CATEGORY

Forgings

Forging is a process in which metals are shaped in to desired designs by compressive forces. The category involves both hot and cold forging process with open dies, closed dies, precision dies, Closed Die Flash-less Forging, Open rotary dies involved

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Forgings.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Ramakrishna Forgings moves towards Sustainable Manufacturing

March 07, 2023UK Metal Forming Manufacturers Face Energy Crisis

April 04, 2023Bharat Forge and GA-ASI signs Partnership Agreement

January 10, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Forgings

Schedule a DemoForgings Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoForgings Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Forgings category is 7.30%

Payment Terms

(in days)

The industry average payment terms in Forgings category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Forgings Suppliers

Find the right-fit forgings supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Forgings market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoForgings market frequently asked questions

According to Beroe, the global forging market is fragmented into different suppliers namely, Bharat Forge, FAW Forge (Auto), JSW, and JCFC (Heavy Equipment). All these suppliers constitute less than 10 percent of the total market w.r.t volume.

Based on insights shared by Beroe, nearly 95 percent of the global forging output is made of steel.

The forging industry analysis report by Beroe indicates that forging production will likely jump from a valuation of 26.5 MMT to 31.48 MMT with a CAGR of 4.5 percent in three years.

The primary factor is the fact that the automotive industry holds nearly 50 percent share in the market across different regions and also because the automobiles have multiple structural forged components that require higher wear resistance, high impact, and shear strength.

As per the forging industry outlook report, the key players of the industry include the following names: ThyssenKrupp AG Alcoa Forgings Bharat Forge Nippon Steel & Sumitomo Metal Corp ATI

As per Beroe's analysis report, three main parameters that majorly influence the costing factor in the forging industry include: Raw material ' it includes steel and aluminum Electricity Labor

The global forging market size is primarily dominated by China, as it holds nearly 33 percent of the overall forging market. The next position is taken by the Asia Pacific region, owing to infrastructure development, advancements in the automotive and construction segments. The same global forging market analysis report also indicates the growth of the following regions due to varying reasons like: E.U. ' driven by increasing economic trend in Europe North America ' increasing demand in the automotive segment and since it holds 18% global automotive market Latin America ' due to high demand in the end-use market, and contributing countries like Brazil, Argentina, and Columbia

The mining machinery industry consumes approximately 4 percent share of the global forgings production.

According to the latest forging industry news, the primary constraints of the industry include: Slow demand Foreign competition Energy costs Availability of labor and capital (both inclusive) Raw material lead time

As per the global forging market news, the concept of powder forging will likely escalate in the coming years. Another breakthrough would be seen in terms of costs as the industry is gearing towards leveraging the benefits of synthetic, water-soluble graphite free lubricants and discarding the old traditional graphite-based counterparts. The power forging technology will be most useful for components whose ends are made to experience different levels of stress.

Forgings market report transcript

Global Market Outlook on Forgings

-

The global forging industry is fragmented, and currently, China holds the highest market share of 41 percent. However, the Russia–Ukraine war is expected to impact the growth of forgings market.

-

APAC holds the largest share of around 67 percent of the global market size, with key supply countries being China, Japan, and India, accounting for around 50 percent of the global share

Global Market Overview: Forgings

-

China occupies around 43 percent of the global forgings production. Consequently, Asia Pacific holds the largest share, due to the development in infrastructure, advancements in the automotive and construction segments. The zero-COVID policy in China and Russia–Ukraine war have impacted the supply market

-

Globally, the production demand for forging is expected to increase in H2 2022, due to the resumption of demand from major end-use OEM industries, such as automotive, aerospace, construction, machine tool industry, and oil & gas sector

-

The European Union is expected to account for ~22 percent of the overall productions, and countries, such as Germany, Italy, France, Spain, etc., are considered to be the key supply bases in Europe

-

North America is estimated to account for ~8 percent of the global production, and the US is expected to hold greater than 60 percent of the production within the North American region.

-

The automotive and aerospace industry is the top end-use market (50 percent) for forgings across regions. Automobiles have a number of structural-forged components requiring high wear resistance, high impact, and shear strength. However, the recent electrification trend in the automotive industry is expected to have a minimal impact in the demand during the forecasted period.

-

Other major end-use sectors include machine tool, construction, energy, machinery, etc. The mining machinery industry consumes about 8 percent of the global forgings production.

-

The machine tool industry is expected to have a positive outlook in the next 2–3 years, majorly due to the demand for increased automation in the manufacturing sector

-

The global mining machinery market is expected to grow at a CAGR of 5–7 percent until 2025, and the same is expected to propel the demand for the forgings industry

-

Rising need for infrastructure developments and increasing urbanization rates in emerging economies are expected to drive the demand for construction industry by 4–5 percent untill 2025, thereby leading to support the forgings market demand

Emerging Technologies : Forgings

Process: Powder Forging

A forging technique for products requiring variable material composition. At present, in different stages of development across the world could emerge as a key technology in the upcoming years:

-

While powder forging is rapidly growing in the developed nations, it is still in its nascent stages across the developing countries

-

This technology allows different material compositions across different parts of the same component

-

This is useful for components, like connecting rods, whose ends are subjected to different levels of stress

-

In this process, custom-blended powders of various alloys are placed along a die and compacted into a rough shape and sintered. This is then placed in the final component die and hot forged

-

These components require little secondary machining and have very high precision.

