CATEGORY

Carbon Dioxide

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Carbon Dioxide.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Toblerone to remove the Matterhorn peak from packaging labels

March 06, 2023Brazil cocoa grinds increase by 15 pc in Q1 2023

April 19, 2023Planet A Foods launch Nocoa, made without cocoa

April 17, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Carbon Dioxide

Schedule a DemoCarbon Dioxide Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Carbon Dioxide category is 6.31%

Payment Terms

(in days)

The industry average payment terms in Carbon Dioxide category for the current quarter is 49.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

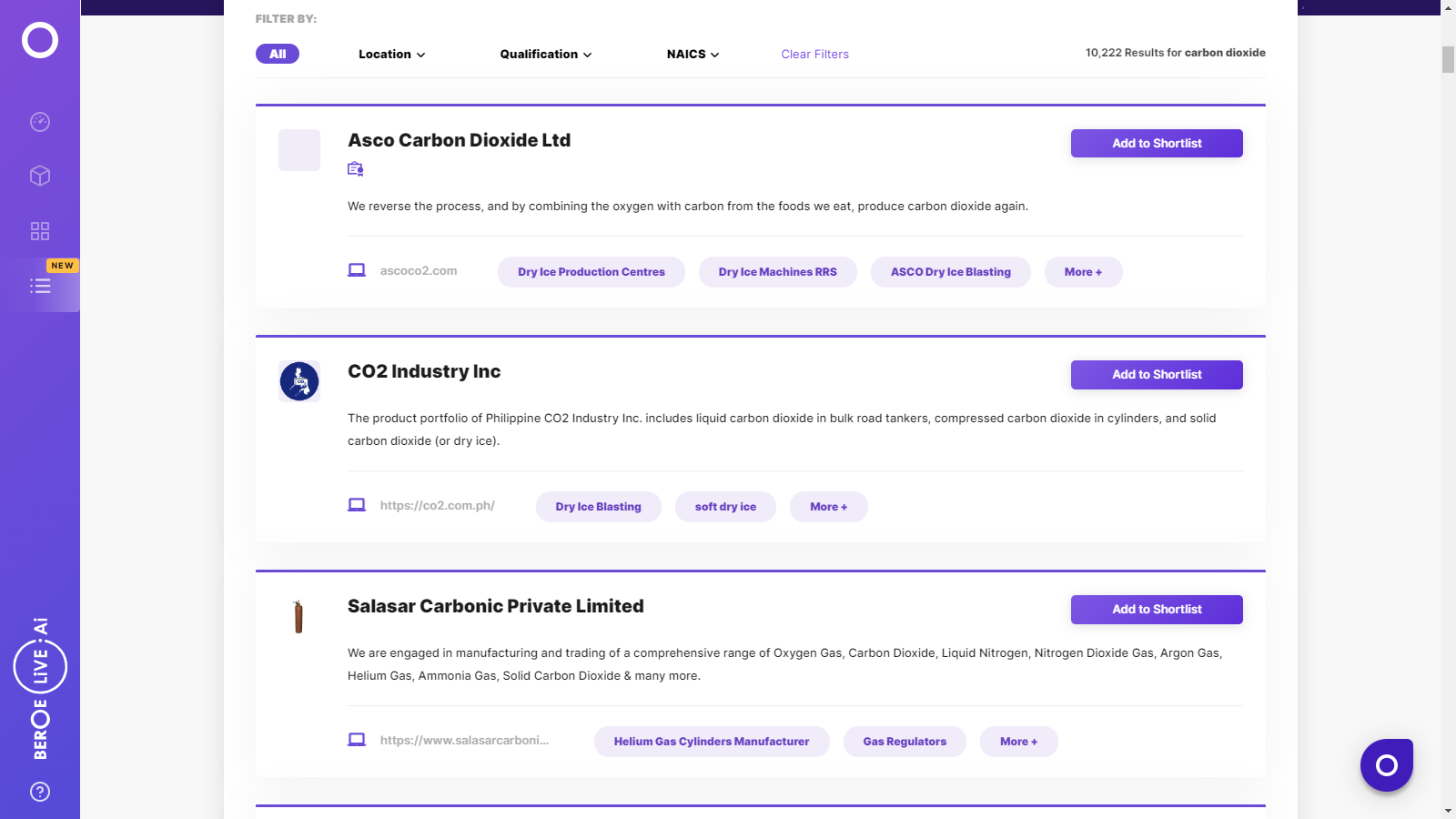

Carbon Dioxide Suppliers

Find the right-fit carbon dioxide supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Carbon Dioxide market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCarbon Dioxide market report transcript

Carbon Dioxide Global Market Outlook

-

The global merchant CO2 market is worth 26.4 MMT in 2021. The market estimate considers CO2 sold to end users and not used on captive model for self use. The CO2 market is expected to grow at a CAGR of 4–5 percent in the next three years

-

North America is the largest market with approximately 38 percent of the global market share. APAC is the second largest market with close to 36 percent of the market share. The APAC market is likely to register the highest growth in the coming years

Impact of COVID-19 on Carbon Dioxide Industry

-

The CO2 market has been witnessing high demand of dry ice, due to its application in vaccine storage and transportation in the US. An increase in COVID cases can drive the demand of CO2 and further constrain the supply in the local markets.

-

Since the start of COVID, the CO2 market has become more tight with narrow capacity surplus in the US

Porter’s Five Forces Analysis on Carbon Dioxide Industry

The bulk and cylinder CO2 market, which mainly serves the industrial grade, food grade, and medical grade CO2 is dominated by a few players globally. CO2 supply in a country is dependent on a top few suppliers, which keeps the competition low to medium. The buyer power is typically low, as the market is consolidated, and purified CO2 market is dependent on by-product raw CO2 from other industries.

