CATEGORY

Utilities Natural Gas South Africa

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for South Africa Natural Gas

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Utilities Natural Gas South Africa.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Utilities Natural Gas South Africa Suppliers

Find the right-fit utilities natural gas south africa supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Utilities Natural Gas South Africa market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoUtilities Natural Gas South Africa market report transcript

Regional Market Outlook on Natural Gas

-

South Africa`s domestic natural gas production is expected to be 4billion cubic meters in 2022. The entire domestic production is supplied to PetroSA`s GTL (Gas-to-oil) refinery in Mossel Bay

-

The petroleum agency has identified around 849 Bcm of shale gas reserves in the Karoo Basin region. Though these estimates are disputed by some, South Africa still potentially has large shale gas resources, when explored, it will lead to surplus, making it the fourth country in the world with such large reserves

-

The newly discovered large offshore South African gas at Brulpadda by Total’s Luiperd could help meet the depleting demand for PetroSA gas to liquid plant. This would give the chance to the nation to develop significant gas reserves, meet the domestic supply and reduce the imports

Utilities Natural Gas South Africa Industry Structure and Outlook

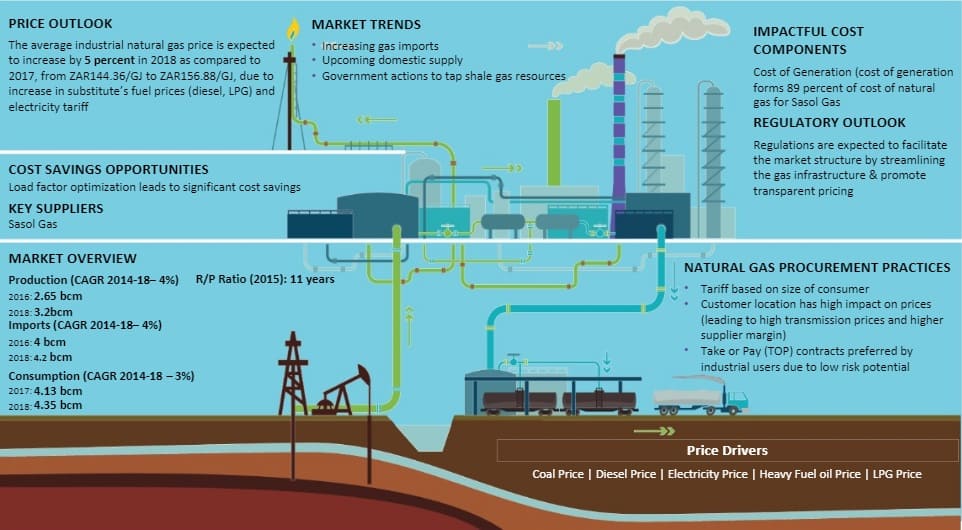

Supply & Demand

-

South Africa`s domestic natural gas production is at 6.2 billion cubic meters in 2020*. The entire domestic production is supplied to PetroSA`s GTL (Gas-to-oil) refinery in Mossel Bay

-

The imported gas from Mozambique reaches from Temane in Mozambique to Secunda in South Africa through 865 km stretch pipeline named ROMPCO. The gas is delivered from Secunda to Durban by Lilly pipeline and regions, like Johannesburg, Pretoria, etc., by Sasol pipelines

-

With a view to diversify primary fuel consumption from coal (that accounted for 70 percent in 2019) and tackle the power shortage situation, natural gas demand is expected to increase by 2.8 percent in 2022

Natural Gas Proved Reserves

-

South Africa`s proven natural gas reserves stood at 27 billion cubic feet in 2017* and majority of the reserves are attributed (55 percent) to the explorations and discovery in Ibhubesi gas field (Orange Basin). Sunbird Energy is expected to supply natural gas to ESKOM from 2018 at 0.3 billion cubic meter/year for 15 years

-

According to EIA estimates, South Africa holds 11.04 Trillion cubic meters of technically recoverable shale gas resources in the Karoo desert basin which could turn the region into a net exporter, depending on the volumes discovered, which could range from 5 Tcf to 20 Tcf

