CATEGORY

Brazil Electricity

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for Brazil Electricity Market

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Brazil Electricity.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Brazil Electricity Suppliers

Find the right-fit brazil electricity supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Brazil Electricity market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBrazil Electricity market report transcript

Brazil Electricity Market Analysis and Regional Market Outlook

-

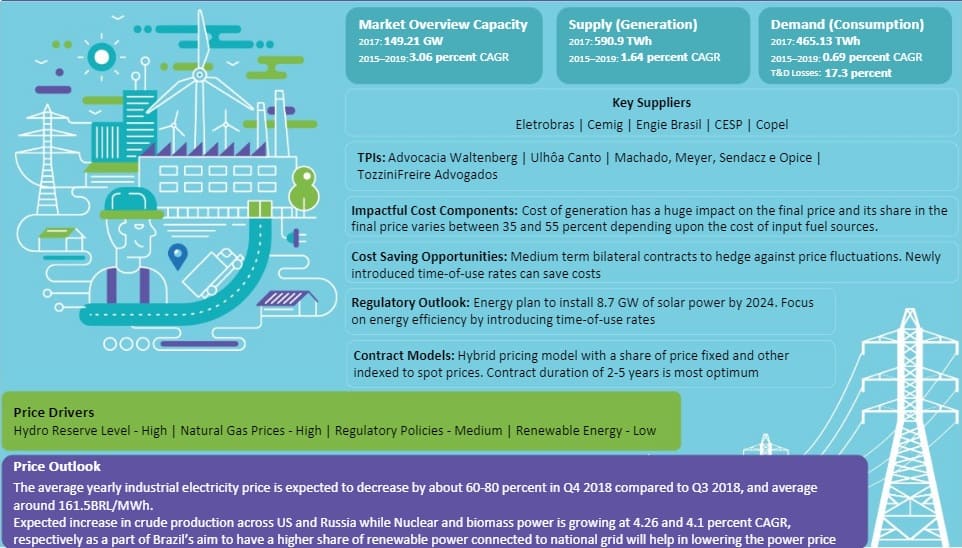

Global power generation is expected to grow at approx. 0.5–2 percent CAGR through 2021–2024

-

South America's largest electrical market is Brazil. Within the next few years, the nation's electricity production is anticipated to rise by 2.5–3.5 percent annually.

-

Due to the dip in COVID-19 cases, Brazil saw an increase in power generation in 2021, and economic activity is back on track. Because of the nation's decreased reservoir levels, hydropower generation suffered in Q3 2021. In Q4 2021, hydropower generation improved, which contributed to a rise in hydroelectric output.

Brazil Electricity Demand Market Outlook

-

South America's largest electrical market is Brazil. Within the next few years, the nation's electricity production is anticipated to rise by 2.5 to 3.5 percent annually. The country had decreased power generation in 2021 due to low reservoir levels. Hence the country is planning to diversify its power generation portfolio. A 3.6% increase is anticipated for the Domestic Electricity Supply (DELS) 2 in 2022, with more than 85% coming from renewable sources. It is anticipated that solar generation will rise sharply (by more than 70%), while wind and hydropower will also increase (by more than 13% each).

Industry Structure and Outlook

Power Generation Capacity

-

The capacity of electricity generation is expected to grow at a CAGR of 2 percent to reach 185.2 GW in 2022, with the highest growth in the renewable energy sector. The rate is expected to continue till 2024.

-

Total installed capacity grew by 4 percent in 2021 to reach 181.6 GW with the highest additions from solar, and natural gas sources.

-

Installed capacity grew at the rate of 2.8 percent annually between 2018 and 2021, driven by the additions in hydropower plants, gas power plants, and wind and solar power generations.

Brazil Electricity –Market Consumption Outlook

-

The industrial segment is the largest electricity-consuming sector with 36 percent of the consumption share in 2021, followed by the residential sector, at 30 percent

-

Electricity consumption had increased in 7 out of 8 sectors in Brazil with industrial sectors leading the top after a drop in 2020 due to the COVID-19 impact

-

The residential and commercial segments are expected to drive the electricity consumption which had growth of 1.1 percent and 5.2 percent in 2021 compared to 2020

Brazil –Green Energy Regulations and Incentives

-

Renewable Energy in Brazil is governed by ANEEL. Brazil does not employ quotas and feed-in tariffs, unlike many other countries. Further, there is no renewable energy certificates market in the country.

Capacity Addition and Utilization Outlook

-

As the government is aiming to reduce its dependency on hydropower share, it had an increase in capacity addition by 0.1 GW in 2021 compared to 2020

-

Thermal power growth capacity of 1.49 GW in 2021 compared to 2020 in which natural gas had the highest addition of 1.39 GW

-

Wind and solar power growth capacity of 3.97 GW and 5.18 GW respectively in 2021

Brazil: Renewable Energy Overview

-

Wind is the major renewable energy sources in Brazil after hydro. Biomass and solar are the other major renewable energy generation sources in Brazil.

-

Brazil has a high dependency on hydropower with 55 percent of the total electricity generated in 2021. Contribution from the Hydro is expected to increase further in 2022.

-

Wind power is expected to increase its supply substantially in 2022 at a growth rate of around 10%. In comparison to 2020, wind generation increased by 26.7%, the fastest growth rate among renewables.

-

Solar PV contributes 3% of renewable sources. In 2021, photovoltaic solar energy accounted for 88.3% of MMGD and was the primary factor driving a rise in MMGD.

Cost Structure Analysis

Contract Models

Electricity Contract Model Parameters: Free Market (Consumers having Annual Demand > 3MW)

Volume Power, Price and Time

-

Demand volume is a key element for negotiation in a contract where higher volume gets lower per unit price

-

Electricity prices are fixed for the duration of the contract and are only indexed to inflation and not to the spot electricity prices

-

Demand is decided on an hourly basis (tariff changes during peak and off-peak hours)

Flexibilities

-

Degree of flexibility in demand is negotiated beforehand in case of over and under consumption and usually resolves with a take or pay contract rule

-

Seasonal variations in prices are very high in Brazil which gives power to suppliers to adjust power rates as per the market rates, the degree of which has to be negotiated beforehand

Contingencies

-

Agreement on appropriate steps during shutdowns and emergency

-

Payment method and guarantee agreement

-

Inflation indexing method of prices – either IGPM or IPCA inflation index is used

-

Agreement on ancillary services charges

Electricity Contract Model: Captive Market (Consumers having Annual Demand < 3MW)

Buying from Utilities

-

In the captive market, electricity buyers have only one option for procuring electricity, i.e., to buy from utilities at a fixed rate, as decided by the state regulator

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now