CATEGORY

Connectors

Connectors are electromechanical devices that are used to join multiple components and form an electrical circuit. Connectors have male-ends (plugs) and female-ends (jacks) which are used to form a permanent or temporary connection based on requirement.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Connectors.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoConnectors Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoConnectors Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Connectors category is 12.00%

Payment Terms

(in days)

The industry average payment terms in Connectors category for the current quarter is 120.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Connectors Suppliers

Find the right-fit connectors supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Connectors market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoConnectors market report transcript

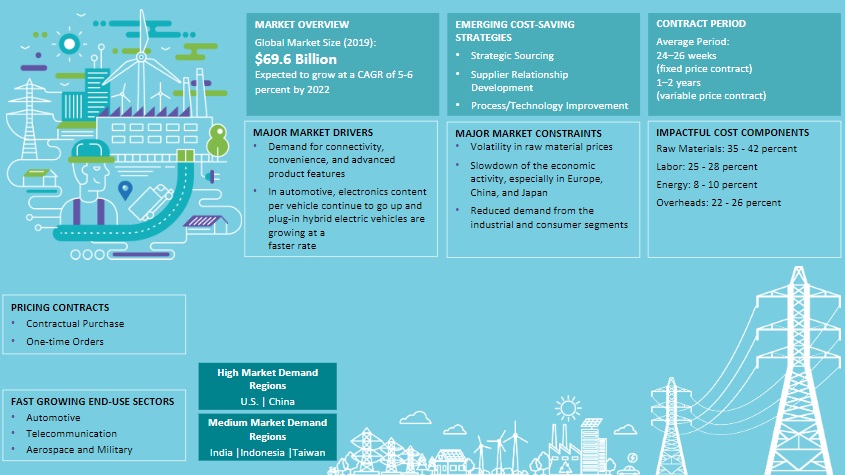

Global Market Outlook on Connectors

-

The APAC would continue to dominate the global connector market, with China being the largest connector manufacturing region

-

Increased demand for connectivity, convenience, and advanced product features is resulting in increased electronic content in the end-use devices, and thereby, driving the demand for connectors globally. Telecommunication and automotive are expected to be the predominant end-use demand market for connectors

Global Connector Market Maturity

- The APAC is expected to remain the largest connector market globally, predominantly driven by the presence of large number of connector manufacturers in China. The high growth in the region is expected to be offset by the contraction of the connector market in Japan.

Global Connector Market Growth Trend & End-use

-

The global connectors market is expected to grow slow at a CAGR of 7-9 percent during 2023–2025, on the account of sluggish global GDP. The market is expected to be primarily driven by increasing electronic content in automotive production

-

PCB connectors recorded the largest market share.

-

Connector sales in 2022 are estimated at $84.6 billion having grown at a CAGR of 7-9% with North America witnessing significant growth in sales at 10-13%. Connectors industry is expected to witness sluggish growth in 2023 due to on-going shortage of labor, inflation pressures, increasing geopolitical tensions etc.

-

The connectors market is expected to witness continued consolidation, primarily driven by an increased rate of mergers and acquisitions in the industry. Surge in demand, due to cloud and data center expansions, Industry 4.0 requirements, electric vehicle growth, greater adoption of factory automation, and advancements in technology, such as artificial intelligence etc. have resulted in surging demand.

-

Presently connector manufacturers are focusing on exploring additional ways to modernize manufacturing by increasing automation levels thereby reducing the number of connectors required, improving functionality etc.

Regional Market Outlook : North America

-

In the North American region, the US is the largest market for connectors, and currently, holds over 70 percent of the overall regional sales

-

Major global manufacturers have connector manufacturing facilities and a strong distribution network in this region. The connectors market is expected to witness an uptrend in the future, driven primarily by the renewed demand from the automotive and aerospace industry

-

Increased adoption of enhanced communication devices, EVs in various end-user verticals is expected to accelerate the demand for durable and efficient connectors

Global Connectors Driver and Constraints

Driver

-

Increasing adoption of digital workplaces and online activities are driving the digital infrastructure growth significantly, in turn, calling for more investments to support the bandwidth and speed requirements. Rollout of 5G is driving the interconnects market demand significantly

-

Demand for connectivity, convenience, and advanced product features is resulting in increased electronic content in the end-use devices. Increased functionality of applications is resulting in rapid advances in the new product development thereby driving the demand for connectors. For example, the increased convergence of connectors used in consumer electronics, mobile devices, and other infotainment devices

-

Growing demand for electronic content in automotive industry at consumer level, especially in North America, Europe, and China is driving the demand for connectors market

-

Rebounding demand from commercial, aerospace and energy markets

Constraints

- Connectors market is presently balanced. However, prices are expected to increase at least till Q1 2023 due to surging raw material prices, high labor rates in the U.S., Europe, China etc. and increasing transportation costs. These factors could constrain the market growth globally.

Why You Should Buy This Report

- The report gives details on the connectors market share, size, growth trends and drivers and constraints.

- This trend market research report provides information on the regional connector market (China, North America and APAC) and the Porter’s five force analysis of the global connector market.

- It details the supplier market share and gives SWOT analysis of major suppliers in the connectors market like TE Connectivity, Amphenol, Molex Incorporated, etc.

- The report provides the cost breakup and price trend, forecast and price driver’s analysis.

- It lists out the best practices in the connector market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now