CATEGORY

Utilities Natural Gas Brazil

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for Brazil Natural Gas Market

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Utilities Natural Gas Brazil.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Utilities Natural Gas Brazil Suppliers

Find the right-fit utilities natural gas brazil supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Utilities Natural Gas Brazil market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoUtilities Natural Gas Brazil market report transcript

Regional Market Outlook on Natural Gas

-

As we anticipate slower demand growth from the power sector and an anticipated rebound in hydropower generation, the growth in natural gas consumption will moderate to 9 percent year-over-year

-

From a long-term perspective, Prices are expected to reach an average value of 4.4-4.6 BR$/m3 over the long-term outlook.

-

A long-term contract between Bolivia's YPFB and Petrobras set to expire in 2025, the Andean country may have the chance to supply natural gas to Brazil at a better price. Despite signing export agreements with different Brazilian companies such as CDGN (MDC), Delta Comercializadora, Tradener, mbar, MTGás, Compass, and Trafigura last year, but the majority of the 16.8Mm3/d of supplies to Brazil were sent to Petrobras

Industry Structure and Outlook : Utilities Natural Gas Brazil

Production and Reserves

-

The natural gas market is regulated by ANP in the upstream of the value chain, and presently, there are 23 companies operating in the production sector

-

In terms of production, in December 2022, there were 3.955 million barrels of oil equivalent per day (boe/d) in total, of which 3.074 million bbl/d of oil and 140.14 million m3/d of natural gas were produced. Compared to December 2021, there was an 8.3 percent increase

-

Production of natural gas decreased by 0.2 percent from November to December but increased by 6 percent from the same month the year before

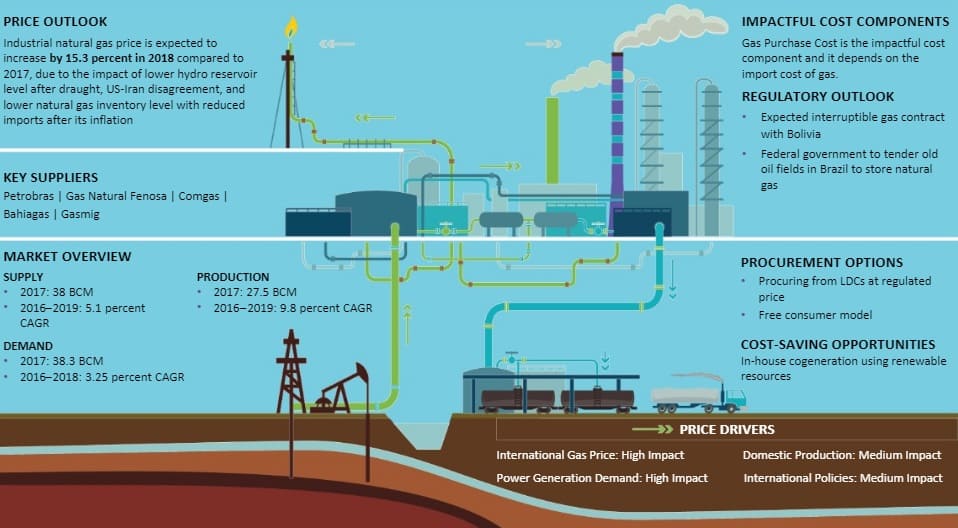

Supply and Demand

-

Slower demand growth is anticipated from the power sector and an anticipated uptick in hydropower generation, the rise in natural gas consumption will moderate to 6-9 percent year-over-year.

-

The natural gas supply in Brazil is estimated to increase in 2022 by 6 percent to reach 44.87BCM, as the domestic production and import of LNG are set to increase

-

The LNG import is set to increase, as the demand is expected to exceed domestic production

-

In Q2 2022, the demand for natural gas decreased to 56 million cubic meters per day from 83 MMm3/d in Q2 2021 and 67 MMm3/d in Q1 2022. Due to the termination of Petrobras' agreements with partners and third parties, who started selling their gas directly to end users, this is the result

-

Brazil's natural gas consumption increased significantly in 2021, by a year-over-year rate of 22 percent, driven by demand from the electricity and industrial sectors

Consumption Profile

-

Transport and industrial consumption are the major driver of natural gas demand growth in the country. The country also provides incentives for certain type of transportation consumption of natural gas

-

The major consumer of natural gas is the power generation sector, which account for 43 percent of the total consumption

-

Industrial consumption, including feedstock for fertilizer and chemical sector, is around 38 percent

-

Petrobras made investments in E&P projects and in refinery assets that are not subject to disposal plans. One of the biggest refineries in the nation, the 252,000 bbl/d Revap refinery, which was left out of the sale plan, generated record amounts of LPG and gasoline in 2022. In 2022, the refinery met 11 percent of the domestic LPG demand

Value Chain of Brazilian Natural Gas Market Regulation

-

Petrobras had been the owner and sole user of all the three LNG regasification terminals in Brazil; however, by 2016, Total agreed to acquire regasification capacity at the Bahia regasification terminal

-

Petrobras has also initiated the bidding processes by 2017 to sell its two other regasification terminals and its associated power plants, Pecém and Guanabara Bay

Alternative Procurement Practices : Utilities Natural Gas Brazil

In House Cogeneration

-

Industries with high heat and power requirement has an option to produce power and heat on the site based on renewable energy

-

Generation is mainly based on the biomass feedstock like bagasse, agricultural and industrial wastes

-

The fuel depends on the availability of feedstock near the consumer location

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now