CATEGORY

Utilities–Natural Gas–Global

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Utilities–Natural Gas–Global.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

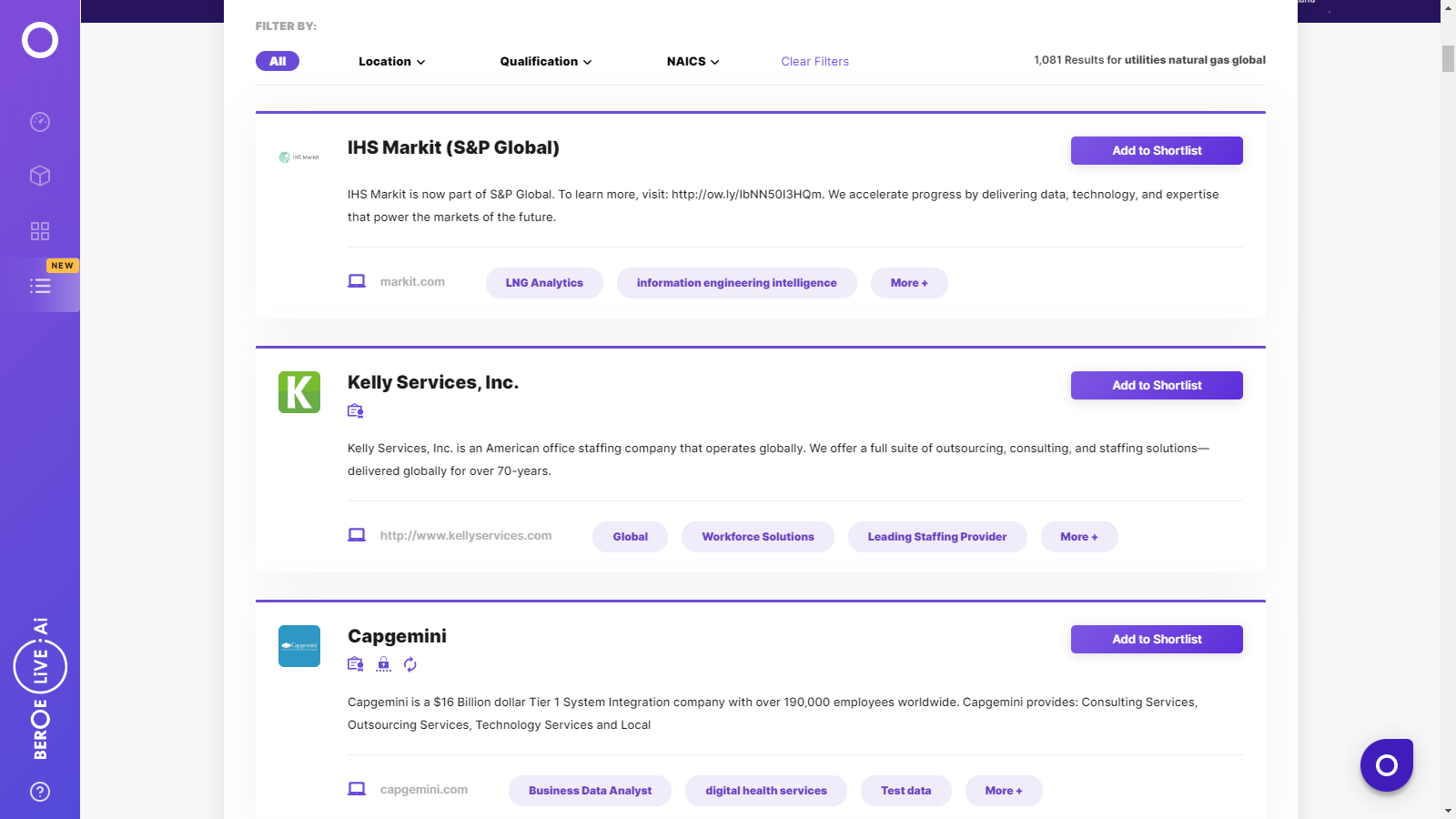

Utilities–Natural Gas–Global Suppliers

Find the right-fit utilities–natural gas–global supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Utilities–Natural Gas–Global market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoUtilities–Natural Gas–Global market frequently asked questions

The U.S. accounts for 82% of the North American natural gas output and 23% of the global gas output. However, while the production in 2020 rose by 0.8% over the 2019 numbers, the consumption declined by 1-2%.

