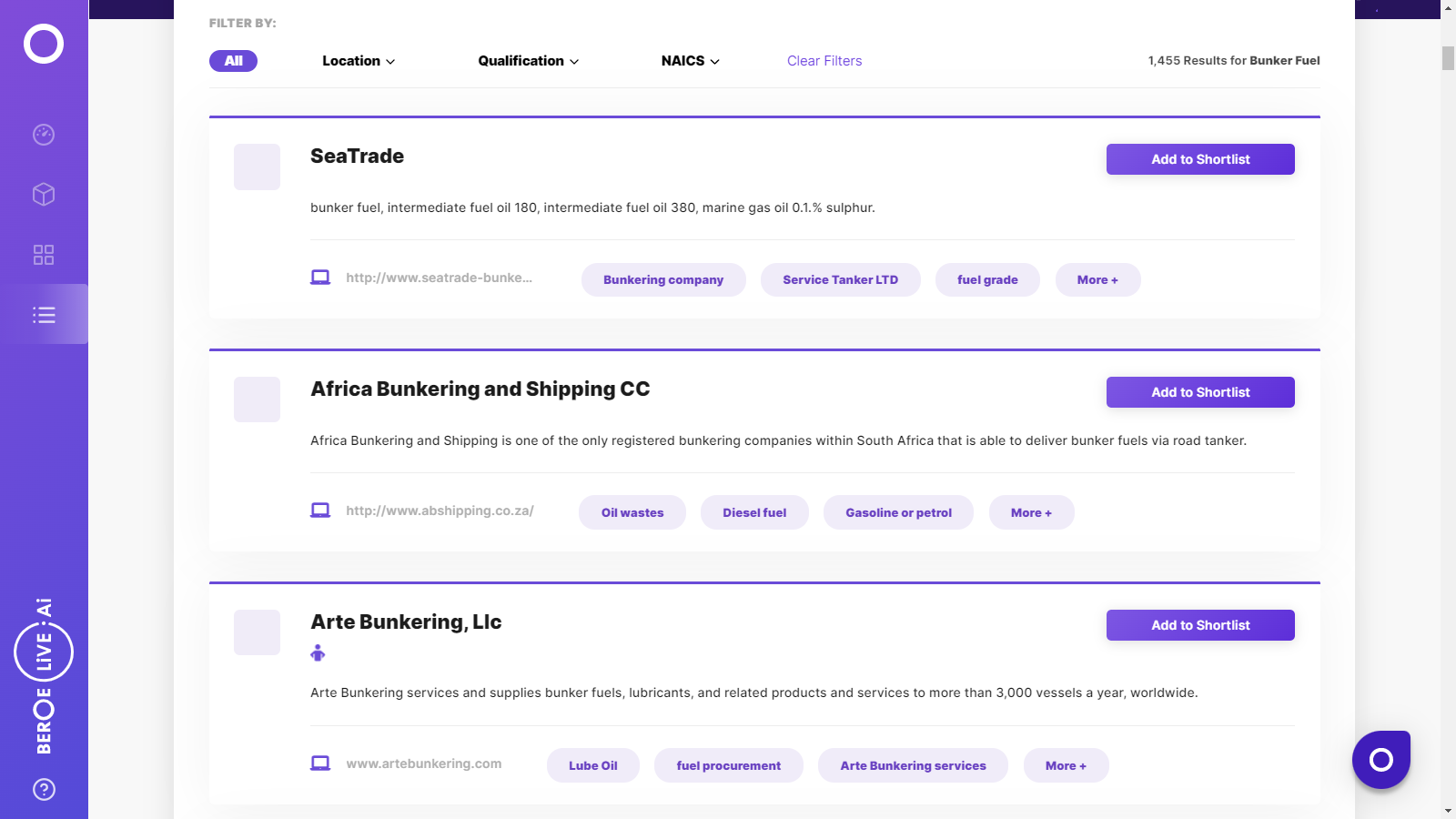

Bunker Fuel Suppliers

Find the right-fit bunker fuel supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Bunker Fuel market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBunker Fuel market report transcript

