CATEGORY

Industrial Motor

An industrial electric motor is an electrical machine that converts electrical energy into mechanical energy and operate through interacting magnetic fields and current-carrying conductors to generate force.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Industrial Motor.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Flash partners with GEM motors for electric motor technology

February 09, 2023General Motors enters binding long-term supply agreement with Vacuumschmelze

February 01, 2023SEW-Eurodrive launched a family of IE5-efficiency synchronous reluctance motors

January 23, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Industrial Motor

Schedule a DemoIndustrial Motor Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoIndustrial Motor Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Industrial Motor category is 4.00%

Payment Terms

(in days)

The industry average payment terms in Industrial Motor category for the current quarter is 96.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

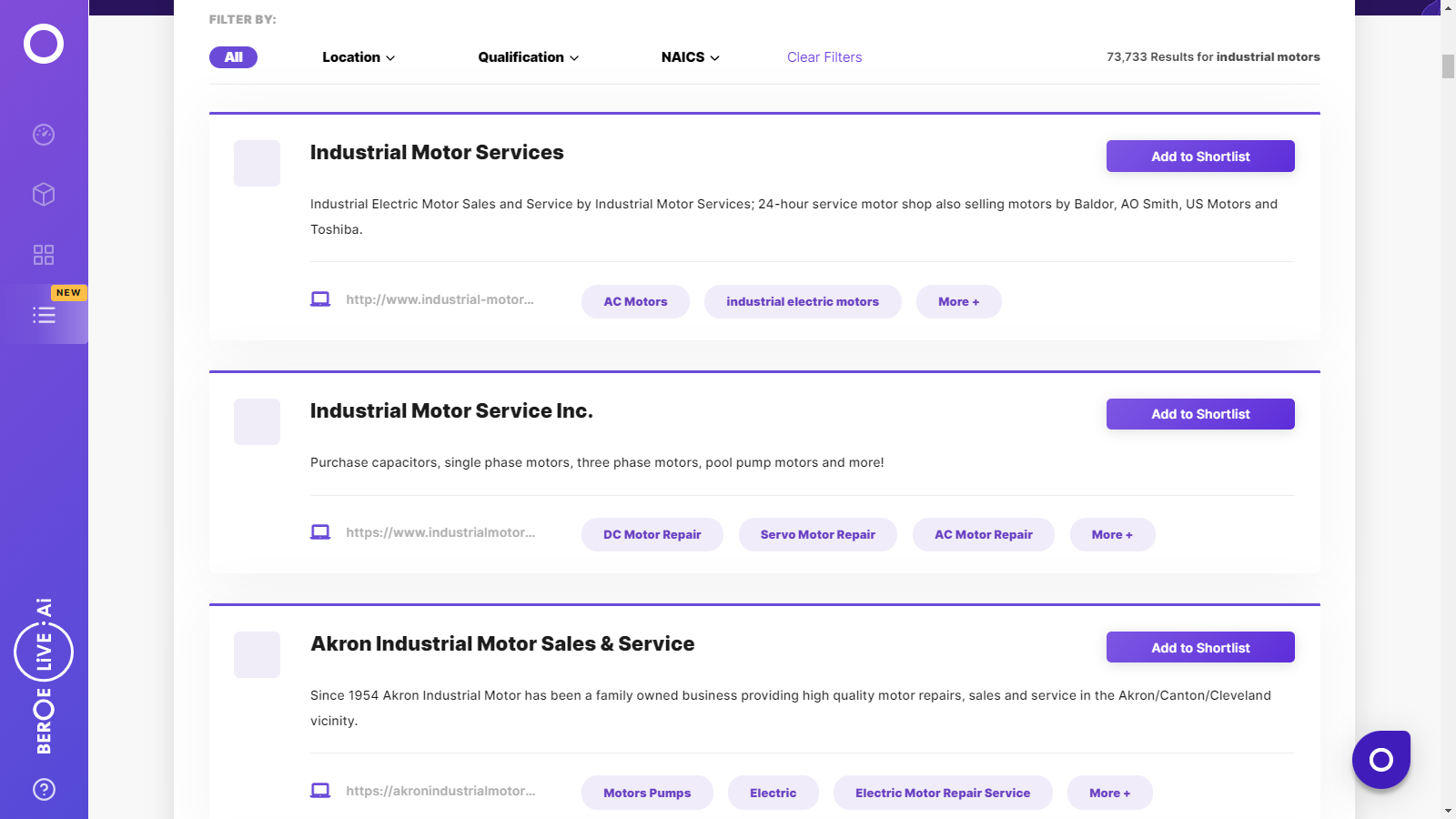

Industrial Motor Suppliers

Find the right-fit industrial motor supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Industrial Motor market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIndustrial Motor market frequently asked questions

What is the electric motor market size in the major market regions across the globe'

From Beroe's industrial motors market report, the factors driving the market growth are ' ' increasing demand from industrial consumers in the emerging and developed countries backed by increasing investment in infrastructural development ' regulations governing the replacement of existing motors with premium efficiency motors, especially in North America and Europe

As indicated by Beroe's electric motor market analysis, the primary factor that will drive the increase in the global sales of electric motors is the increasing demand from downstream industries, especially in emerging economies. On the other hand, the situation looks different in the developed economies, where the boost in motor sales will be observed due to the regulations demanding consumers to upgrade to higher efficiency motors.

