CATEGORY

Transformers

A transformer is a static electrical machine which transfers electrical energy from one circuit to another through the process of electromagnetic induction and is most commonly used to increase (‘step up’) or decrease (‘step down’) voltage levels between circuits.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Transformers.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Siemens introduces sensor bushing, protection and indication device

April 18, 2023U.S. government examines transformer manufacturers.

April 18, 2023Extent of Chinese-made components in U.S. electrical grid still unknown

April 04, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Transformers

Schedule a DemoTransformers Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoTransformers Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Transformers category is 7.30%

Payment Terms

(in days)

The industry average payment terms in Transformers category for the current quarter is 72.9 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

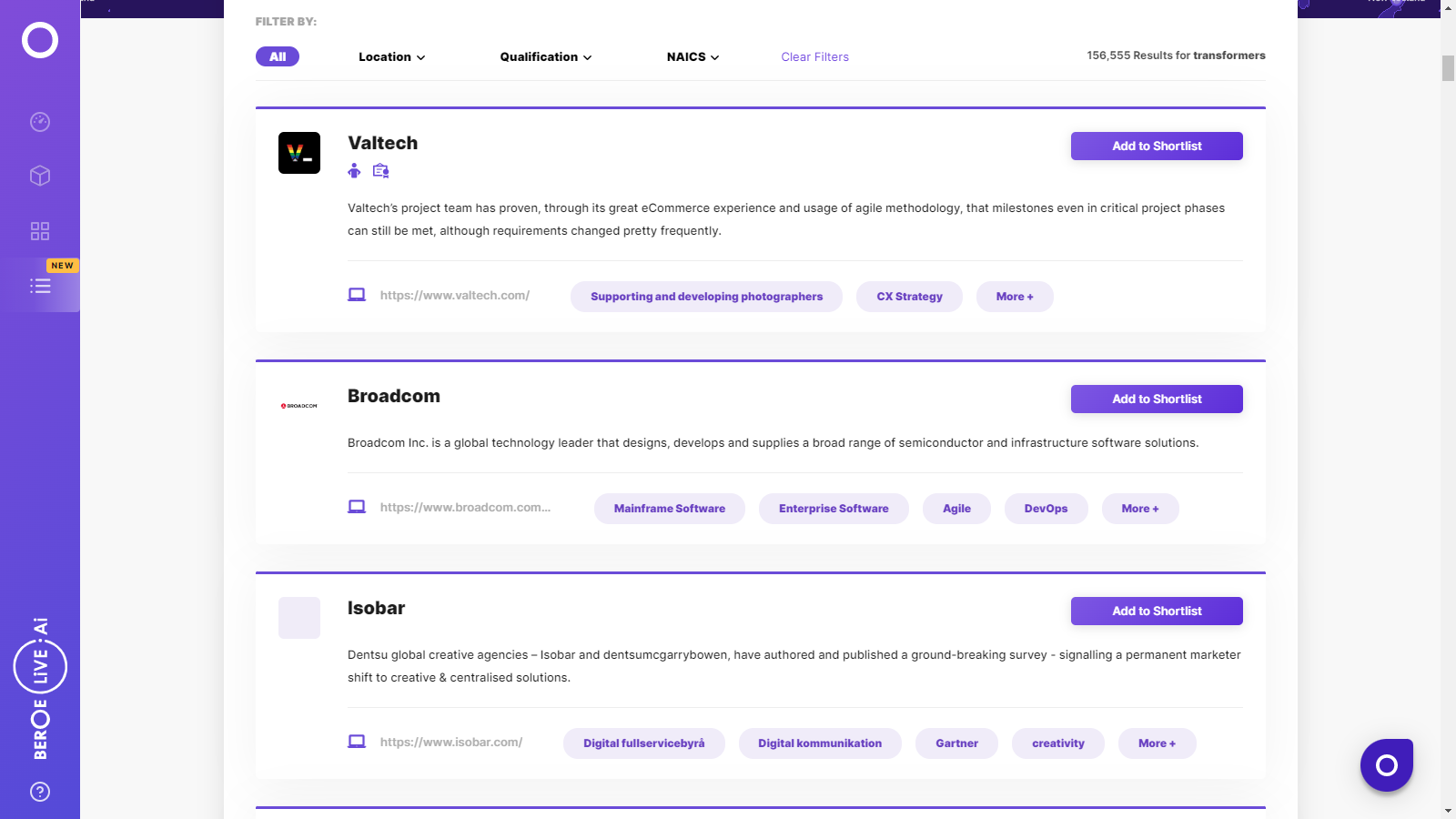

Transformers Suppliers

Find the right-fit transformers supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Transformers market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoTransformers market report transcript

Global Market Outlook on Transformers

MARKET OVERVIEW

Global market size: ~$35.90 billion (2023E)

Expected to grow at a CAGR of 3–5 percent to $37.34 billion by 2024

MARKET TRENDS

-

Increase in innovation

-

Increase in safety

-

Increase in demand of environment friendly transformers

Transformers Regional Market Outlook

-

The APAC will continue to dominate the market, in terms of growth prospects through to 2023

-

Increasing demand for electricity in the emerging and developed countries, backed by increasing investment in infrastructure, is expected to drive the transformers market globally. Also, initiatives taken to replace aging transformers with energy-efficient transformers, especially in North America and Europe, are further expected to drive the power transformers market

Transformers Global Market Maturity

-

Increasing demand for electricity in emerging and developed countries, backed by increasing investment in infrastructure, is expected to drive the transformers market globally. However, slowdown of economy and investments in the mining sector are likely to affect the demand for transformers in this particular segment.

Transformers Global Market Size and Trend

-

The global transformers market is estimated to be around ~$35.9 billion in 2023, and it is expected to reach ~$37.34 billion by 2024, growing at a CAGR of 3–5 percent during 2021–2026

