CATEGORY

Din Rail Terminal Blocks

Terminal blocks are modular, insulated blocks that are used to secure and/or terminate wires and, in their simplest form, consisting of several individual terminals arranged in a long strip.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Din Rail Terminal Blocks.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

BEC Distribution announces the availability of Euro-style low-voltage PCB terminal blocks with screw or push fixings in short lead times

July 07, 2022BEC Distribution announces the availability of Euro-style low-voltage PCB terminal blocks with screw or push fixings in short lead times

July 07, 2022BEC Distribution announces the availability of Euro-style low-voltage PCB terminal blocks with screw or push fixings in short lead times

July 07, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Din Rail Terminal Blocks

Schedule a DemoDin Rail Terminal Blocks Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoDin Rail Terminal Blocks Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Din Rail Terminal Blocks category is 7.30%

Payment Terms

(in days)

The industry average payment terms in Din Rail Terminal Blocks category for the current quarter is 72.9 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Din Rail Terminal Blocks Suppliers

Find the right-fit din rail terminal blocks supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Din Rail Terminal Blocks market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDin Rail Terminal Blocks market report transcript

Global Market Outlook on Din Rail Terminal Blocks

-

The APAC will continue to dominate the market, in terms of growth prospects, with an estimated CAGR of 6–8 percent

-

Increasing industrialization and demand for HVAC in countries, such as China, India, South Korea, and Indonesia, are expected to drive the DIN RAIL terminal block market

DIN RAIL Demand Market Outlook

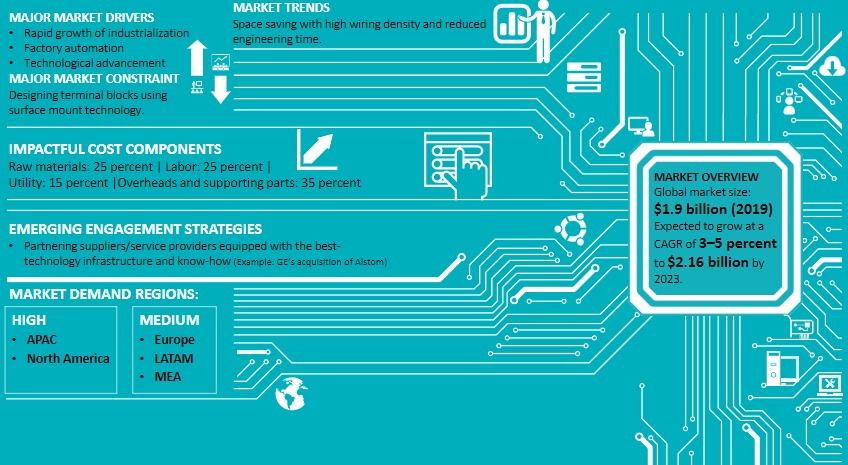

- Rapid growth of industrialization, factory automation, and instrumentation over the past 3–5 years were the main factors driving the DIN RAIL terminal block industry. Further technological advancements may lead up to compact designs, resulting in mutual cost benefits.

Global DIN RAIL Terminal Block - Global Snapshot

-

The global terminal blocks market was estimated to be $1.2 billion in 2022, and it is expected to reach $1.5 billion by 2025, growing at a CAGR of 5–7 percent during 2022–2025

-

Rapid growth of industrialization, factory automation, and instrumentation over the past 3–5 years were the main factors driving this industry

-

Technological advancements in terminal blocks, with respect to termination technology, have increasingly resulted in more compact designs, thereby driving replacement demand for this product

-

DIN RAIL terminal blocks are said to be the fastest growing segment within the terminal blocks category

Terminal Block Market Split: By Region (2022 E)

-

The APAC dominated the global terminal blocks market, with a market share of around 32–34 percent. Increasing industrialization and demand for HVAC in countries, such as China, India, South Korea and Indonesia, are expected to drive the terminal blocks market

-

North America is one of the major regions for the terminal blocks market, due to the presence of prominent manufacturing companies in this region. Approximately 60 percent of the terminal blocks used in the US are of DIN type

-

The DIN RAIL terminal blocks market was moderately consolidated with the top five suppliers, constituting to around 48–50 percent of the market share. Leading suppliers in this industry have typically increased their market share through strategies, such as mergers, new product developments, partnerships, collaborations and business expansions etc.

Global Terminal Block Market Maturity

-

Rapid growth of industrialization, factory automation, and instrumentation over the past 3–5 years were the main factors driving the terminal blocks industry. Further technological advancements may lead up to compact designs, resulting in mutual cost benefits.

-

Increasing focus on digitalization across all industries is expected to boost adoption of automated machinery, so as to achieve better accuracy and productivity. Further, surging deployment of robotics is expected to have a positive impact on the terminal blocks market

Global DIN RAIL Terminal Block - Drivers and Constraints

Drivers

-

Increasing demand for DIN RAIL from the APAC and American markets acts as a key driver for this segment

-

Increasing industrialization and demand for HVAC in countries, such as China, India, South Korea, and Indonesia are expected to drive the terminal block market in this region

-

Rapid growth of industrialization, factory automation, and instrumentation over the past 3–5 years were the main factors driving this industry

-

Technological advancements in terminal blocks, with respect to termination technology, have increasingly resulted in more compact designs, thereby driving replacement demand for this product

-

Increasing focus on digitalization across all industries is expected to boost adoption of automated machinery, so as to achieve better accuracy and productivity. Further, surging deployment of robotics is expected to have a positive impact on the terminal blocks market

Constraints

-

The industry mandates constant need for innovations, which are expensive, and thereby, make the product costly for the end user. This acts as a key constraint in this industry

-

Terminal Blocks market is presently balanced. However, prices are expected to increase at least till Q1 2023 due to volatile raw material prices, high labor rates in the U.S., Europe, China etc. and increasing transportation costs. These factors could constrain the market growth globally.

Din Rail Terminal Blocks Cost Structure

-

The above price structure is relevant to a global terminal block manufacturer, having over 50 years of experience

-

Supporting parts and overheads include manufacturing mounting body, construction of holes in the body of terminal block, fabrication of current carrying parts, etc., and overhead costs

-

Others include utility costs, for e.g., electricity consumption, overheads, etc.

-

The profit margin of the large supplier has been considered for a standard design of terminal blocks

Market Overview

- The industry has a presence of large and small players. The din rail terminal block supplier generally cannot increase the price of terminal blocks significantly, even in case of fluctuation in raw material prices, which makes the supplier power low.

- DIN RAIL terminal blocks are more preferred, due to their compact design, and hence, there are no potential substitutes for DIN RAIL terminal blocks.

- There exists a significant competition in this industry among the large leading players, having 50 percent of the terminal block market share, both for existing and new demand. Other small players compete for the remaining 50 percent of the market.

- While it requires moderate capital investment to enter the terminal blocks market, however, DIN RAIL terminal block manufacturers need to focus continuously on innovation and develop more advanced and cost-effective terminal blocks.

Why You Should Buy This Report

- The report gives information about the din rail terminal block market, global snapshot, maturity, and industry drivers and constraints.

- It gives the Porter’s five force analysis of the global terminal block market, details the supply landscape and does a SWOT analysis of major din rail terminal block supplier like Phoenix Contract, Weidmuller, Wago, etc.

- The report analyses the cost structure and price drivers and gives the price trend and forecast.

- It lists out the recent technological developments in the din rain terminal block market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now