CATEGORY

Transformer Oils

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis across the industries for Transformers Oil

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Transformer Oils.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoTransformer Oils Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoTransformer Oils Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Transformer Oils category is 8.10%

Payment Terms

(in days)

The industry average payment terms in Transformer Oils category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

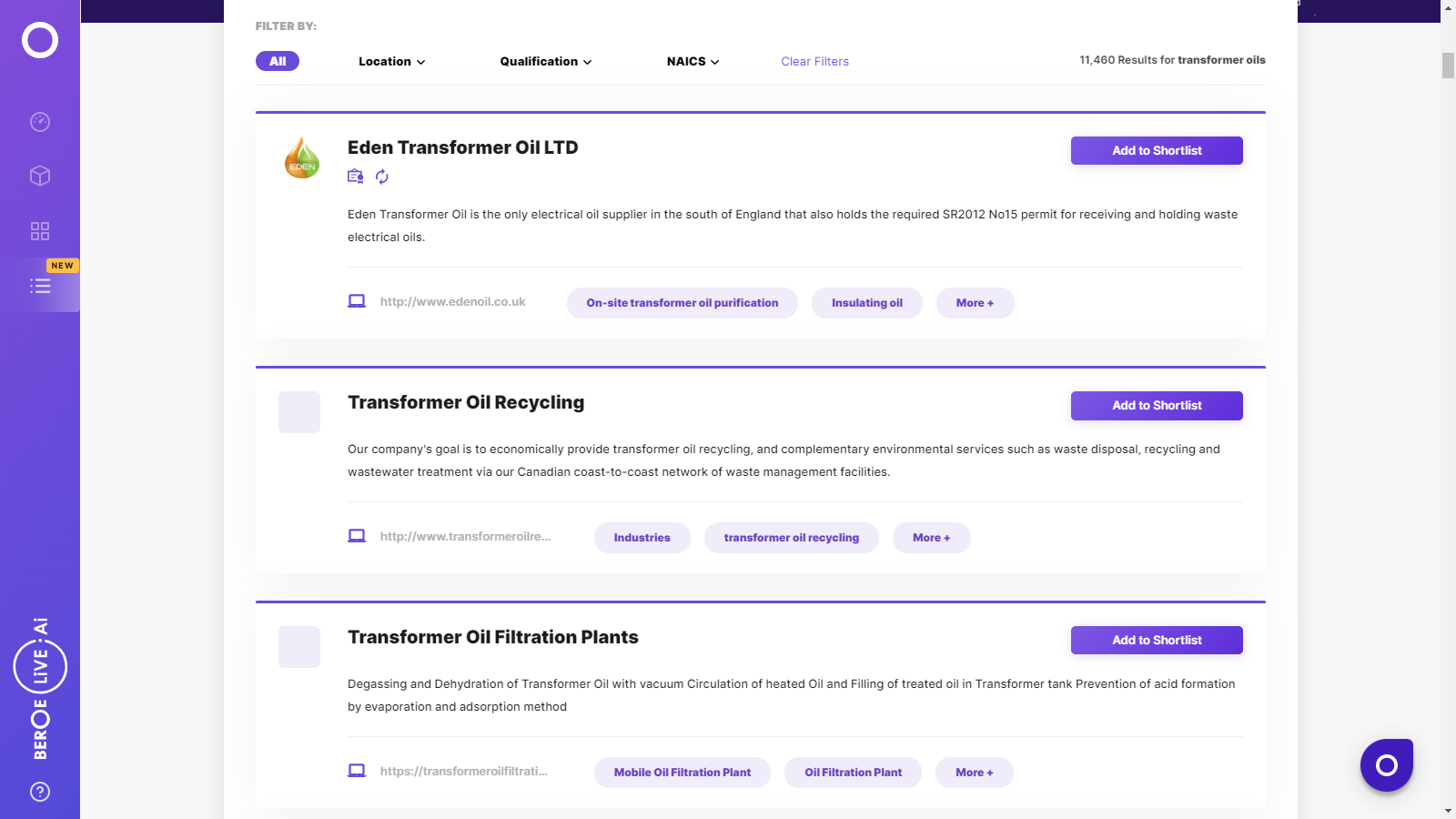

Transformer Oils Suppliers

Find the right-fit transformer oils supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Transformer Oils market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoTransformer Oils market report transcript

Transformer Oils Market Size and Global Outlook

MARKET OVERVIEW

Global market size – $2.87 billion (2022)

