CATEGORY

Electricity

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Electricity.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Cracker new capacity addition to decrease the current supply-demand gap.

March 16, 2023Asia to face PE shortage in Q1 2023 due to maintenance activities.

January 30, 2023Dow Chemical?s globally reduced operating rates by 15%

September 12, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Electricity

Schedule a DemoElectricity Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoElectricity Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Electricity category is 1.80%

Payment Terms

(in days)

The industry average payment terms in Electricity category for the current quarter is 85.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

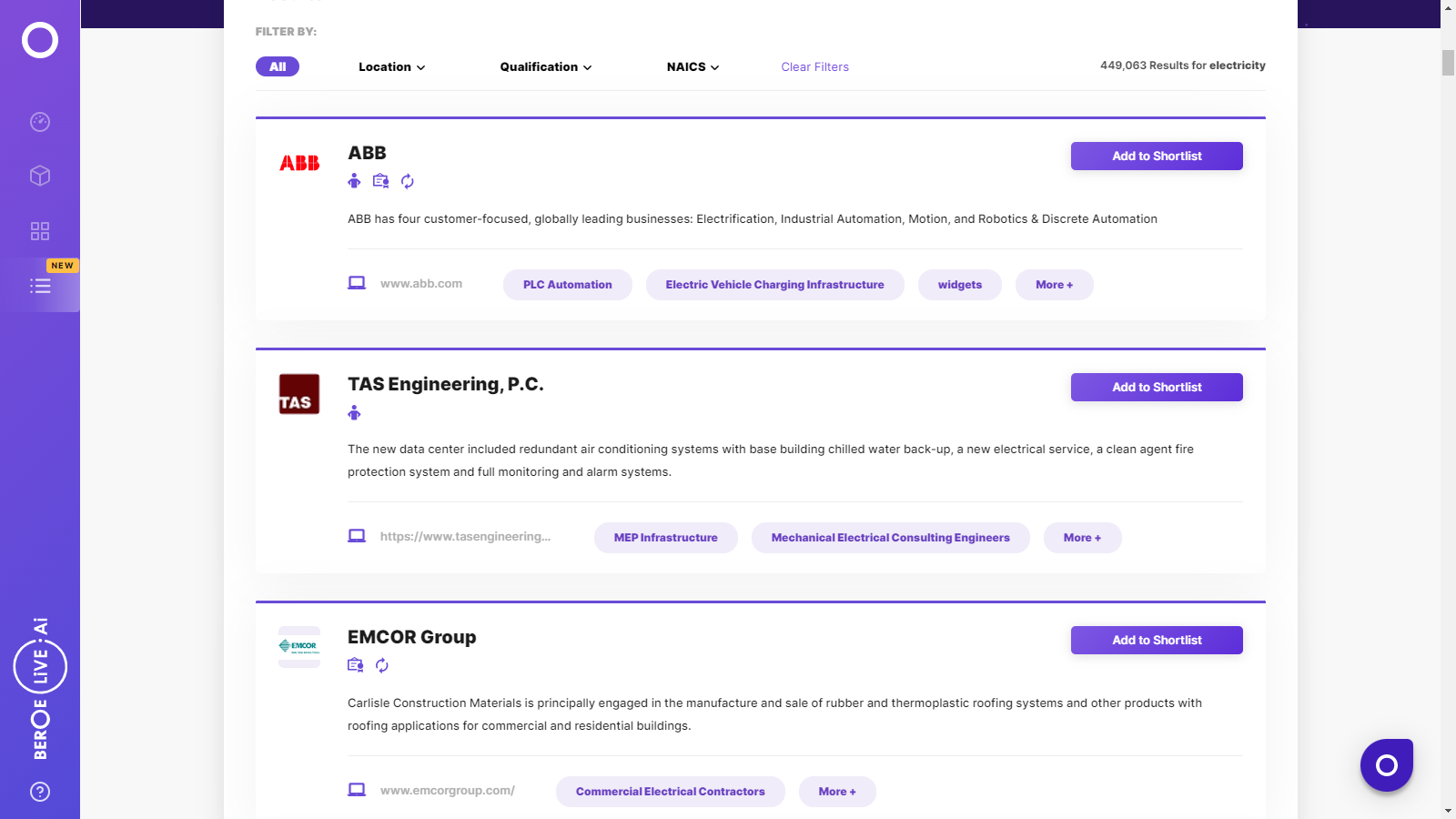

Electricity Suppliers

Find the right-fit electricity supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Electricity market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoElectricity market frequently asked questions

China’s national demand is poised to surge at around 2-3% CAGR during 2019–2024. In addition, China is among the chief producers of renewable energy. In 2019, the country produced nearly 600 TWh of electricity from wind and solar power plants.

With the significant demand dip due to the COVID-19 pandemic, several electricity generators in Brazil have witnessed a decline in revenues. As such, the government raised a bail-out package of BR$ 14.8 Bn to help the electricity suppliers for contract settlement and utilization of the transmission system.

Australia’s electricity price decreased by around 14.6% and averaged about $43/MWh in August 2020. The key factors driving this trend were the notable rise in relatively low-cost offers, with a 2% decline in the operational demand.