In the US, the major demand for natural gas comes from the industrial, commercial, and residential sectors. However, Beroe’s analysis reveals that natural gas consumption in the commercial and industrial sectors reduced by 3.8% in Q4 2020 compared to Q4 2019 due to adverse impacts of the COVID-19 pandemic. Similarly, power plants also witnessed a decline in natural gas consumption in Q4 2020.

Canada is the sixth-largest producer and exporter of natural gas globally. The country’s national demand for natural gas is poised to increase at around 1-2% CAGR during 2019-2022.

The prominent five natural gas producers in Canada capture over 40% of the overall market, while several other private players occupy the remaining share. For instance, TransCanada Group deals with the transmission of natural gas in the midstream sector. Moreover, the Canadian firm accounts for over half of the total market.

Increasing demand from the power industries and rising domestic consumption primarily fuel the Australian natural gas market growth. However, the demand from the electricity generation sector will slump over the years ahead due to the growing inclination toward renewables in the fuel mix.

Beroe’s analysis suggests that the natural gas production in Australia is projected to swell by 18.81% in 2020, with a surge in Queensland and East Coast coal seam gas (CSG) production.

Utilities–Natural Gas–Global market report transcript

Global Market Outlook on US Natural Gas Market

-

The US is a net exporter of natural gas and depends mainly on domestic production to meet the demand. Natural gas production is expected to increase by 3-4 percent in 2022 and is projected to grow by 2-3 percent in 2023

-

Dry gas production is expected to rise to 100.27 billion cubic feet per day (bcfd) in 2023 and 101.68 bcfd in 2024, up from a record 98.09 bcfd in 2022, according to the EIA

-

Domestic gas consumption is expected to fall to 87.04 billion cubic feet per day in 2023 and 86.10 billion cubic feet per day in 2024, down from a record 88.63 billion cubic feet per day in 2022

Global Market Outlook on Canada Natural Gas Market

-

The national demand is expected to grow at approx. 2 percent CAGR during 2022–2025

-

The top five natural gas production companies hold for more than 40 percent of the share and the rest is hold by many other private players

-

The midstream sector, which includes the transmission of natural gas, is done by TransCanada Group that holds more than 50 percent of the market share

-

Canada is sixth largest producer of natural gas and exporter of natural gas globally

Impact of COVID-19 on Natural Gas –Canada

-

The natural gas sector has recovered from a significant impact, as industrial demand has recovered. The expected winter demand increasing gas usage for heating applications also acts as a relief for the sector.

-

The reduced demand is mainly due to the less industrial activities amid Covid-19 due to the lockdown impositions that came in to force to restrict the spread of virus

-

The reduced demand has also shown an impact on natural gas prices in the country

Global Market Outlook on Australia Natural Gas Market

-

Australia’s natural gas production is expected to increase by 4 percent in 2022, with a rise in East Coast and Queensland CSG production and an increase in global demand

-

The electricity generation sector is expected to decrease its share in natural gas consumption in the coming years, due to an increasing share of renewables in the fuel mix

-

Australia was the largest exporter of LNG beating Qatar, with 108.1 BCM of LNG exports

Australia Natural Gas Market Industry Structure and Outlook

-

An interconnected gas grid connects all of Australia’s eastern and southern states and territories. While traditionally focussed on domestic sales, this market is undergoing structural changes as a gas export industry

-

The western gas market is heavily focused on exports, but also supplies domestic consumption in Western Australia

-

The northern gas market is Australia’s smallest producer. Its basins provide gas for export, and also for domestic consumption in the Northern Territory.

-

The eastern gas region has some wholesale markets for gas, which allow retailers or large customers to purchase gas without entering into long-term contracts.

-

Commissioning of the Northern Gas Pipeline in 2018 linked gas fields in the Bonaparte Basin having over 800PJ reserves (offshore of Darwin in the Timor Sea) to Queensland. A large quantity of the gas produced in this basin is converted to LNG for export

-

Australia is the world’s largest LNG exporter and most of its LNG is shipped to Asia, where it is stored, re-gasified and injected into local gas pipeline networks

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now