-

Increasing demand for electricity in the emerging and developed countries, backed by increasing investment in infrastructure, is expected to drive the transformers market globally. Also, initiatives taken to replace aging transformers with energy-efficient transformers, especially in North America and Europe, are further expected to drive the power transformers market

-

The growth of the large power transformers segment is higher, due to the increasing adoption of HVDC transmission projects in the APAC region, so as to reduce transmission loss during transmission over large distances

-

Volatility in raw material prices, such as copper and steel, may restrain the growth of transformers industry globally

Global Drivers and Constraints : Transformers

Drivers

-

Grid upgradation to support massive renewable energy integration, distributed generation, and EV infrastructure

-

Electrification, industrialization, and urbanization in the developing countries

-

Replacement and refurbishment of aged grid infrastructure to increase reliability, capacity, and loss reduction

-

Rise in deployment of smart cities & IoT adoption in power infrastructure

-

Increasing demand from data center and increasing investment in infrastructure supported by various recovery packages

-

Upcoming capital reinvestment wave in the oil & gas sector & increasing captive power plant installations in the mining sector

Constraints

-

Volatility in steel, copper, and crude oil prices is expected to restrain the growth of transformers globally. A

-

Such volatility in raw material prices has created pressure on manufacturers’ profit margin, due to which, some of the global suppliers in the industry have shifted their production facilities to regions that facilitate lower cost of manufacturing as well have a higher demand, like China, India, etc.

-

Power transformers are special ordered machineries and require highly skilled workforces. Low availability of skilled service engineers is likely to hinder the growth in this industry

-

Protectionist policies of major demand regions like US & India

Why You Should Buy This Report

- The report gives information on the transformers market size, maturity, drivers and constraints, and the regional market outlook of North America, APAC, Middle East, Europe.

- It gives the Porter’s five force analysis of the global transformers market, the supply landscape and swot analysis of transformer industry.

- The report analyzes the cost breakup, pricing trends, price drivers, etc. It lists out the best industry practices, sourcing and contract models and technological innovations.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now