CATEGORY

Clean and renewable energy Australia and New Zealand

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for Australian Renewable Energy Market

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Clean and renewable energy Australia and New Zealand.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

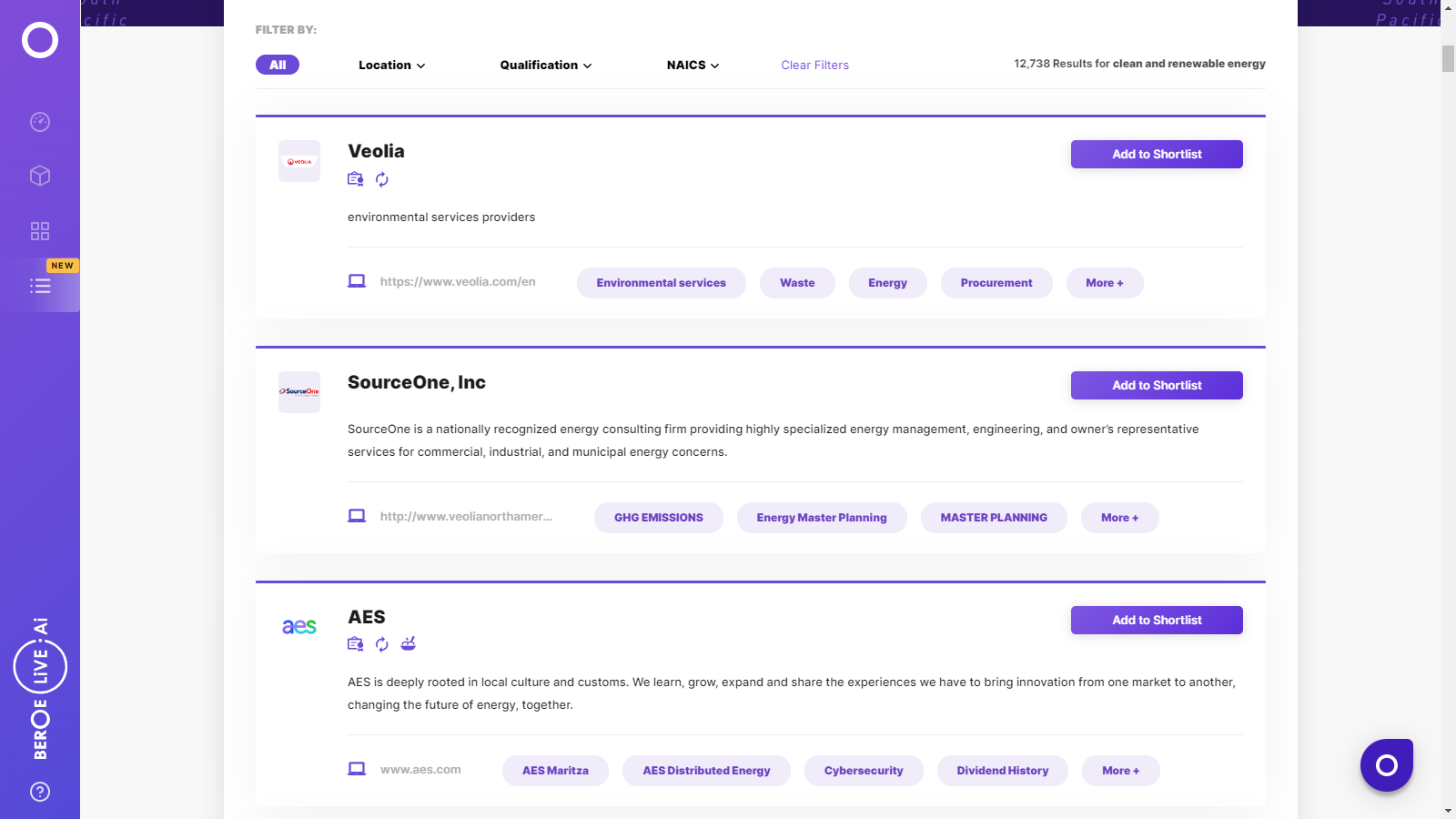

Clean and renewable energy Australia and New Zealand Suppliers

Find the right-fit clean and renewable energy australia and new zealand supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Clean and renewable energy Australia and New Zealand market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoClean and renewable energy Australia and New Zealand market report transcript

Regional Market Outlook on Renewable Energy

- Renewable Energy Target (RET) target set by the Australian government for 2020 is 33,000 (GWh), which is expected to be dominated by solar and wind

- Solar and wind installations are expected to grow higher compared to other renewable energy technologies, due to the availability of excellent resources of solar radiation and wind speed experienced throughout Australia

- From the total electricity mix for 2016, renewable energy generation was 17 percent, Tasmania and South Australia actively contributed to the generation of electricity through renewable energy

Renewable Energy Overview

There was a significant increase in generation from renewables in 2016; and looking at the strong wind and solar project pipeline, the growth trend is expected to continue.

About 17 GW capacity of renewable energy was completed by the end of 2016, which is expected to increase further. Among the 30 new renewable projects constructed (until 2017), 27 are wind and solar projects and other projects under bioenergy.

- In Australia, the renewable energy generation share increased from 14.6 percent in 2015 to 16.0 percent in 2016

- Power generation from hydro was the major contributor, providing 42.3 percent of the total renewable generation. Excellent rainfall in 2016 was one of the reasons for the increase in hydro generation

- The large-scale RET has been set at 33,000 GWh by 2020 and of which, 17,500 GWh was generated in 2016

PPA Model

Procurement through a PPA established a fixed rate of electricity, which can be bought over a time frame of 20–25 years. Renewable energy can be procured through PPAs. They offer a long term supply of electricity at prices that is often below or at the market value.

On-site PPA/Operating Lease

- An external party owns, installs, operates, and maintains a renewable energy power system at an organization's facility

- In this method, a PPA agreement establishes a fixed rate for electricity and/or RECs generated by the system that are sold to the organization, typically for a 20–25 year term

- High-visibility projects with the opportunity to highlight in internal/external communications, if the RECs are retained

- An organization is not responsible for upfront capital costs or O&M costs

PPA

- PPAs are contractual agreements used in the utility power sector for long-term purchase of electricity from a single source of energy

- PPAs offer a long-term supply of green power with stability in prices

- Contracted prices are often at or below the market prices

- Significant volume can be purchased in a single transaction

- PPAs are increasingly becoming the most common green power solution for large-scale electricity consumers

Renewable Energy Certificates (RECs)

RECs can be purchased to show that the electricity consumed are from renewable energy sources. Industry can even install small renewable energy generators and be credited with RECs. RECs in Australia are divided in two categories, STC and LGC. One REC certificate is equal to 1 MWh of electricity generated.

STCs

- STCs are created for eligible installations of solar water heaters, air source heat pumps, and small generation units (small-scale solar panels, wind and hydro-electricity systems)

- One STC is equal to 1 MWh of renewable electricity generated by a small generation unit, or 1 MWh of electricity deemed to be displaced by the installation of solar water heaters or air source heat pumps

LGCs

- Accredited renewable energy power stations are entitled to create LGCs, based on the amount of eligible renewable electricity produced

- One LGC is equal to 1 MWh of eligible renewable electricity

- These certificates act as a form of currency and can be sold and transferred to other individuals and businesses at a negotiated price

PPA Analysis

PPA agreement with renewable energy suppliers in Australia would be a preferred mode of procurement if a large amount of renewable electricity needs to be purchased for a long period. Procurement of renewable energy with PPA has high ease of engagement and would prove beneficial to the consumer, as there is no upfront and maintenance cost involved.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now