CATEGORY

Utilities Electricity Canada

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for Canada Electricity Market

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Utilities Electricity Canada.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Utilities Electricity Canada Suppliers

Find the right-fit utilities electricity canada supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Utilities Electricity Canada market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoUtilities Electricity Canada market report transcript

Utilities Electricity Canada Industry Structure and Outlook

-

Global power generation is expected to grow at approx. 2–3 percent CAGR through 2022-2025

-

The APAC region, the largest consumers of electricity, would be the pivotal point for this growth, considering the ease covid restrictions

-

The electricity generation in Canada is expected to have 635 TWh in 2022. The consumption is expected to reach 584 TWh in 2022. Between 2015 and 2019, electricity consumption climbed by around 1 percent every year. It fell by 3 percent in 2020 as a result of the Covid pandemic and was stable in 2021 at 569 TWh. Canadian electricity demand is expected to have a milder growth rate of about CAGR 0.5 percent. Supply growth is expected to reduce at a CAGR of 0.1 percent, as the demand for export is likely to increase

Industry Structure and Outlook : Utilities Electricity Canada

Capacity

-

The Canadian electricity industry has surplus generation capacity and a balanced supply-demand scenario for meeting the domestic need and exports

-

The generation in 2022 was about 635 TWh with the majority generation share coming from hydropower plants, and renewable contribution to generation is fast growing. Electricity storage is also growing rapidly in Canada. Wind and solar would be primarily meeting new demand, while high GHG emission generation technologies are rapidly declining

-

The installed capacity is expected to rise at a CAGR of 2 percent from 2022 to 2025 in the coming years, and at present, close to 3,000 MW of hydro projects are under construction. Phasing out of traditional coal-fired power plants is expected by 2030

-

Canada has a well-developed infrastructure for the power industry, and the provincial authorities have proposed high voltage transmission capacity additions of close to 4,750 MW by 2030 to incorporate more renewable energy sources across provinces.

Fuel Mix

-

Major mode of electricity generation is using hydro-based resources, and it accounts for more than 60 percent of the total generation in the country. Ontario Power Generation has urged the Ontario government to proceed with the construction of new hydroelectric power plants in Northern Ontario, which has a hydrogeneration potential of 4,000 MW. Ontario's long-term plan to stabilize electricity prices includes the construction of a new small modular reactor at the Darlington Nuclear site

-

The Oneida Energy storage project, with a capacity of 250 megawatts (MW), is being developed in collaboration with the Six Nations of the Grand River Development Corporation, Northland Power, NRStor, and Aecon Group

-

The government’s initiative to phase out coal is expected to increase the contribution of natural gas in the fuel mix in the medium to long term

Supply and Demand

-

Canada enjoys an energy surplus situation, with almost all the provinces having its own major utility giants, generating electricity for themselves and trading across the provinces and to the US.

-

The electricity supply to end-use consumers in the regulated provinces is mainly undertaken by provincial crown utilities or other municipal distribution. Electricity's share of end-use demand rises from approximately 17 percent today to more than 29 percent in 2050

-

In the deregulated provinces of Ontario, Alberta, and in some parts of BC, private distributors also undertake electricity supply

-

The demand is expected to stay stable or grow by nearly 0.5 percent CAGR from 2022 to 2025. The supply, on the other hand, is likely to stay low in the coming year to match the demand and lower export demand from the US

Generation and Consumption Profile

-

Power trade happens between the US and Canada via well connected, transmission grid across the border in different regions and excess energy is exported to the US

-

The industrial sector is likely to remain the highest energy consumer, as more energy-intensive industries will come up across different provinces as a part of industrial development in the country

-

Rapid implementation of energy-efficient technologies and small-scale renewable generation in the residential and commercial sectors will limit the demand growth in these sectors

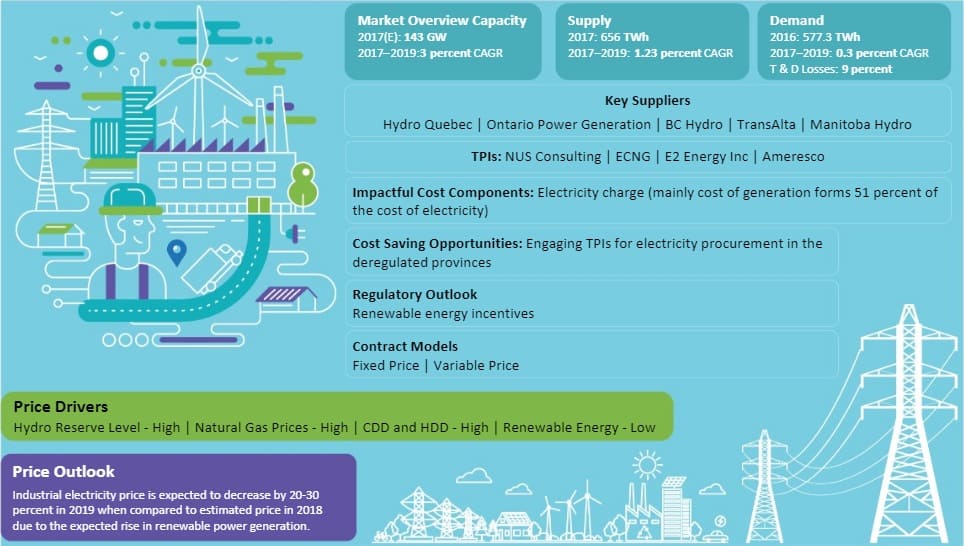

Price Drivers : Utilities Electricity Canada

-

Hydro reservoir level, fuel prices and cooling, and HDDs are the major factors influencing the Canadian power prices

-

In the future, the renewable energy generation is likely to have a greater impact on prices, as global technological developments have brought down the generation cost significantly

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now