CATEGORY

DC Motors

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like DC Motors.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoDC Motors Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in DC Motors category is 6.57%

Payment Terms

(in days)

The industry average payment terms in DC Motors category for the current quarter is 74.2 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

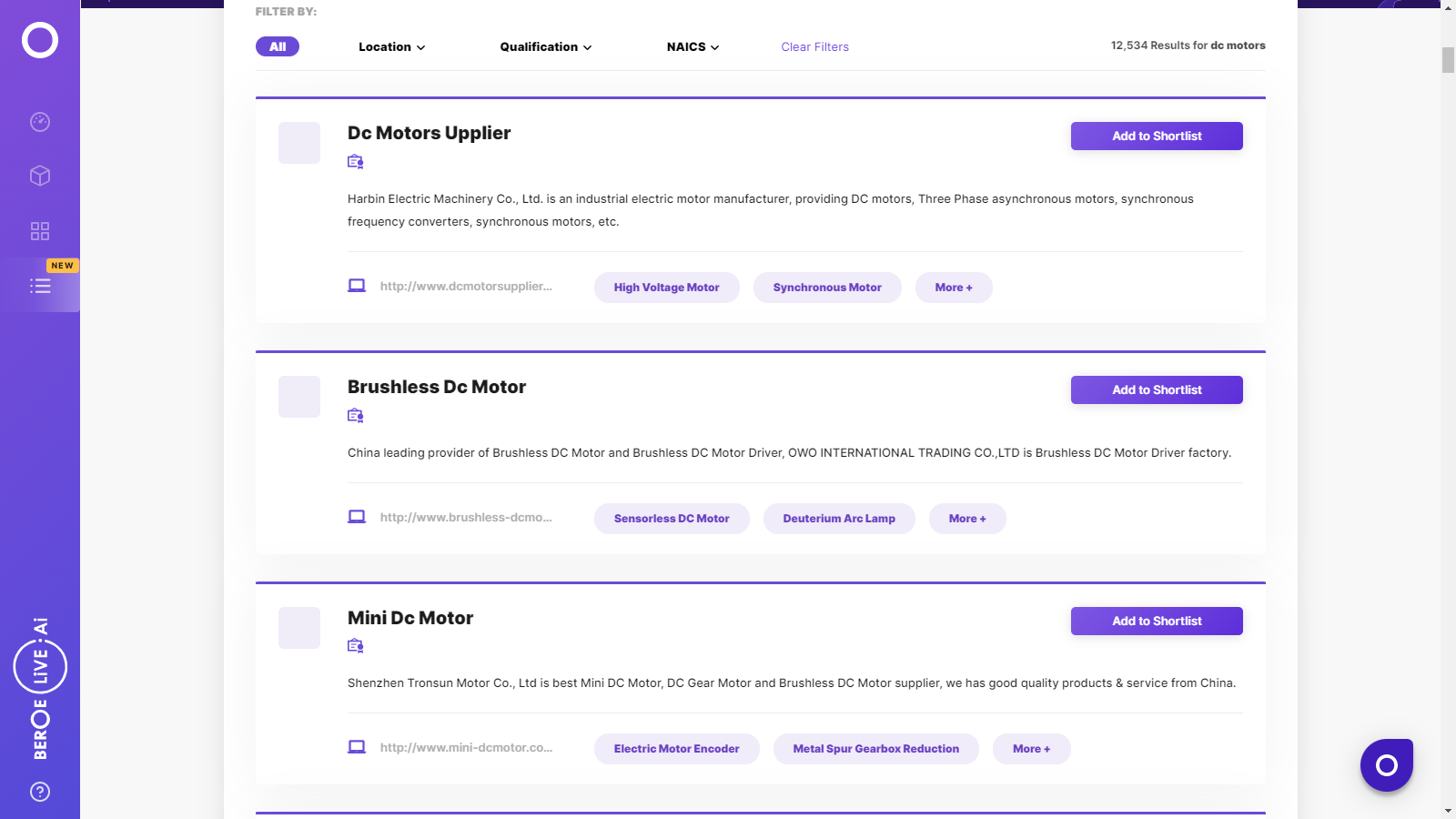

DC Motors Suppliers

Find the right-fit dc motors supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the DC Motors market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDC Motors market report transcript

DC Motors Global Market Outlook

- The APAC will continue to dominate the market, in terms of supply and demand for DC motors. The demand in the region is expected to be driven by increasing demand from major end-use industries, such as Consumer Electronics & Appliances, Automotive, HVAC, etc., led by increasing disposable income and urbanization & industrialization trends

Impact of COVID-19 on DC Motors Industry

-

Post recovery of activities by major industries, building resilient supply chain has become the top priority. Local sourcing, reduced dependency on China/single large source, increased automation, etc., are few of the supply chain risk mitigation strategies in discussion by industry majors.

-

Due to supply chain uncertainties created by the COVID-19 pandemic, buyers from varied industries have planned to reduce their dependencies on global sourcing by developing strategies to engage with local suppliers, thereby ensuring uninterrupted supply of parts/components.

Global DC Motors Market: Drivers and Constraints

Industry Drivers

-

Increasing demand from major end-use industries, such as Consumer Electronics, Automotive, HVAC, etc., is expected to drive the demand for DC motors globally

-

Regulations demanding that consumers upgrade to higher efficiency motors is expected to boost motor sales globally. Development of new electric motor technologies, such as compact and modular motors, BLDC motors with integrated speed controllers, etc., are expected to boost their demand in new and existing applications

-

Development of new electric motor technologies is expected to boost use of such products in new applications. Major manufacturers are increasing spend on R&D, so as to differentiate their products from those of competitors

Constraints

-

Raw material accounts for more than 70 percent of motor cost, volatility in raw material prices is expected to have negative impact on the market

-

High maintenance (high power applications) required for DC Motors may also restrain the market for industrial DC Motors

-

Various barriers to adoption of high-efficiency motors involve customer sentiment, such as buyers being cost oriented and focusing on short-term savings as opposed to life cycle cost assessments

-

Existing and threatened trade protectionism, arising from trade disputes between nations could pose a serious concern

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now