Fuel oil/Bunker Fuel Global Industry Outlook

-

The global demand for liquid fuel in 2023* was estimated to be 102.1 Mbpd. It is expected to grow by 4–6 percent in 2023 and reach approx. 101–102 Mbpd in 2023

-

The global product demand for bunker fuel during 2021 was estimated to be 5.8 Mbpd, and it is forecasted to reach approx. 8 Mbpd by 2022

-

The demand for fuel in 2023 is expected to increased in 2023, owing to the ease in COVID restrictions and rapid economic revival actions and economic recovery in China

Bunker Fuel Oil Market Scenario and Outlook

Fuel oil is expected to remain primary bunker fuel over the next five years. VLSFO consumption is expected to increase in the coming years, whereas gas oil consumption could witness a decline. HSFO consumption could increase with scrubbers installed ship. LNG and alternate fuel consumption are also likely to increase in the next five to ten years.

-

Fuel oil consumption in bunkering application rebounded to 3.93 mbpd in 2021, after declining to 3.77 mbpd in 2020 from the previous year

-

In 2020, bunker fuel consumption declined, due to the pandemic and reduced shipping trade

-

VLSFO consumption increased by more than 4 times in 2020 from 2019, due to IMO rules. Marine gas oil demand is expected to reduce between 2021 and 2026 because it is expected to be replaced by VLSFO and HSFO

-

Fuel oil constitutes more than 90 percent of the bunker fuel consumption globally. LNG is the other major bunker fuel used in the vessels

-

LNG consumption in shipping is expected to increase from 2 bcm in 2020 to 7 bcm in 2024

-

Ammonia, hydrogen, and bioenergy are expected to contribute to 8 percent, 2 percent, and 7 percent by 2030. In 2020, these alternate fuels had 0 percent share of the marine fuel market

Bunker Fuel Cost Structure

-

Raw material cost (crude oil) constitutes the largest component of bunker fuel oil at around 75 percent. Change in crude oil cost, therefore, reflects in the price of bunker fuel.

-

Raw material cost (crude oil for producer- Chevron and Petrobras & fuel oil for others) is the largest cost component for suppliers in bunker fuel

-

Logistics (Transportation and storage), labor, financing cost (including hedging), Depreciation and amortization, SG &A (Selling, general and Administrative) cost are the other major cost factors

Porter’s Five Forces Analysis: Bunker Fuel

Supplier Power

-

The bunker fuel market is present with several type of suppliers. Some firms, such as oil majors, are vertically integrated. The market has many raw material suppliers, making it competitive

-

Several medium-scale and small-scale suppliers depend on bunker fuel supply from other firms. Since the bunker fuel market is highly dependent on crude oil prices, suppliers can typically pass on the rise in crude oil prices with end users. Overall supplier power is moderate to high

Barriers to New Entrants

-

Barrier for entrance is moderate. Service providers entering trading and brokerage service do not require huge capital investment. However, physical suppliers require high upfront cost

-

Suppliers also need to have market and technical knowledge. Several shippers have recently entered the market for bunker fuel trading

Intensity of Rivalry

-

Intensity of rivalry is moderate to high, due to large number of players and narrowing margin. Market players are acquiring smaller companies to increase the economies of scale. This can reduce the competition level at the small to medium scale

-

There are also several large players in the market, who focuses on the bunker suppliers. The competition at these level are expected to remain steady

Threat of Substitutes

-

Bunker fuel market faces substitution from different types of fuel to reduce carbon footprint. New regulations to replace heavy fuel oil with VLSFO has increased the consumption of low sulfur oil

-

Fuel oil is facing substitution from LNG alternate fuels, such as ammonia, hydrogen, methanol, etc. Apart from LNG, adoption rate of other fuels are slow now. But it is expected to pick up with focus in energy efficiency. Overall threat of substitute is moderate

Buyer Power

-

Buyers have moderate power, as the market is competitive. Buyers have little control over prices, since prices are determined typically by crude oil price movement

-

Large users have better bargaining power. Buyers are entering into buying alliances and trying to increase purchase power through volume consolidation

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now