CATEGORY

China Electricity

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for China Electricity

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like China Electricity.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

China Electricity Suppliers

Find the right-fit china electricity supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the China Electricity market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoChina Electricity market frequently asked questions

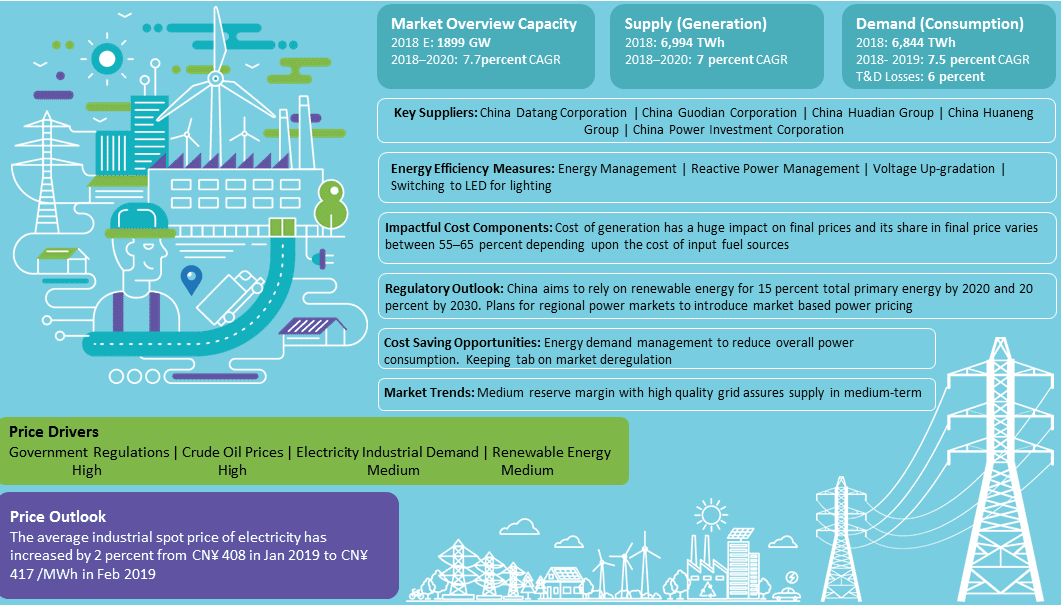

According to market forecasts, by 2020, China is expected to witness a growth in its electricity generation capability and renewable energy generation at 8.6 percent and 38.2 percent CAGR respectively.

The key suppliers for the China electricity market are China Datang Corporation, China Guodian Corporation, China Huadian Group, China Huaneng Group, China Power Investment Corporation.

The following factors drive the price in the electricity market in China: -- Government regulations play an important role in driving electricity prices in China.Crude oil prices impact prices by determining cost structure and economic growth. -- Hence, a rise in crude oil prices will definitely result in a surge in electricity prices in China. --- Industrial demand and renewable energy also have a significant impact on driving electricity prices.

To reduce carbon emissions and heavy air pollution, China plans to generate electricity from cleaner and renewable sources like solar and wind power, natural gas to replace coal and nuclear sources. China also plans to achieve the solar capacity target of 100GW by 2020.

China Electricity market report transcript

China Electricity Market Global Industry Outlook

-

The global power generation is expected to grow at approx. 2-3 percent CAGR through 2021–2024

-

The electricity market in China is a regulated market with the government controlling most of the assets in generation, transmission, and distribution of electricity

-

The APAC region, the largest consumers of electricity, would be the pivotal point for this growth, amid COVID-induced pandemic

-

China is one of the largest generators of renewable energy. In 2021, the country has generated about 2,322.7 TWh of electricity from hydro, solar, and wind power plants increase from 2082.9 TWh in 2020. With the same growth rate, the expected generation in 2022 is 2,590 TWh

Industry Structure and Outlook

Generation Capacity

-

China’s generation capacity has been growing strong in the last 5 years even in the renewable generation capacity. Despite the commitment to reduce GHG emissions the fossil fuel based generation capacity has also grown

