CATEGORY

Batteries

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Batteries.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Hyundai Motor and LGES enter JV for building two battery plants in U.S.

November 29, 2022China-based Sunwoda Electronic announces plans to build joint venture battery factory

September 29, 2022Honda and LG Energy Solution announces JV investing $3.5B in EV battery plant in Ohio

October 13, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Batteries

Schedule a DemoBatteries Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoBatteries Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Batteries category is 3.00%

Payment Terms

(in days)

The industry average payment terms in Batteries category for the current quarter is 105.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

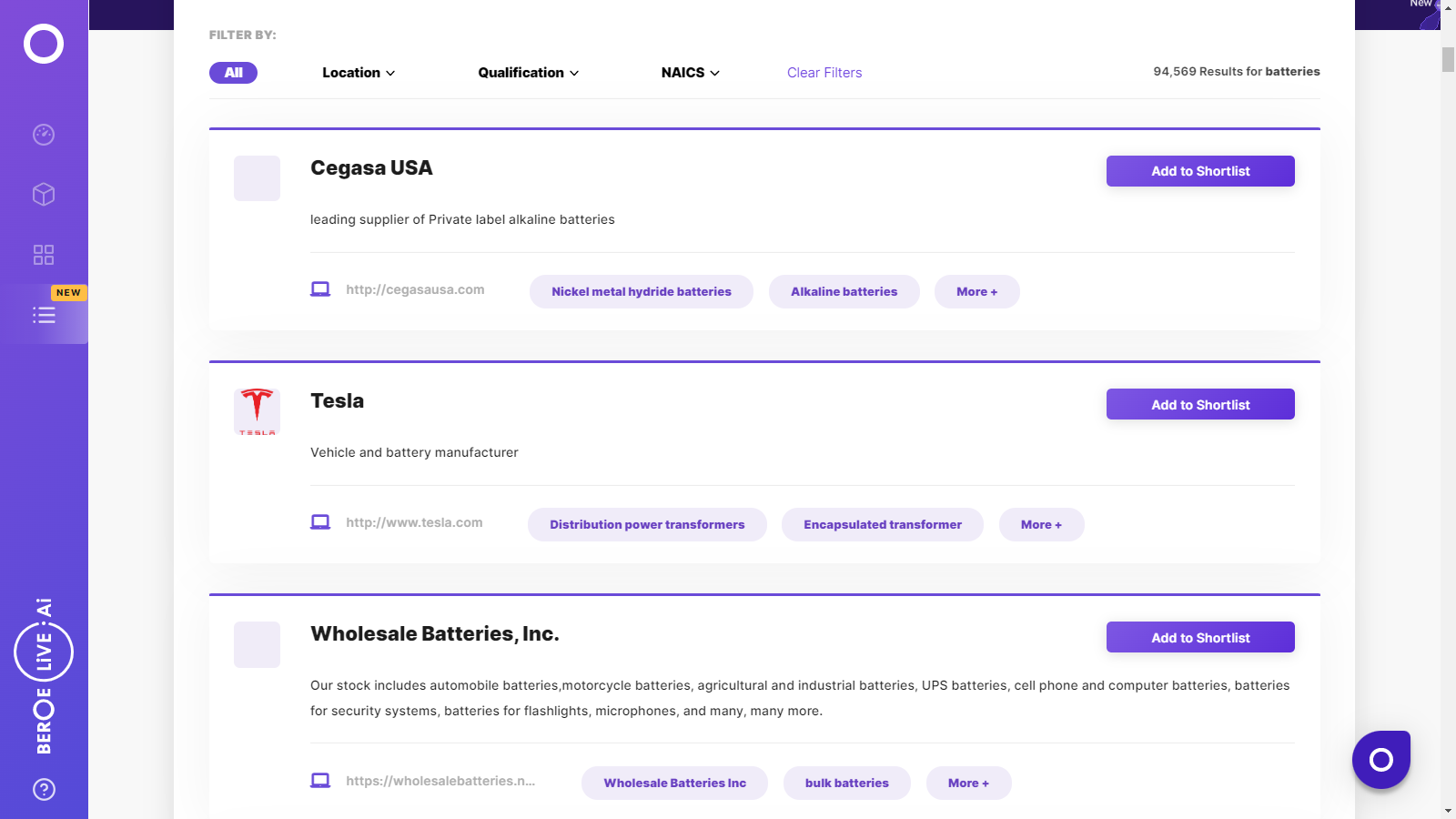

Batteries Suppliers

Find the right-fit batteries supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Batteries market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBatteries market report transcript