As 96 percent of the total costs of running electric motors over a lifetime can be attributed to energy costs, the rise in energy prices globally would result in an increased demand for higher-efficiency electric motors. Secondly, with the development of new electric motor technologies, the use of such products will be increased in new applications. Considering these factors, major manufacturers are increasing their spending on R&D to differentiate their products from those of competitors.

According to Beroe's report on industrial motors market share of key players, ABB accounts for 12.55 percent of the global motor's revenue, followed by Siemens at 10.05 percent, WEG at 8.87 percent, TECO Westinghouse 2.79 percent, Hyundai at 2.30 percent and other players at 62.58 percent.

According to industrial motors market trends and analysis by Beroe, the constraints that the industrial motors market has to face are ' Barriers to adoption of high-efficiency industrial motors due to the buyer's focus on short term savings rather than life cycle cost assessments High competition among manufacturers leading to low-profit margins within the electrical motors industry The typical product life cycle of over 15 years restricts the growth of smaller manufacturers

Entering into the industrial motor market can be challenging because it is a capital-intensive segment and manufacturing firms have to comply with the regulations. They need to have proven credentials that have to be approved by consultants and opinion leaders like electrical consultants. Other constraints that the electric motor market faces are ' Most of the buyers are cost-oriented and focus on short-term savings without considering the life cycle costs of the motor. Typically, they prefer repairing the existing motor instead of replacing them due to the cost factor and production downtimes. The competition is quite high among the industrial motor manufacturers. As a result, the profit margins are low within the electric motors market. In addition to that, as the lifecycle of these motors is usually over 15 years, small manufacturers don't get a chance to enter the market. So, these manufacturers try to compete in the market by cutting down on the costs which also affects the quality of the products they manufacture.

Industrial Motor market report transcript

Global Industrial Motors Market Outlook

MARKET OVERVIEW

Global market size: $56.89 billion (2022E) forecasted to grow at a CAGR of 4–5 percent to $61.77 billion by 2024.

-

APAC will continue to dominate the market, in terms of driving the demand for industrial motors

-

There is an increasing demand for electrical steel and there is pressure in production, with widening gap between supply and demand, mainly due to increased demand from EVs. The motor suppliers, who are vertically integrated within their supply chains (for steel supply), will begin to win market share, based on lower lead times and lower prices, while rest of the suppliers would struggle to secure necessary raw materials for production

-

Zero-COVID policy in China and Russia–Ukraine war have already created a huge impact on the supply market; thereby causing lead time delays and price increase in 2022

Global Industrial Motors Market Overview

-

Increasing demand for premium energy efficient motors from the downstream industries is expected to be the primary driver for increase in the global industrial motor sales, especially in the emerging economies.

Industrial Motors Market Size and Trend

The global industrial motor sale is expected to be driven by the growing adoption of premium energy efficient motors from the downstream industries, coupled with the increasing demand for mining, water treatment plants and etc.

-

The global industrial motors market is estimated to be around $56.89 billion in 2022 and is forecasted to reach $61.77 billion by 2024, growing at a CAGR of 4–5 percent until 2024

-

The global replacement demand, due to motors life cycle, forms a considerable portion of the overall industrial motors demand. With the increasing legislative norms, the market for replacements and repairs is expected to grow, especially in the emerging economies

-

The rise in demand for superior machine control in automotive industry, due to high efficiency of AC synchronous motors fuels the market growth

-

Additionally, increase in demand for medium to large voltage motors in emerging wind power industry is expected to increase demand

-

Adoption of motors ranging 21-60 V in HVAC sectors, due to heat dissipation will provide high demand for these motors in near future

-

The regulations such as Minimum Energy Performance Standards (MEPS) will drive the growth of energy efficient motors

-

Motor prices are closely tied to the cost of the raw materials – especially copper, aluminum and magnetic steel. Each of these experienced dramatic price increases during 2021. Supply chain shortages and delays were another factor in the motor price rises. The prices for steel has come down since Aug 2022 and is expected to reduce the motor prices marginally

