CATEGORY

Iron Castings

Iron Casting is the process in which the molten metal (Iron) is melted in the furnace and then poured into the cavity of the mold (esp. Sand Mold) by gravity or by force which solidifies to form the shape. The mold is then separated from the part.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Iron Castings.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Interpump Group announces the acquisition of 85% of Indoshell Automotive System India P.L. share capital.

April 10, 2023SMS to Supply Rebar Minimill to YK Steel in Korea

February 08, 2023Researchers From University Of Birmingham, U.K., Show Novel Adaptation For Existing Furnaces

February 08, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Iron Castings

Schedule a DemoIron Castings Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoIron Castings Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Iron Castings category is 7.30%

Payment Terms

(in days)

The industry average payment terms in Iron Castings category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Iron Castings Suppliers

Find the right-fit iron castings supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Iron Castings market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIron Castings market report transcript

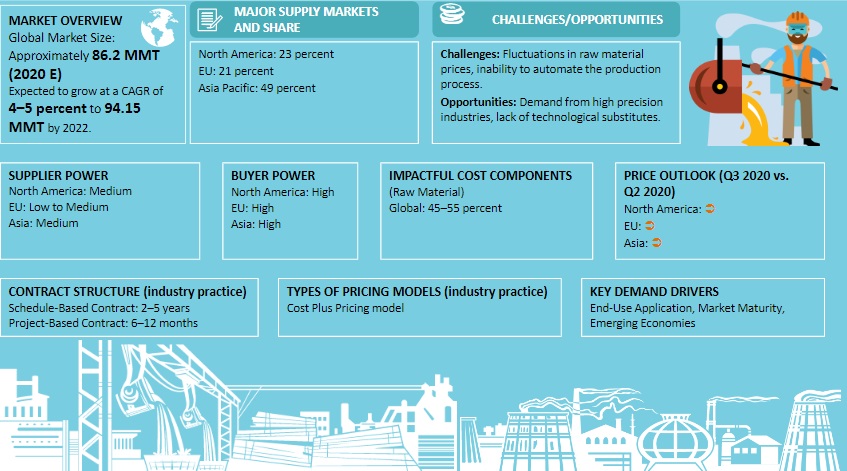

Global Iron Castings Industry Outlook

-

The global castings market is highly fragmented with the major supply bases spread across the US, China, India, Japan, and Germany

-

The demand from major end uses at a global level has increased during 2022, due to the resumption of major OEM industries.

-

Zero-COVID policy and energy crisis across European countries have created impact on the supply market; thereby causing lead time delays and price increase

Global Iron Castings Market Maturity

-

China contributes to 44–48 percent of the global iron castings production. Most of the iron castings producers are small and medium-sized enterprises

-

Automotive, industrial machinery, and construction are the major end-use industries that serve as key demand drivers for iron castings production

Global Iron Castings Industry Trends

-

The global iron castings market is fragmented, and the foundries compete by offering various additional services and differentiate themselves amongst peers on cost and product quality

-

The developed nations, such as the US, Germany have stringent environmental regulations, and hence, the foundries are likely to invest more on environment friendly practices like recycling of sand, usage of silicate binder, etc.

Cost Structure : Iron Castings

- Primary cost drivers are those, which directly affect the cost of the product

–Materials, energy, wage rates are some of the primary drivers, which can be directly tied to the variations in cost

- Secondary cost drivers are those, which explains the variations in primary cost drivers that affects the cost indirectly

–Coke/charcoal and iron ore are the main raw materials used in the production of pig iron. Any change in the price of coke/charcoal and iron ore will have its impact on the price of pig Iron

-

Coal prices will have its effect on the price of electricity

-

Key price drivers are end-user demand, taxes contract terms, and the overall cost

Industry Best Practices : Iron Castings

Design

-

Integration with suppliers in terms of design reduces the over all cost and helps in leveraging their expertise

-

Collaboration in casting design and rapid tooling are adapted in many foundries

Quality

- The cost of rejections are reduced by focus on suppliers and sub-suppliers with PPAP, APQP capability

Matrial purchase

-

Most of the OEMs are now procuring the raw materials on behalf of their suppliers

-

Savings to be redeemed on while purchasing finished components

Labour

-

Identifying suppliers with high levels of automation will enable high quality and consistency and can offset the labor cost

Integration

-

Having a number of levels in supply chain can lead to longer lead times and higher total costs.

-

Opting suppliers with integrated capabilities reduces lead time and cost

Iron Castings Emerging Trends

Additive Manufacturing

-

An emerging trend in the field of pattern making is the use of 3D printing technology for making the mold, Despite this technology is gaining traction in the developed countries in the West, a majority of the developing economies are yet to catch up. The advantages of adopting this technology would relatively reduce the operational cost. However, still research is being conducted to improve the quality of the mold patterns in terms of surface finish.

Casting Simulation Software

-

Development of casting design simulation software’s such as Quickcast, ProCast, Flow 3D cast, etc., has resulted in the reduction of casting defects like shrinkage, cold shut, porosity, blowholes, etc., Simulation based castings is a modern casting technique which is implemented in the design phase to improve the quality of the casted product by suitably designing the mold shape, runner and riser assembly.

Advancements in Binders

-

Few sand mixing binders in the market such as ECOLOTEC, GMBOND, etc., are used in the core making process. ECOLOTEC is a odorless binder suitable for Steel/Iron castings which improves the strength of the mold, prevents the emission of hazardous pollutants thereby creating a clean and a safer core making process.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now