-

However, due to various technical, environmental restrictions coupled with lack of demand and market maturity, achieving the shale gas potential (Global Rank: 8) is quite challenging and hence has received any impetus so far

-

The coal bed methane resources in Botswana, Mpumalanga in South Africa could have substantial volumes of gas in place. The exploration activities are been carried out to identify the gas reserves at these places

Consumption Profile

-

Around 75 percent of the natural gas consumed in South Africa is attributed to transformation by Sasol (that transforms the natural gas to synthetic gas) and PetroSA (which produces the liquids from natural gas at its GTL plant)

-

The second biggest consumer of natural gas in South Africa is the electricity sector (where natural gas contributes to ~2 percent of the total electricity in South Africa)

-

The petroleum Agency has identified around 849 Bcm of shale gas reserves in the Karoo Basin region. Though these estimates are disputed by some, South Africa still potentially has large shale gas resources when explored will lead to surplus, making it the fourth country in the world with such large reserves.

-

South Africa currently imports about 60 percent of its oil-product needs in the form of crude, which is processed at local refineries.

Procurement Practices : Utilities Natural Gas South Africa

Natural gas is predominantly sold under bilateral contracts with three popular models: take or pay, firm and interruptible contracts. Industrial users usually prefer Take or Pay contracts as it involves higher cost savings and lower risk (in terms of supply security)

Take or Pay (TOP) Contracts

-

Under this agreement, buyer agrees to take a minimum quantity of gas at a price that is decided in the agreement. If the buyer does not take the minimum quantity, then the buyer is liable to pay for that minimum quantity at the contract price or specific price agreed in case of default

-

This contract provides buyer with a right to receive a make up quantity in later years, only when the buyer has taken TOP quantity for that year. Industrial users usually opt for TOP (minimum take of 90-95 percent) contracts because higher the minimum percentage lesser the contract price

Firm Gas Contracts

-

Under this contract, either party may interrupt its performance without liability only to the extent that such performance is caused by an event of Force Majeure

-

Party invoking Force Majeure is held responsible for any imbalance charges related to the interruption after the nomination is made to transporter and until the change in deliveries and receipts is confirmed by transporter

-

In this contract, concerned parties anticipate no interruptions and are legally obligated to either receive or deliver the amount of gas contracted. These contracts are specially very beneficial in high demand season, when there are chances of supply disruption

Interruptible Gas Contracts

-

Under this contract, either party may interrupt its performance at any time for any reason, whether or not caused by an event of Force Majeure, with no liability, except the interrupting party will be held responsible for any imbalance charges as decided in the agreement

-

Under this agreement, two parties involved anticipate and permit interruption on short notice, generally in high demand seasons. Usually, interruptible contract price is lower than firm gas contracts

Supplier Market Outlook : Utilities Natural Gas South Africa

-

The South African government published its long-anticipated draft oil and gas legislation in January 2020, hoping it will usher in a new era of exploration and production

-

To combat the country’s energy deficit, it must pave the way for the rapid development of substantial recent discoveries, including Total’s huge Brulpadda field last February, and prospects

-

South Africa is also competing for a necessary investment in a challenging global market. Lower oil and gas prices, combined with a focus on capital disciple mean host governments, are being forced to consider offering better terms to attract IOCs

Regional Agency

-

Market Share: Sasol being the sole distributor of Natural Gas continues to monopolize the market. With the new draft regulations brought in the by the government, there is a possibility that this will usher in many international oil companies and thereby, disrupting Sasol’s market share. PetroSA, which is a native gas exploration company, has identified many more basins for the production, however, it currently consumes all of the indigenous natural gas for its Gas to Liquid plan

Engagement Trends

-

The opening up of the market to international oil companies and identifying more significant gas basins to meet the energy deficit. This would open up the market and also make use low prices of natural gas in South Africa

Why Should You Buy This Report

- Information about the South Africa natural gas market value chain analysis, market trends, key regulations and policies affecting the market etc.

- Porter’s five force analysis of the South Africa natural gas market.

- Cost break up, pricing mechanism, price drivers and trends and forecast of natural gas price south africa.

- Best procurement practices, contract models, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now