CATEGORY

Diesel

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the Global Diesel Market

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Diesel.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Australia is expected to import record amounts of petrol and diesel in the coming year.

March 30, 2023PetroChina anticipates a resurgence in oil demand following record 2022 profits.

March 30, 2023India intends to continue its restrictions on fuel exports beyond March.

March 30, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Diesel

Schedule a DemoDiesel Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoDiesel Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Diesel category is 8.10%

Payment Terms

(in days)

The industry average payment terms in Diesel category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Diesel Suppliers

Find the right-fit diesel supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Diesel market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDiesel market frequently asked questions

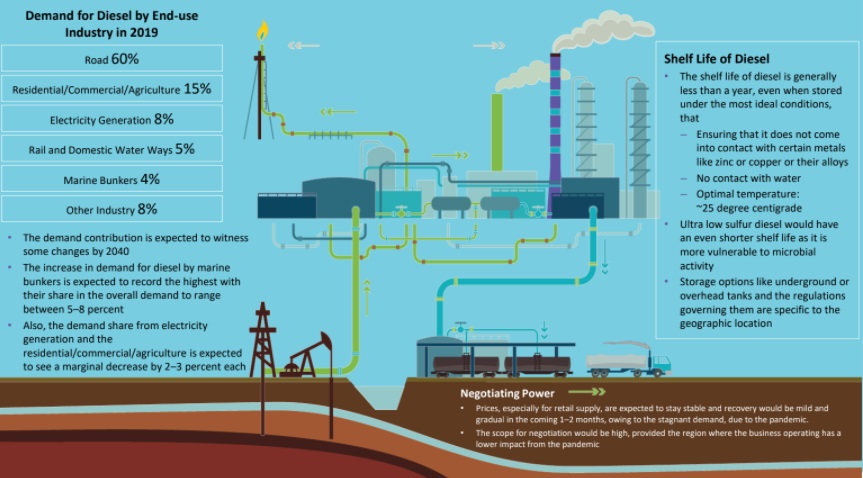

As per Beroe's report, the global demand for diesel is expected to reach 27 Mbpd by 2020.

The key players in the global diesel market are APAC, followed by North America and Europe.

The latest trends in the diesel market are that the diesel fuel share in the transport sector is expected to increase, developing nations are expected to have a higher demand for power which is indirectly resulting in the growth of diesel generators.

As per Beroe's diesel fuel price forecast, the industry is expected to grow at a CAGR of 30-32% by 2025.

The key drivers affecting the diesel price forecast long term are the rise of private suppliers and state-owned diesel market in APAC, Africa, LATAM and the Middle East

Diesel market report transcript

Global Diesel Fuel Industry Outlook

-

The global demand for liquid fuel (oil) in 2022 was at 99.6 Mbpd, about 2.7 percent higher than in 2021. It is expected to grow by 2–3 percent in 2022 and reach 101.9 Mbpd. The rise of 2.5 million barrels per day (mb/d) in 2022 is supported by strong economic growth in both OECD and non-OECD countries, except for China, which has seen its annual oil requirements fall

-

The end of China's zero-COVID-19 policy in December 2022, on the other hand, is anticipated to increase the country's oil demand in 2023. Meanwhile, the OECD predicts slightly slower growth in oil demand leading to a 2.3 mb/d increase in global oil demand in 2023

Diesel Fuel Demand Market Outlook

- Diesel prices are highly driven by crude oil cost and supply–demand balance in the region. Wholesale and retail prices have been affected by Russia's invasion of Ukraine, although the price of fuel has been growing practically continuously for more than a year. Global demand is expected to slow down, as interest rates have increased globally, and this trend can extend further. Oil prices continue to remain high, and hence, will negatively impact the upcoming demand growth rate

Drivers and Constraints for Diesel Fuel

Drivers

Energy Efficiency

- Having high energy density per unit volume, diesel is preferred in the markets, such as commercial heavy-duty vehicles, power generation, and in various other industrial applications for its high energy/thermal efficiency

Heavy Transport Sector

- Growing demand for heavy transport sector, especially in the emerging economies, like China, India, Brazil, and Indonesia, drives the demand for diesel fuel

Taxation policies

- Taxes imposed by most of the nations are less for diesel compared to gasoline. Hence, diesel consumers enjoy a price advantage. However, in the US, federal and local taxes on diesel are slightly higher than gasoline

Constraints

Environmental Policies

- Stringent emission standards on diesel lowering sulfur emissions. By imposing “Clean Air Zones”, the governments around the world have put some restrictions to drive diesel vehicles

Geopolitical Tensions

- Geopolitical tensions over the Russia–Ukraine Front and lack of production clarity between US and Russia and OPEC countries impact the oil and underlying refined product market and prices

Alternative Fuel Vehicles

- Increasing usage of alternative fuel vehicles, such as Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG) vehicles, could hamper the diesel fuel market, though the penetration level is low. Countries, like the US and China, are creating dense network of natural gas refueling stations

Supply Trends and Insights : Diesel Fuel

Oil Demand Outlook

-

Oil Demand: Even while the production companies warned that the invasion of Ukraine by Russia and developments related to the COVID pandemic represent a significant risk, OPEC has maintained its prediction that global oil consumption will surpass pre-pandemic levels in 2022

-

Outlook: Diesel and gasoline are anticipated to record the highest gains among petroleum products Y-o-Y, on the back of increasing mobility and healthy industrial activity globally. In Q2 2022, the global oil demand was registered at 98.19 MP and expected to cross 100 MP by Q3 2022 and 102.77 MP by Q4 2022 according to OPEC

Refinery Impact

-

Capacity Drops and Closures: The refinery sector is likely to witness a significant impact, in terms of capacity closures and idling. About 2.5 mbpd of capacity is expected to go offline by 2025, and by 2045, an additional 6 mbpd would go offline. This trend is expected to bring out a balance between demand and supply, and also to bring back a healthy utilization rate, which is about 80 percent from the current 73 percent

-

Capacity Additions: The capacity additions in the coming 1–4 years are about 3.8 mbpd, although some delay could be expected from COVID impact. However, considering an expectation of oil demand to peak by 2040 and reach 109 mbpd

Engagement Trends

-

Most Adopted Model Globally: Engage with OMC or dealer

-

Why: Engaging with OMC directly would help in avoiding additional dealer costs and more likely help in stabilizing the prices, as OMCs are usually backward integrated up to refining or even exploration stages

-

Contract Length: 1 year

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now