CATEGORY

Electronic Manufacturing Services

Electronics manufacturing services (EMS) are being provided by companies that design, manufacture, test, distribute, and provide return/repair services for electronic components and assemblies for original equipment manufacturers (OEMs)

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Electronic Manufacturing Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoElectronic Manufacturing Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoElectronic Manufacturing Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Electronic Manufacturing Services category is 5.80%

Payment Terms

(in days)

The industry average payment terms in Electronic Manufacturing Services category for the current quarter is 63.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

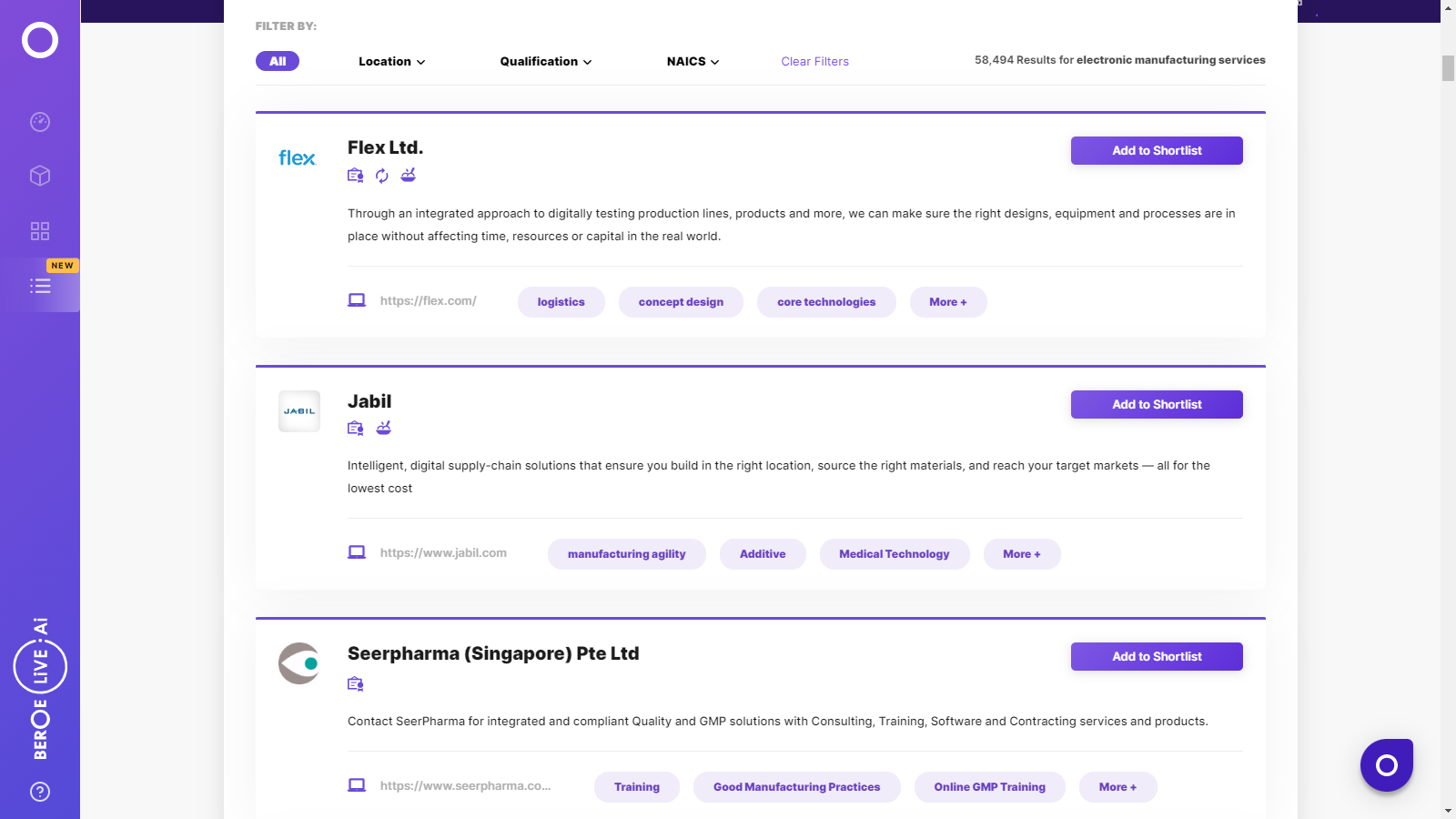

Electronic Manufacturing Services Suppliers

Find the right-fit electronic manufacturing services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Electronic Manufacturing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoElectronic Manufacturing Services market frequently asked questions

The global market size of the electronics manufacturing industry is expected to reach $575.69 billion by 2022 according to Beroe's analysts.

As per Beroe's electronic manufacturing services trends report, the high market maturity regions are China, Taiwan, Japan, South Korea, Mexico, Brazil, and Germany and the medium market maturity regions are India, UAE, Africa, Eastern Europe, Indonesia, US, and Canada.

The latest electronics manufacturing services trends are that the market regions of the US, LATAM, and Canada are expected to grow significantly. The overall market size of the electronic manufacturing industry is also expected to grow. The demand for consumer electronics is also surging.

The electronics manufacturing industry is expected to grow at a CAGR of 7-8% by 2022.

Some of the major driving factors for the electronics manufacturing industry are EV, hybrid EV smartphone innovations, and automotive electronics growth as a result of the emergence of smart cars and industrial electronics.

Electronic Manufacturing Services market report transcript

Electronic Manufacturing Services Global Market Outlook

MARKET OVERVIEW

Global market size: $597.99 billion (2022 E)

Expected to grow at a CAGR of 7-9 percent from 2022 to 2025, to reach $758.9 Billion.

