CATEGORY

Machining

Machining category involves cutting of metals, non metals, plastics by conventional machines, CNC machines through the process such as Turning, Milling & Drilling. The category also involves high precision machining which is majorly prevalent in industries such as aerospace, medical, etc.,

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Machining.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Cadrex Manufacturing Solutions buys D&R Machine Company

March 20, 2023Armor Group acquires Kelm- Acubar

January 23, 2023Arch Medical Solutions acquires Alpha Manufacturing & Design

November 24, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Machining

Schedule a DemoMachining Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoMachining Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Machining category is 15.10%

Payment Terms

(in days)

The industry average payment terms in Machining category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Machining Suppliers

Find the right-fit machining supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Machining market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMachining market frequently asked questions

According to the latest machining industry news from Beroe, China holds the highest market share of 22.4 percent in the fragmented global machining industry.

Due to factors like reshoring machining industry trends, increasing wages, and slower economic growth, investors are being compelled to consider alternative lower-cost locations, such as Vietnam, Indonesia, and Malaysia. This is expected to reduce the growth rate of the market.

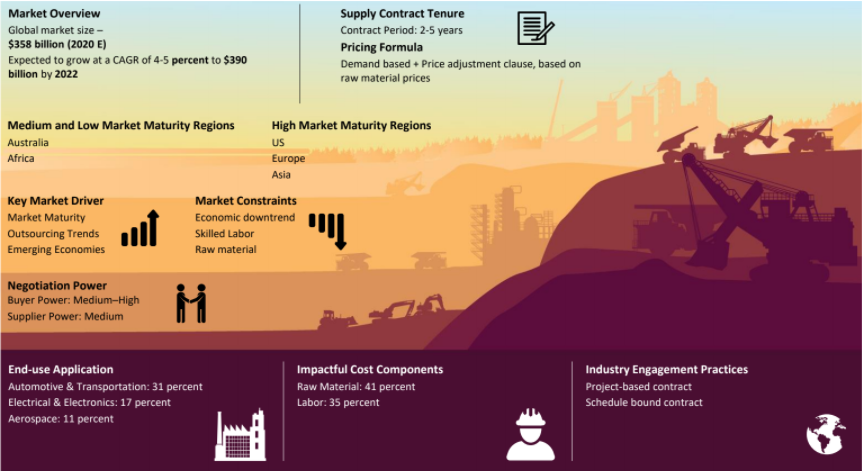

As per Beroe's machining industry analysis reports, the global market size is expected to reach $414.24 billion by 2022.

The key factors contributing to the growth in machining market size are Market maturity: The lack of feasible substitutes like 3D printing and additive manufacturing will be sustaining the machining market for the short-term. Outsourcing trends: Machining suppliers are setting up manufacturing plants in low-cost regions such as Eastern Europe and South-East Asia. Emerging economies: The demand from emerging economies along with competitive pricing for raw materials and low labor cost is anticipated to be driving innovation in the machining market.

The US, Europe, and Asia are the regions with high market maturity. On the other hand, Australia and Africa have low market maturity.

In 2015, about 30 percent of the revenue that machining services generated were from industries like heavy equipment, engineered components, watch industries, sub-assemblies, defense, marine, and medical device machining.

Owing to features such as multi-functionality and reduction in setup time, the milling machines segment is anticipated to grow at a CAGR of 8-9 percent.

As per Beroe's machining industry statistics, 70 percent of the market is comprised of precision machining while conventional machining covers the remaining 30 percent.

The machining market is facing constraints from an economic downtrend, skilled labor, and raw materials. Economic downtrend: Owing to the challenges in the global economic recovery, consumer spending is adversely affected. This can affect machining market growth. Skilled labor: With technological advancements, the need for skilled labor is increasing. But there is a shortage of suitable labor. Raw materials: Suppliers can't hedge against the commodity price fluctuations due to low volumes of raw material purchases. This can affect supplier margins and restrict the growth of the supply base.

HRC steel prices are expected to drop due to the volatile trade relations and availability of cheaper imports leading to a cautious buying approach. Although labor-related strikes are anticipated, they are not likely to cause any disruptions in the price trends.

Machining market report transcript

Machining Market Analysis And Global Outlook

-

The US, China, India, Japan, and Germany are ranked as the top five machining producing countries of which, China and the US hold the highest market share of 19 percent and 15 percent (approx.), respectively

-

The manufacturing activities have resumed, however, concerns surrounding Zero-COVID policy in China, Russia–Ukraine war are posing a supply chain threat to the industry

-

Continuous efforts on improving process efficiency and increasing automations are the major trends in the supply market

Market Overview-Machining

-

The APAC is estimated to account for approx. 37 percent of the global market share for machining in 2022 and is considered the largest demand region for the industry.