-

Electricity generation capacity is expected to grow at a CAGR of 3 to 5 percent for next year, with wind and solar will contribute the major growth factor

-

China’s dependence on thermal power capacity increased from 70 percent in 2018 to 65 percent in 2021, and it can be expected to go below 50 percent by 2030 if the coal power production curb continues

-

China’s total electric power capacity increased to just over 2.37 terawatts, with hydro, wind, and solar sources, accounting for 41 percent in 2021 up from 39 percent in 2020 with a growth rate of 13 percent

Supply and Demand

-

With the large-scale manufacturing projects, the country's electricity demand is predicted to continue to expand at a rate of 4% to 5%

-

Electricity generation is expected to grow at a CAGR of 4–5 percent for the next two years to keep up with consumption which is also in same trend

-

Electricity consumption in the grid is expected to grow at a CAGR of 2-4 percent for the next two years, reaching around 8800 TWh in 2023.

-

Transmission losses are at 5–6 percent currently, which is lower than the world average of 8 percent and it is expected that the losses will remain at a level of 5–6 percent for next couple of years

-

Dependence on hydro, wind, and solar rose to 28 percent in 2021, in terms of electricity generation and by 41 percent, in terms of electricity generation capacity

Generation and Consumption Profile

Market Consumption Outlook

-

Secondary industries are the largest consumers of electricity this sector is one of the fastest growing in the Chinese economy consumes about 67.5 percent of the country’s power consumption

-

Secondary industry has the highest share of 68.3 percent in the consumption share in 2020, followed by tertiary industry sector with 16.42 percent share.

-

The tertiary industry sector had increase in growth rate of 17 percent in 2010–2021 as expected, but primary sector had highest growth rate compared to other sector of around 19 percent.

-

In 2021, industrial consumption had increased it consumption by 9 percent after the growth rate drop in 2020 due to COVID 19 pandemic

Capacity Addition and Utilization Outlook

-

Government spending on capacity expansion had switched for two years in a row to the generation than grid and transmission infrastructure

-

Generation capacity growth rate is around 13 percent CAGR for past five years, which is lower than expected due to slowdown in power demand in China

-

Transmission capacity investment is has reduced by -1.5 CAGR for past five years period

-

Wind had highest investment for past 2 years but in 2021 the investment drop by 6.6 percent compared to 2020. Hydro power is the next funded project after wind followed by thermal and nuclear power in power generation

China – Renewable Energy Overview

China making some mistakes in demand forecast for electricity after the COVID 19 lockdown has made country to use more coal irrespective of its sustainability goal. From 2018 to 2021, the renewable energy have grown at 6.96 percent CAGR. The contribution to production have increased from 26 percent 2018 to 28 percent in 2021.

-

China’s vast coal resources enable the fuel to be the major component, with more than 50 percent share in electricity fuel mix

-

Solar is currently less than 5 percent of the total generation, however, with a more focus on renewable sources, generation capacity for solar power has witnessed a 16.6 percent CAGR jump in 2021 from 2018

-

Chinese government has announced subsidy cuts for solar panel manufacturers, which is expected to slow down the solar power ancillary industry in the country

-

Hydro energy is the strongest RES contributor in electricity generation with a share of 58 percent in 2021 followed by wind energy

China Electricity Price Drivers

-

Regulations set by the government are the major drivers for electricity prices in China, as the price are regulated and completely controlled by government

-

Crude oil prices also impact prices in multiple ways by determining cost structure, economic growth, and hence, a rise in crude oil prices will definitely put an upward pressure on Chinese Electricity Prices

Why You Should Buy This Report

The China electric power market reports give information on the industry structure, value chain, china electricity generation capacity, supply and demand, market consumption, etc. It lists out the key regulations and policies affecting the China electricity market and gives details on the regulations and incentives for renewables. It gives the Porter’s Five Force Analysis of the China Electricity Market, details the supplier landscape and gives the SWOT analysis of key players like China Huaneng Group, China Guodian Corporation, China Datang Corporation, etc. The report provides the cost structure analysis, cost breakup, China electricity price trend and forecast and lists out the price drivers.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now