Forecasted to grow at a CAGR of 7.23 percent to $3.80 billion by 2024

-

Asia-Pacific will continue to dominate the market, in terms of growth prospects through to 2022

-

Increasing demand for electricity in the emerging and developed countries, along with the increasing infrastructure investment for energy access is expected to drive the transformer oil market globally. Also, replacement of ageing transformers in North America and Europe is expected to further drive the market

Global Market Size –Transformer Oil

-

Power industry growth to drive the demand for transformer oil: The transformer oil market is expected to grow at the CAGR of 7.23 percent from 2019-2025, mainly driven by the increased demand from the T&D sector of power industry

-

Significant growth is expected to come from the increasing demand for oil-filled transformers on the account of increasing energy demand and increasing electrification and increased industrial usage in developing economies

-

Asia-Pacific (especially China and India) is expected to lead the global transformer oil market in the next 5–8 years, due to the need for improving the rural and urban development infrastructure

Global Transformer Oil Supply-Demand Analysis

-

Higher growth in transformer oil capacity due to the developing markets: Transformer oil growth in developing markets is expected to be higher as more demand is coming from new transformers in these markets. Demand from revamping of old transformers in developed markets will be comparatively lower to new transformers

-

Developing countries to drive the demand for transformer oil: The demand for transformer oil in developing nations like China, India and Brazil is expected to be largely driven by the installation of new electrical infrastructure due to the increasing population and building better infrastructure

-

Revamping activities to increase the demand in developed nations: In developed nations like U.S. and Europe, significant investments in infrastructure were made during 1960-1980, and transformers have reached their lifetime (40 years). Therefore, a lot of revamping of the existing facilities were expected to fuel the demand for transformer oil in these regions

-

Large scale end-use players are direct buyers: Small quantity of transformer oil is sold through distributors and marketers. However, a large quantity is directly sold from the refiners to electrical distributors or transformer makers. Going forward, during 2019-2020, the demand for transformer oil is expected to put pressure on the supply leading to higher utilization of suppliers and capacity additions/expansions

Global Transformer Oil Demand by Application

Major demand driver for transformer oil is from the OEM and that is expected to drive the demand in the near future. The market for utility demand in higher in developed markets due to the ageing infrastructure of transformers

Downstream Demand Overview

-

Demand for transformers is expected to grow at a CAGR of 7-8 percent 2018 – 2022F: The transformer OEM contributes about 85 percent of the global transformer oil demand. Going forward, the demand is expected to increase owing to the robust transformer demand from developed and developing nations alike

-

About 12 percent demand for transformer oil is derived from electrical utility companies that utilizes the transformer oil for maintenance of the existing transformers and upgrading power grids. Demand from this sector is also expected to grow with ageing transformers (primarily in the developed markets)

-

Dielectric transformer oil is used in capacitors and contributes about 3 percent of the total transformer oil demand on a global level However, this type of capacitors, currently, are being replaced with solid state capacitors that offer superior performance and reliability. Therefore, demand from this sector is expected to dwindle going forward

Global Transformer oil production by category

-

Mineral-based transformer is the market leader for transformer oil production and is expected to be the leader in 2020, mainly due to the established value chains and operational benefits. The alternate forms of transformer oil are also making strides in transformer markets owing to their environmental friendly characteristics

-

Mineral-based transformer oil has two types – Naphthenic and Paraffinic. The naphthenic type supply is higher in the global market due to the maturity of developed markets but the growth of the paraffinic type is expected to be higher due to the increase in demand from the developing markets

-

There have been numerous environmental issues with mineral-based transformer oil due to production and end-of-life disposal. This has led to an increase in development of alternate types of transformer oil, i.e. silicone based and bio-based

-

Many companies, like Dow Corning, Cargill (silicone-based) and Novvi-Chevron (bio-based), are focusing on alternate types of transformer oil due to their environment benefits; but, due to limited usage benefits as compared to mineral-based oil, their market share is expected to increase marginally

Why You Should Buy This Report

- The report details the different drivers and constraints in the transformer oil market. It gives a regional market overview of Europe, APAC and North America, including the market size, growth rate and major transformer oil suppliers in each.

- Porter’s five force analysis for the global transformer oil industry

- It provides key supplier profiles and SWOT analysis of major transformer oil manufacturers like Nynas AB, Ergon Inc., APAR industries Ltd., etc.

- The report gives the cost structure, transformer oil price trend analysis and forecast along with the best procurement practices.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now