-

The global machining industry is highly fragmented and comprises of several small and medium-scale enterprises that offer service through contract manufacturing

-

With a growing demand from end-use sectors, like the automotive and electrical industries, the market is expected to increase at a CAGR of 4–5 percent and forecasted to reach a value of ~$380.4 billion by 2024

-

The machine tool market is expected to grow at a CAGR of 4–5 percent up till 2025, owing to advanced features, such as multi-functionality, adoption of robots, etc., thereby increasing the demand share for the precision machining market

Market Overview-Precision Machining

(Global)

-

The precision machining market is expected to grow at a CAGR of 4.5–5.5 percent and forecasted to reach ~$342.36 billion in 2024. This is primarily due to demand, driven by end-use industries, such as automotive, aerospace, medical, etc.

Industry Drivers and Constraints : Machining

Drivers

Market Maturity

-

The present technological substitutes, like 3D printing and additive manufacturing, are yet to be made commercially viable. Lack of viable substitute is expected to sustain the machining market in the short term

Outsourcing Trends

-

Suppliers from traditional manufacturing hubs, such as the US and Western Europe, are setting up manufacturing plants in low-cost regions, such as Eastern Europe, Mexico, and South East Asia, driving the market in developing regions

Emerging Economies

-

In emerging economies, factors, such as low cost labor, growing supply base concentration, etc., are expected to attract OEMs to engage with suppliers in these regions, thereby driving the demand for the machining market

Constraints

Impact, due to Russia–Ukraine war and COVID Lockdowns:

-

The energy crisis in Europe has increased the production cost and few suppliers have reduced their production capacities. In China, COVID related lockdown restrictions has impacted the supply market. This has impacted the supply-demand balance, thereby leading to increase in factors such as final price, lead times, etc.

Raw Material

-

Suppliers are susceptible to commodity price fluctuations (especially for high mix, low volume industries), against which they cannot hedge, due to their relatively low volume of raw material purchase. These are expected to impact supplier margins and the final price of the product

Cost Structure Analysis of Machining

Input Material Cost (Direct + Indirect): Range 35-45 percent

-

The cost and proportion of input materials for machining differ based on the type of metal to be machined and the commodity cost fluctuations which are generally passed on to the customers

-

Design and complexity of the product, wastages, material availability/cost by region are other key factors influencing the cost structure

Labor and Utility Costs: Range 30-45 percent

-

This area has the highest impact on the value chain. Labor cost plays a vital role in determination of the overall cost structure depending on the skill set involved, complexity of the end product, etc.

-

Regional price differences on labor rates and power can play a crucial factor for sourcing decisions

-

For long-term contracts, the increase in power costs are absorbed by the customer upon mutual consent; however this does not apply to the labor costs

Overheads: Range 15-20 percent

-

Overhead cost typically includes machine depreciation, SG&A, plant administration and ranges between 15-20 percent depending on the component, material, etc., and varies from supplier to supplier

Supply Trends and Insights : Machining

Supply Market Overview

-

Machining supply base is highly fragmented with suppliers serving to multiple industries such as Automotive, Aerospace, Electrical/Electronics, Construction, etc.

-

Supply base concentration is found to be relatively higher in countries such as China, U.S, India, Germany, Japan, etc., when compared to other countries and suppliers are majorly found to be serve Automotive industry.

Supply Capabilities

-

Majorly suppliers in the machining market are found to have integrated sheet metal fabrication services. Also, suppliers are capable in providing secondary services such as heat treatment, surface treatment, etc., either by In-house or outsourced capabilities.

-

Majorly, suppliers are found to have ISO 9001 quality certifications and also adoption for availing TS 16949 certification is expected to increase in the machining supply base.

-

Machining market is found to be matured in terms of technology, as 90-95 percent of the supply base has replaced from utilizing conventional machines to CNC machines. This trend is expected to continue in the coming years.

Emerging Markets

-

Supply base is emerging in countries such as Mexico, Costa Rica, Poland, Czech Republic, Bulgaria, Vietnam, Taiwan, etc., due to factors such as increasing supply base concentration, low labor cost, etc.

-

Machining supply base is expected to grow in regions such as Latin America, Eastern Europe, South East Asian countries, etc.

-

In Saudi Arabia, the supply base for machining is expected to increase due to governmental support schemes implemented in the country.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now