Batteries Global Market Outlook:

-

EVs, one of the major segments for Li-Ion batteries, witnessed a sharp spike in sales globally in 2021 driven by favorable government policies. The governments in Europe and the US have announced their electrification targets for all new cars by 2030-35 coupled with investment in EV charging infrastructure

-

Due to COVID-19, battery production is expected to shift back to Japan and Korea for certain products, like consumer electronics. However, China will still remain the leader for battery production for EVs. Increasing adoption and awareness of EVs, government initiatives, and regulations, supporting the adoption of EVs globally, backed by declining prices, are further expected to drive the growth of the Li-Ion battery market

Market Overview: Batteries (Global)

Increasing adoption of Li-Ion batteries from its end-use markets due to its technical advantages over its counterparts is the primary trend expanding the market growth rate for Li-Ion batteries. Although lithium batteries are used in various medical devices, such as ventilators, which have been critical during the pandemic, however, EVs are the major demand segment for lithium batteries and is expected to significantly dominate the category in the coming years, thereby providing strong growth prospects for Li batteries during 2022–2025.

Market Insights

-

The global market size for Li-Ion batteries was estimated at $61.91 billion in 2022 and is expected to grow at a CAGR of 14-16 percent to $94.15 billion by 2025, primarily driven by the demand from EVs

-

EVs, one of the major segments for Li-Ion batteries, witnessed a sharp spike in sales globally in 2021 driven by favorable government policies. The governments in Europe and the US have announced their electrification targets for all new cars by 2030 -35 coupled with investment in EV charging infrastructure

-

The growing acceptance of clean energy technology, along with escalating demand for Energy Storage Systems (ESS), is expected to propel the growth in the Li-Ion battery industry. ESS mitigates energy security issues and renders a cost-effective & sustainable solution to meet the growing demand for energy

-

Auto and battery makers are presently focusing on reducing cobalt content in batteries on account of legal and reputational risks related to cobalt mining from DRC. Chinese companies such as Huayou Cobalt and CMOC presently dominating cobalt mining in DRC are investing in Indonesia for nickel extraction and processing

Procurement-Centric Five Forces Analysis (Global) on Batteries

Supplier Power

-

Presently the supplier power is low due to the battery shortage caused by surging EV demand coupled with raw material availability (especially lithium) and logistics concerns.

-

With increasing trend of EV adoption, the supply demand gap is expected to further widen inspite of capacity expansions by suppliers. It is challenging to achieve capacity additions at the same pace as that of demand thus further decreasing supplier power

Barriers to New Entrants

-

Players need to have highly skilled R&D team besides continuous R&D investments so as to be at par with the current innovation trends in the industry

-

Consequently, it is difficult for new manufacturing firms to enter the market, due to the presence of well-established manufacturers already entrenched in the market and the high costs of R&D investments, patent technologies etc. However, present trend of JV between car makers and battery startups is expected to reduce the barriers to some extent.

Intensity of Rivalry

-

The top global and regional manufacturers have similar product portfolios, leading to enhanced competition. Increasing demand for Li-Ion batteries, surging prices, amid industry need for constant technological advancements with respect to cell chemistries, form factors etc. is expected to keep the intensity of rivalry at significantly high levels.

Threat of Substitutes

-

Threat of substitutes is quite high with researchers trying to analyze various alternatives, such as sodium-ion, nickel-zinc, proton, aluminium-ion, graphite dual-ion batteries, etc., since producing cheap batteries with enhanced performance having less impact on the environment is the need of the hour. Hence threat of substitutes is expected to remain high.

Buyer Power

-

With suppliers struggling to meet demand, the buyers especially the automotive segment enjoys a very high buyer power. The other industry buyers such as Consumer Electronics, Energy Storage etc. have a comparatively lesser buyer power

-

However, the buyer power is expected to be moderate as more capacity additions come online backed by increasing prospects of Li-Ion battery recycling and upcoming alternate technologies

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now