-

IoT integration, EV, hybrid EV, smartphone innovations, automotive electronics growth, due to smart cars and industrial electronics, are the major driving factors for the EMS industry

-

Increased mergers and acquisitions is driving the EMS industry expansion in EMEA market.

-

Prevailing Shortage situation is significantly impacting the North American EMS market.

Global EMS Market Overview

-

Electronic manufacturing services market posted a bullish growth rate of ~13.8 percent between 2020 and 2021, supported by strong sales order from notebooks, servers, computers, and smart phones.

-

EMS market is estimated to be 597.9 Million USD and is projected to grow at a CAGR of 8-9% to 758.9 Million USD driven by strong demand from Automotive, Communications, Computing etc.,

Electronic Manufacturing Services Market Drivers and Constraints

Drivers

-

Technology Innovation: External OEMs pressure to introduce new products in the market on account of intense competition is driving technological innovation and thus in turn expanding the market opportunities for EMS players

-

Outsourcing trends: Increasing rate of outsourcing to contract manufacturers for cost optimization has now expanded from Consumer, Communication sectors to new market segments such as Automotive and Medical sectors. Corona crisis has elevated the market demand for critical health care devices such as Ventilators, Respiratory devices and more and EMS companies has rightly positioned. Also, the need for increased quality, flexible solutions and quicker operational speed (i.e., speed to market) are some factors that are increasing the dependance for EMS players.

-

Growing end use demand: Computer, Communication and Consumer sector are the prime sectors driving the Electronic manufacturing services market. COVID driven Work from Home policy, Implementation of 5G infrastructure plan and adoption of Wireless and IoT based consumer devices are expected to further expand the market size of EMS industry. Also, the penetration of emerging EV/HEV demands for high complex assemblies and further is expected to boost the market. Demand for medical devices has shown an elevated growth trend during the early COVID phase and has outpaced the sales orders as compared to other market segments.

-

Changing Industrial landscape: During the pandemic situation, Most of the industries have been exposed to Supply chain risk on account of sourcing problems, labor shortage and logistics issues. Considering this, the companies have realigned their strategies and were looking out for domestic sourcing alternatives. Hence, the companies tend to go with diversification of supply base so as to mitigate the supply chain risks and hence, it may be expected that the global EMS companies may expand their presence in varied geographies so as to address this.

Constraints

-

Extended Lead times of electronic components: Particularly during the COVID situation, Many EMS players were facing shortage of electronic components due to supply chain problems. Hence, this results in extended delivery times and thus in turn affecting the supplier and OEM relationship

-

Shrinking Margins: Considering the global competition and fast paced innovations in the industry, OEMs demand for cost reduction and hence, EMS players were forced to reduce their profit margins and eventually they do reduce their cost so as to gain business orders.

-

Penetration of Counterfeit Electronic Components & Quality control: Usage of counterfeit products affects the quality and performance of the assembly/final product. Hence, Quality management team and protocols (quality traceability system and compliance) are must to have factors expected by the OEM’s so as to ensure product quality.

-

Sustainability: Disposal of electronic wastes from the industry should be properly regulated and controlled as improper disposal methods can create harmful effects to environment.

EMS Cost Structure Analysis

-

The major cost factors involving a global IFM model are raw materials and energy costs, which account for about 70 percent percent of the total cost. Rising global inflation is expected to put pressure on the prices across all the cost components and in turn limits the negotiation potential for an OEM.

-

Raw material like aluminium, steel, copper and polypropylene takes up almost 40 percent of the overall cost of an electronic component. Electricity follows the above taking up 25 percent of the overall cost

-

Generally, severe fluctuations in the material pricing will effectively show in the overall component pricing but, nowadays, component pricing generally remains low even with increased raw material pricing and energy in order to sustain the high competition in the market

Supply Trends and Insights : Electronic Manufacturing Services

Supply market Overview

-

Electronic manufacturing services supply base is highly fragmented with suppliers serving to multiple industries such as Computers and Peripherals, Communication and Telecom, Consumer, Automotive etc.,.

-

Supply base concentration is found to be relatively higher in Asian countries specifically China, India and other south east Asian countries.

Supply Capabilities

-

Earlier EMS providers were catering only for PCBA services. Now, their role has expanded to provide complete end to end support for OEMs starting from design phase, prototype development, assembly, testing and validation, packaging.

-

Considering the competitive landscape of EMS market, major suppliers are entering into strategic engagement mode with OEMs. It is in order to provide value added services to OEM’s such as repair and replacement ie., after sales support, tracking product life cycle changes and also asset recovery and disposition services for products that enter into obsolete cycle.

Emerging Markets

-

Considering the recent supply chain impacting situations like US-China Trade war and ongoing Corona crisis, major suppliers are realigning their strategies to diversify their supply markets and shift their manufacturing bases from China to neighbouring South East Asian countries such as Vietnam, Thailand, India, Hong Kong and Malaysia.

-

These factors indicate the geographical expansion of services by EMS suppliers and hence, this gives the mitigate supply chain risks of global OEMs with operation in multiple geographies.

Why should you Buy this Report

The report on the electronic manufacturing services market discusses the regional market overview constituting market size, growth rate and key suppliers in the US, Canada, LATAM, EMEA, and APAC. Also, it highlights Porter's Five Force Analysis including the supplier power, buyer power, barriers to new entrants, intensity of rivalry and threat of substitute.

Comprehensive analysis of market drivers and constraints, cost and pricing forecast as well as the impact of key price drivers have been included. The research study scrutinizes key global suppliers' profiles and offers a SWOT analysis of some of the major industry giants including Foxconn, Pegatron, Flextronics, Jabil Inc., and Sanmina. Furthermore, the electronic manufacturing service market study covers procurement best practices such as sourcing strategy, engagement models, contract models, and risk analysis.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now