Supplier Power

-

Raw CO2 gas is the major raw material for purified CO2. Raw CO2 is produced as a by-product of production processes of ethanol, ethylene oxide, ammonia, etc.

-

There are several players who emits CO2, however, all sources are not economically viable. The by-product nature of raw CO2 gas results in supply disruptions seasonally

-

Shutdown of ethanol plants, or ammonia plants can create shortages in the market sometimes. This makes the supplier power medium

Barriers to New Entrants

-

CO2 purification process from raw CO2 to industrial grade, medical grade, food grade, etc., are capital intensive.

-

New entrants should also be mindful of the location of raw CO2 gas production, which need to be near to the customer market

-

These factors make the barrier to entry medium to high

Intensity of Rivalry

-

Intensity of rivalry in the onsite market is low, as the market is controlled by a few companies. The bulk CO2 market, which caters to large to medium users is characterized by low level of rivalry

-

The cylinder gas market is supplied by manufactures and local distributors. Intensity of rivalry for small-scale users is medium, however, for large users, it is low. Overall, the intensity of rivalry among suppliers for industrial users is low to medium

Threat of Substitutes

-

There are not many substitutes for CO2 in most application. Food-grade nitrogen can be substitute for CO2 in food and beverage applications

-

Some of the nitrogen uses are in filling beer racking tanks, pressure filling in soft drinks, modified atmosphere packaging, etc. Nitrogenating beverages is an alternative to carbonation

-

Although nitrogen can be a substitute in some application, CO2 cannot be replaced in most end-use industries, thus making threat of substitutes low to medium

Buyer Power

-

Buyer power is low for the consumers of merchant CO2, which includes bulk and cylinder CO2 markets

-

Industries, such as urea production, have captive CO2 plant, hence, they do not depend on external suppliers

-

It is not feasible for small to medium-scale customers in the food and beverage, welding, waste treatment, etc., to backward integrate CO2 production. Presence of a few dominant players and by-product nature of raw gas CO2 also keep buyer power low

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now