Global Industrial Motors Drivers and Constraints

Drivers

-

The cost efficiency of industrial motors is anticipated to drive the market forward. Also, energy-saving motors and intelligent drives are forecasted to push significant traction in the coming years

-

Increasing degree of adoption towards premium energy efficient motors (IE3, IE3) by FMCG, food & beverage, water treatment plants and other downstream industries

-

Evolving equipment as a service business being considered by the downstream industries will bring new revenue streams for the industrial motor makers

-

There is an increase in demand for medium to large voltage motors, particularly in emerging wind power markets is expected to drive the industrial motors market in the near future

Constraints

-

Motors have witnessed a price hike (approximately in double digits), due to supply shortage followed by prolonging port congestions and container shortage and increase in price of raw materials affecting the revenue for the market, together with extended lead time, due to subsequent lockdowns in China, and prolonged Russia–Ukraine war

-

Lack of awareness of benefits associated with smart motors among small and medium companies for various applications is a constraint to motors market

-

Various barriers to adoption of high efficiency industrial motors involve customer sentiment such as buyers being cost oriented and focusing on short term savings as opposed to life cycle cost assessments.

-

High competition among industrial motor manufacturers leads to low profit margins within the industry and coupled with product lifecycle which is typically over 15 years, this restricts the growth of smaller manufacturers, especially in emerging markets. Such suppliers typically compete on price terms, which affects the quality of the products they manufacture

Insights on the cost structure

-

Raw material content accounts for over 70 percent of the overall cost. Key raw material used are copper, iron, steel. The content increases with the power and voltage rating of a motor.

-

The content of electrical steel and copper increases with the motor efficiency.

-

Majority of the large AC motors are custom motors and amount of margin increases with the size of the motor.

-

Manufacturing overheads includes energy cost too

-

Other include SGA, other indirect costs

Industrial Motors Market Overview

- The global industrial motors market is highly raw material intensive with the raw materials contributing to around 50 percent of the total industrial motor cost.

- Copper and steel are the major raw materials and are abundantly available which makes the supplier power low.

- Currently, there is no technology or product which provides an alternative solution to industrial motors for a buyer.

- However, within the electric motor market threat of substitution is high. The low efficient motors could be substituted with higher efficiency motors and AC motors can be substituted with PM motors or Sync motors in few applications.

- The industrial motor market has high barriers to entry as the segment is capital intensive and is required to comply with regulations.

- Industry motor manufacturers are required to have proven credentials in a particular segment and required to be approved by consultants and opinion leaders (like electrical consultants). Without these approvals, it is difficult for them to compete against global players.

- The sourcing channels include OEMs, distributors, and system integrators.

Pricing Models

- Details about the different pricing models in the industrial motor market are given in the report with the inherent pros and cons of each.

- The components that have the greatest impact on the cost and pricing are raw materials, design, and labor.

- The two main models are the contractual and direct buying models.

There are different metals that are the main price drivers of the electric motor market. Each of these price drivers is analyzed individually and described. This helps understand the pricing dynamics of the market. In addition, labor and electricity also have a direct influence on the electric motor market trends.

- Copper

- Pig Iron & Ferrous Scrap

- Carbon Steel

- Grain Oriented Electrical Steel

Why You Should Buy This Report

- The electric motor market report gives information about industrial motor market size, overview, trends, electric motor market analysis, and drivers and constraints.

- Regional industrial motors market outlook for North America, APAC, EMEA, and LATAM regions with detailed facts and figures of each region is given.

- Porter’s five forces analysis of the global industry motors market gives an overview of the market dynamics and competitive factors.

- Supplier profile and market share of key players in the electric motor market.

- Cost structure, price driver analysis, price trend, and forecast.

- The price driver analysis includes the details of labor as well as the source metals that drive the price of motors such as copper, pig iron & ferrous scrap, carbon steel, and grain-oriented electrical steel.

- Learn about electric motor market size, best procurement practices, sourcing channels, etc.

- Electrical Motors such as AC motors (Alternating Current Motor), DC motors (Direct Current Motor), induction motor, torque converter, motion controller, single-phase motor, three-phase motor and variable drive, etc.

- The supply-demand, manufacturing, and production analysis for electrical motor segments in the market such as AC motor, DC motor, BLDC motor (Brush Less Direct Current Motor), foot mount motor, flange mount motor, geared motor, gearless motor, squirrel cage motor, synchronous motor, stepper motor, Servo motor, and BLDC Motor.

- There are constant innovations in the market. The report details the more salient developments and innovations in the industrial motor market. Features that improve efficiency and safety are the most in demand.

- There are constant innovations in the industrial motors industry. The report details the more salient developments and innovations in the market. Features that improve efficiency and safety are the most in-demand.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now