Major end-users in Australia’s electricity market include automotive, residential, industrial, commercial, and healthcare sectors. While the electricity demand slumped considerably in the industrial and commercial domains, the residential load surged due to nationwide lockdowns. Further, the gradual resumption of automobile operations and constant demand from healthcare institutes will bring Australia’s electricity market back on track.

Brazil’s electricity consumption dropped during Q2 2020, amidst COVID-19-induced stressors, hitting suppliers’ bottom lines. However, the explosive usage of cooling appliances during the summer season is expected to keep the electricity demand intact.

The subsequent plant shutdowns during Q1 2020 amidst the COVID-19 crisis have drastically affected China’s electricity demand. However, Beroe’s analysis has highlighted demand recovery since Q2 2020.

Electricity market report transcript

Electricity Global Market Overview

-

The global power generation is expected to grow at approx. 2-3 percent CAGR through 2022-2025

-

China's power consumption increased by 3.6 percent year-on-year in 2022, reaching 8,637 TWh. In 2022, power consumption in China's primary, secondary, and tertiary sectors was 114.6 TWh, 5,700.1 TWh, and 1,485.9 TWh, representing year-on-year growth of 10.4 percent, 1.2 percent, and 4.4 percent, respectively

-

The installed capacity till the first half of 2022 was 2.44 TW and is expected to reach 2.6 TW by end of 2022. From January to November 2022, the total electricity generation was 7,628.6 TWh with a 2.1 percent year-on-year increase

-

The installed capacity of non-fossil fuel generation is 1.18 TW, accounting for 48.2 percent of the total capacity by the end of November 2022. Wind and solar installed capacities are around 351 GW and 372 GW, respectively

Industry Structure and Outlook : Electricity

Generation Capacity

-

China’s generation capacity has been growing strong in the last 5 years even in the renewable generation capacity. Despite the commitment to reduce GHG emissions the fossil fuel based generation capacity has also grown

-

Electricity generation capacity is expected to grow at a CAGR of 3 to 5 percent for next year, with wind and solar will contribute the major growth factor. The year-on-year increase in hydropower and solar installed capacity exceeded 20 percent in 2022

-

China’s dependence on thermal power capacity increased from 70 percent in 2018 to 57.4 percent in 2022, and it can be expected to go below 50 percent by 2030 if the coal power production curb continues. There was a decrease of 4 percent year-on-year in the first half of 2022

-

China’s total electric power capacity increased to just over 2.51 terawatts, with hydro, wind, and solar sources, accounting for 45 percent in 2022 up from 39 percent in 2020

Fuel Mix

-

The fuel mix has changed significantly in the last five years, from insignificant generation from renewables in 2015 to about 982 TWh generation from solar and wind based generation in 2021

-

Due to high summer, the coal power generation share has increased to 69 percent in 2022, as there was low output from hydro, due to low water levels. The thermal power share was 67 percent in 2021, as a result of a large increase in renewable generation

-

The nuclear expansion has resulted in an increase in generation share from 3 percent in 2016 to 4.95 percent by 2022, with year-on-year growth rate of 2.1 percent

-

The power generation from hydro increased by more than 20 percent in the first half of 2022, but there was a decline in the power output, due to high summer temperature. China will have massive hydro energy growth in the future to obtain sustainability

Electricity : Supply and Demand

-

With the large-scale manufacturing projects, the country's electricity demand is predicted to continue to expand at a rate of 2-4 percent

-

Electricity generation is expected to grow at a CAGR of 2–4 percent for the next two years to keep up with consumption which is also in same trend

-

Electricity consumption in the grid is expected to grow at a CAGR of 2-4 percent for the next two years, reaching around 8800 TWh in 2023

-

Transmission losses are at 5–6 percent currently, which is lower than the world average of 8 percent and it is expected that the losses will remain at a level of 5–6 percent for the next couple of years

-

Dependence on hydro, wind, and solar rose to around 28 percent in 2022, in terms of electricity generation, and by 45 percent, in terms of electricity generation capacity

Electricity Market Consumption Outlook

-

Secondary industries are the largest consumers of electricity this sector is one of the fastest growing in the Chinese economy consumes about 67.5 percent of the country’s power consumption

-

In 2022, power consumption in China's primary, secondary, and tertiary sectors was 114.6 TWh, 5,700.1 TWh, and 1,485.9 TWh , representing year-on-year growth of 10.4 percent, 1.2 percent, and 4.4 percent, respectively. The secondary industry has the highest share of 66 percent in the consumption share in 2022, followed by the tertiary industry sector with a 17.3 percent share

-

The tertiary industry sector had an increase in the growth rate of 17 percent in 2010–2022 as expected, but the primary sector had the highest growth rate compared to other sectors around 19 percent

-

In 2022, industrial consumption had increased it consumption by 1.2 percent year-on-year to reach 5,600 TWh, accounting for 64.8 percent of the total consumption. The manufacturing sector had only 0.9 year-on-year growth in 2022 compared to 2021

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now