CATEGORY

Canada Natural Gas

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for Canada Natural Gas

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Canada Natural Gas.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Canada Natural Gas Suppliers

Find the right-fit canada natural gas supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Canada Natural Gas market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCanada Natural Gas market report transcript

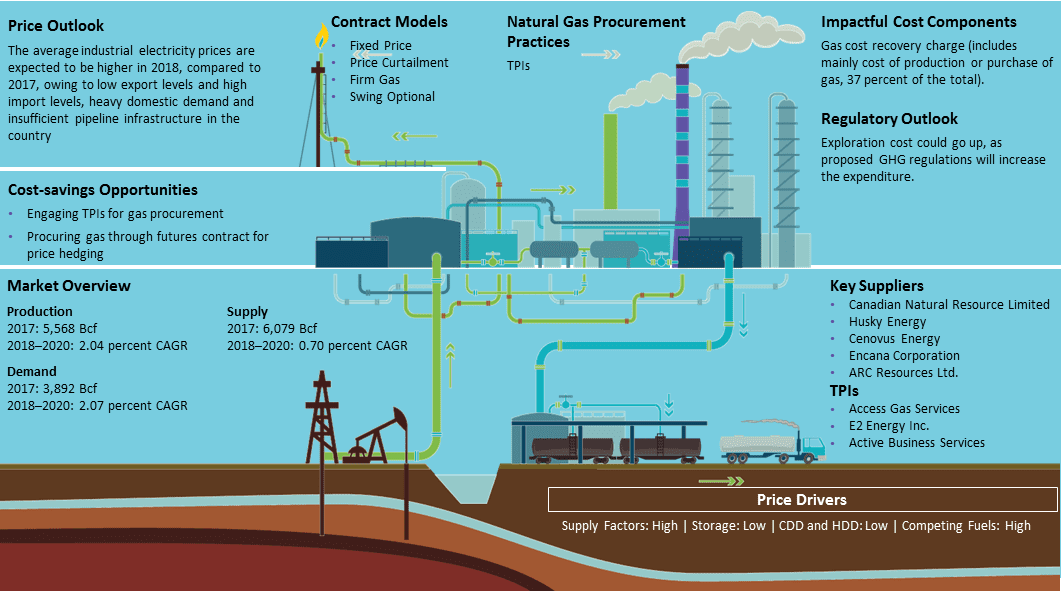

Regional Market Outlook on Natural Gas

-

The national demand is expected to grow at approx. 122 percent CAGR during 2020–2022

-

The top five natural gas production companies hold for more than 40 percent of the share and the rest is hold by many other private players

-

The midstream sector, which includes the transmission of natural gas, is done by TransCanada Group that holds more than 50 percent of the market share

-

Canada is sixth largest producer of natural gas and exporter of natural gas globally

Canada Natural Gas Supply and Demand

-

Canada gas business has been heavily integrated with the energy demand in the US. Traditionally, Canada exports its surplus to only one market, i.e., the US, and imports a smaller amount from the US into Central Canada and the exports to US has been declining

-

Local demand for natural gas is expected to grow by about 1–3 percent CAGR, from 2019 to 2023

-

Tight natural gas production has grown significantly from the Montney formation over the past five years

-

Canada is increasing its shale gas production activities in order to increase its overall natural gas export markets and gain a competitive advantage in the international markets

Consumption Profile

-

The industrial sector has the highest share of 65 percent in the consumption share in 2021, followed by the Commercial sector with 18 percent

-

The industrial sector is expected to grow at a higher rate, compared to the rest of the end-users, whose consumption will mostly be growing at smaller pace

-

The transportation sector has been dominated by oil products. Improved fuel economy, as well as electrification cause transportation energy use to decline

-

To make pipeline supply of gas much easier in the international markets, the government is continuously working on maintenance of natural gas pipeline infrastructure

Canada Natural Gas Price Trend and Forecast

Historical Price

-

Canada natural gas prices averaged at 4.50 CDN$/GJ in October-22 decreasing by 19.64% on an M-o-M basis as the supply increased domestically. Natural gas prices have seen a dip due to a slowdown in the economy and decreasing demand from Europe due to their inventory being full.

Price Forecast

-

On a short-term outlook, In November 2022, Canada’s natural gas is expected to average at 5.45 CDN$/GJ increasing by 21% as compared to October-22. Volatility to remain high with prices for the short-term period.

-

The natural gas companies have reduced their production rates by 1.5% which could increase prices. The demand for natural gas in winter will have an impact on the prices driving them higher.

Canada Natural Gas Trading Practices

-

Natural gas trading can be categorized as physical trading and financial trading. Physical trading involves buying and selling of the physical commodities, whereas in financial trading, there is no physical delivery of natural gas

-

Financial trading involves financial instruments, which are used to provide hedge against the risk of price movement

-

Natural gas can be traded either on a short-term basis, via spot market trades or using long-term bilateral contracts

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now