CATEGORY

Cable Harnesses

A cable harness is an assembly of wires or electrical cables transmitting signals or electricity. Rubber, vinyl, electrical tape, conduit, a weave of extruded string, or a combination thereof are used to keep the cables bound together.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cable Harnesses.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCable Harnesses Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCable Harnesses Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Cable Harnesses category is 2.60%

Payment Terms

(in days)

The industry average payment terms in Cable Harnesses category for the current quarter is 52.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Cable Harnesses Suppliers

Find the right-fit cable harnesses supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Cable Harnesses market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCable Harnesses market report transcript

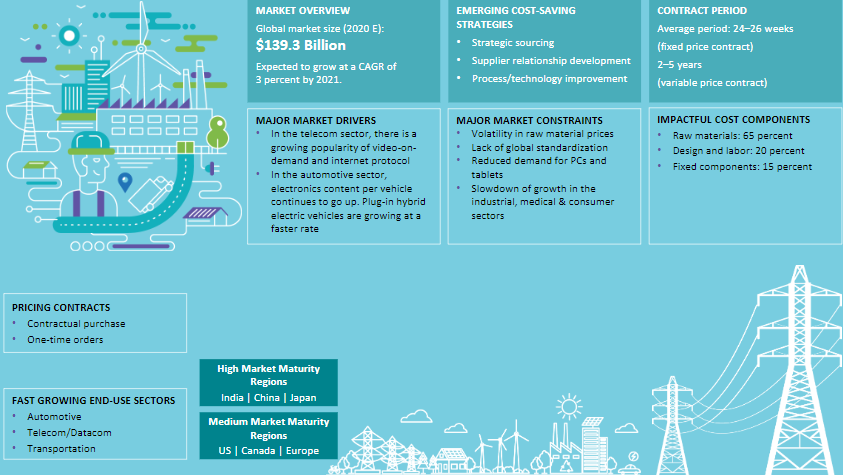

Global Market Outlook on Cable Harnesses

-

APeJ has been dominating the cable harness market with around 50 percent of the market share, which is majorly due to the developing economy, more technological growth, and increased growth of end uses, like automotive, telecom, and consumer electronics. China and Japan are the leading countries in these regions with the highest demand, together holding around 40 percent of the global demand

-

Increasing demand for interconnect systems in EV vehicles and hybrid automotive, enterprise networking, subscriber equipment in telecom and power distribution, and power train in automotive are the major market drivers

Global Cable Harness - Market Maturity

-

Increasing demand for connectivity and internet protocol in emerging and developed countries and pent-up demand for automotive (especially cars) are expected to drive the cable harness market globally. The current scenario of the Russia–Ukraine war resulting in severe production disruption in Ukraine has resulted in a severe supply shortage for wire harness, especially for Europe and the US.

Global Cable Harness Drivers and Constraints

Drivers

-

Demand for high voltage wire harness such as 48V is on the rise due to increased popularity of EV bikes and hybrid passenger cars that uses higher voltage wires for various complex functionalities. These harnesses transmit power to each and every electronic and electrical components such as wipers, power delivery, ignition engine, lights, doors and seats, etc. This drives the growth of automotive wire harness.

-

Increasing demand for connectivity and internet protocol in emerging and developed countries, such as China, India, Germany, and the UK, are expected to drive the telecom cable harness market, globally

Constraints

-

Volatility in copper and crude oil prices is expected to restrain the growth of cable harness market, globally. Such volatility in prices and increase in competition have created pressure on manufacturers’ profit margin, due to which, some of the global suppliers in the industry focus on shifting to locations, where the final products are being assembled

-

Wiring Management is a complex task while it has complicated regulatory standards that includes regional standards like UL, IEC, ANSE, CSA, etc. which are made mandatory and many a times considered an increased business cost to set all the standards. This is one of the major constraints for the automotive wire harness market

-

Recent Russia–Ukraine war stalled the production of wire harness, which results in severe supply shortage, especially for automotive end use

Porter's Five Forces Analysis (Global) : Cable Harnesses

Supplier Power

-

Global cable harness market is highly raw material and labor intensive

-

Copper, Aluminum and Plastics (PVC) are the major raw materials and are abundantly available, which makes the supplier power low

-

Similarly, the suppliers are fragmented in most of the regions, so high competition within the industry also makes the bargaining power of suppliers to be low

Buyer Power

-

Buyer power is highly supported by large number of players in the industry, which gives the buyer high options

-

Switching costs to buyers is also relatively low because of the availability of more number of suppliers and generic equals in many applications. However, in the automotive and transportation sector, wiring harness manufacturers work closely with automotive manufacturers to design & develop a harness system in line with the vehicle model requirement. Hence, they do not change suppliers frequently

Barriers to New Entrants

-

Advanced technologies makes it significantly difficult for new competitors to enter the market because they have to develop those technologies before effectively competing

-

In addition to this, there are several big brands holding a large amount of market share. The brand identity in the industry is high. This may also create a significant barrier to new entrants in the market

-

Thus, the overall barriers to new entrants in the cable harness market is moderate

Intensity of Rivalry

-

Nowadays, the value-adds by offering various types of connector assembly along with cable harness has been increasing. This makes all top brands to intensively compete with each other to offer more such value-adds to attract the customers

-

The exit barrier is relatively low, hence weak firms are more likely to leave the market. This will increase the profits for the remaining firms

Threat of Substitutes

-

Currently, there is no technology or product, which provides an alternative to cable harness from end-use/application point of view. There are wireless signal transmissions coming up but it may only replace signal and communication

-

Thus, threat from substitutes is likely to have low impact on the overall cable harness market

Cable Harnesses Cost Structure Analysis: Global

Typical Cost Structure

-

Cable Harness cost is highly influenced by raw material and labour cost which are variable cost components. Lack of automation in the manufacturing process for cable harness results in higher labour cost. Similarly, the other benefits provided to the labour also gets added to the fixed overheads

-

Similarly, at the component level, Terminals and connectors hold the largest cost share of cable harness due to the metallic cost influencing the terminals and connectors

-

Harness Components accounts for the major portion of the wire harness cost as it is manufactured with key raw materials like copper/aluminum/optical fiber, polyethylene insulation and some sheathing. They are generally, cables and wires, connectors, terminals, crimps, Grommets, Protectors, sheaths etc. and holds 60 percent of the overall harness cost

-

Apart from the harness components, the major cost contributor is the labor cost as majority of cable harness assembly is made manually with physical labor. The automation involved in cable harness assembly is only up to 30 percent for low-mix high volume products like automotive wire harness

-

When estimating the total cost of cable harness using component wise split, Electrical cables and wires, connectors and terminals occupy the major portion of the cost of up to 70-75 percent as they have more weightage of cost and they are larger components of the wire harness

-

The other portion of the cost is shared by protectors, Grommets, Clamps, Convoluted Tubes, Sheaths etc. which comprises only 25 percent of the cost.

-

However, based on number of connectors, terminals, wires, clamps used, the weightage might vary for each application

Why You Should Buy This Report

- The report provides information on the wire harness market size, maturity, growth trends and the drivers and constraints in the wire harness market.

- It gives the regional market outlook and Porter’s five force analysis of the global cable harness industry.

- It details the cable harness supplier market outlook, share and gives the SWOT analysis of major players like Yazaki, Sumitomo Electric, Aptiv PLC, etc.

- The report does the cost structure and price driver analysis and gives the price trend and forecast for the wiring harness market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now