Consumables: Forging Lubricants

Graphite Free Lubricants

-

Lubricants are important cost saving levers in die forgings. This is because a good lubricant can help improve ease of operation as well as increase die-life

-

In closed die forgings, die costs account for ~10-15 percent of total cost and this depends on order volume requirements. Therefore, any improvements in die-life would lead to significant cost savings

-

Over the past decade, there has been a move to replace graphite lubricants, due to economic as well as environmental considerations

-

Synthetic, water soluble graphite free lubricants have the following advantages over their traditional graphite based counterparts:

-

While synthetic lubricants have the above advantages, these have mainly been proven with respect to small–medium components (up to 12kg). More work in this area is expected in the future for large components as well

Supply Trends and Insights : Forgings

Supply market Overview

-

Forging supply base is highly fragmented with suppliers serving to multiple industries such as Automotive, Machine tool, Construction, energy, etc.

-

Supply base concentration is found to be relatively higher in countries such as China, Germany, India, Japan, etc., when compared to other countries and suppliers are majorly found to be serve Automotive industry.

-

Suppliers in Europe are currently involved in production stoppages due to energy crisis prevailing because of Russia-Ukraine war. Consequently, this has increased the supply-demand gap, thereby leading to increase in final price of product.

Supply Capabilities

-

Few suppliers in the forgings market are found to have integrated CNC machining/casting/fabrication services. Also, suppliers are capable in providing secondary services such as plating, powder coating, etc., either by In-house or outsourced capabilities.

-

Majorly, suppliers are found to have ISO 9001 quality certifications and also adoption for availing certifications such as TS 16949, ISO 13485,etc., is expected to increase with the forging suppliers.

-

Forgings market is found to be matured in terms of technology, as buyers are interested in engaging with suppliers who are capable in providing process such as cold forging, powder forging, etc.

Emerging Markets

-

Supply base is emerging in countries such as Mexico, Poland, Czech Republic, Bulgaria, Vietnam, Taiwan, etc., due to factors such as increasing supply base concentration, low labor cost, etc.

-

Forging supply base is expected to grow in regions such as Latin America, Eastern Europe, South East Asian countries, etc.

-

In Middle East, the supply base for forging is expected to increase due to governmental support schemes currently being implemented in the country.

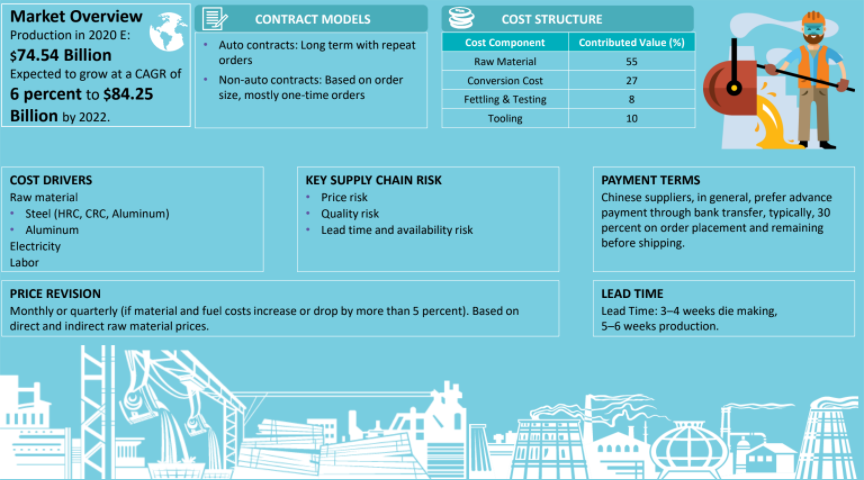

Forgings : Cost Structure

-

The main cost drivers for forged components are raw material (steel and aluminum) and conversion cost. These account for nearly 80 percent of the total costs

-

−The grade of raw material used is important and can cause significant changes to cost structure. For example, using a lower/higher grade could result in variation of raw material proportion from 45 to 60 percent of the total cost. The number of pieces produced also affects the cost structure and total costs

-

Any price hikes by raw material suppliers directly affect the total component costs, and in turn, prices.

-

−However, the price increase shall not be directly transferred to long term relationship buyers, especially buyers from high volume industries. Forging suppliers try to compromise on their margins until to a certain threshold increase in input cost.

-

Prices could be revised quarterly/bi-annually/annually, depending on the end-use segment and relationship with customers

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now