CATEGORY

Switchgears

Switchgear is composition of electrical disconnect switches, fuses or circuit breakers which are used to control, protect and isolate an electrical equipment. Switchgears are used both to de-energize equipment to allow work to be done and to clear faults downstream

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Switchgears.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Toshiba Company Introduced 72.5 KV SF6 Free Gas Insulated Switchgear With The Brand AEROXIA

April 25, 2023Hitachi Energy?s new transformer insulation fluid treatment equipment improves quality, reliability and energy efficiency.

April 25, 2023BIS authority announces Amendment of Conformity Assessment Scheme for LV Switchgear

April 03, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Switchgears

Schedule a DemoSwitchgears Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoSwitchgears Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Switchgears category is 6.10%

Payment Terms

(in days)

The industry average payment terms in Switchgears category for the current quarter is 112.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Switchgears Suppliers

Find the right-fit switchgears supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Switchgears market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoSwitchgears market report transcript

Global Market Outlook on Switchgears

-

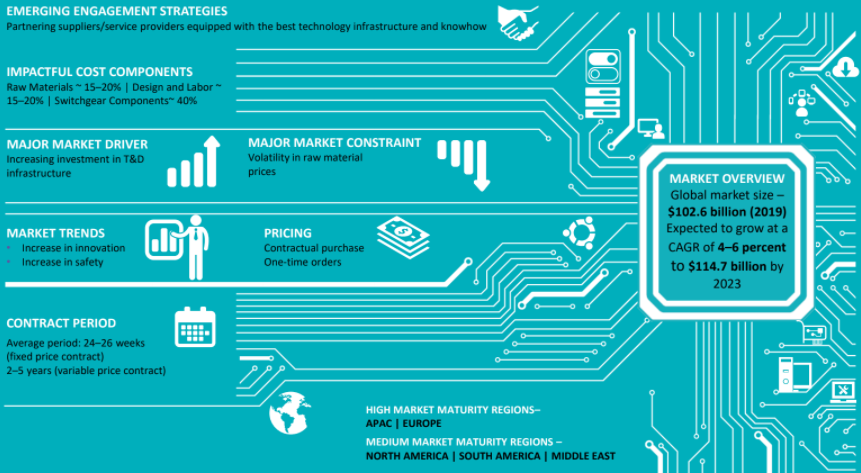

The global switchgear market is expected to be driven by the increased investment in transmission & distribution infrastructure and the upgradation of ageing substation equipment.

-

The global switchgear market is estimated to be approx. $108 billion in 2023, and it is expected to reach about $113.8 billion by 2024, growing at a CAGR of 4–5 percent during 2022–2023

-

Increasing demand for electricity in the emerging and developed countries, backed by increasing investment in infrastructure, is expected to drive the switchgear market globally. Also, initiatives taken to upgrade ageing substations with energy-efficient solutions for better performance, especially in North America and Europe, are further expected to drive the switchgear demand globally

-

Price volatility in key raw materials, such as copper, aluminum, steel, is expected to have a significant impact on the switchgear cost, as they are raw material intensive

-

Local companies have a significant market share in emerging economies, such as India and China, and give tough competition to the multinationals, in terms of switchgear quality and price

Switchgears Regional Market Outlook

-

The APAC will continue to dominate the market, in terms of driving the demand for switchgears

-

Growth of the power distribution equipment industry in developing regions is being driven by the upgrades and expansion of the electrification infrastructure and demand for electricity

-

In North America and Europe, the growth is being driven by the increased proliferation of renewable energy projects

Global Switchgear Market Maturity

-

Increasing demand for electricity in the emerging and developed countries, backed by increasing investment in infrastructure is expected to drive the switchgear market globally. However, intense price-based competition is expected to affect the overall growth.

Global Switchgear Market Drivers & Constraints

Drivers

-

Grid upgradation to support massive renewable energy integration, distributed generation and EV infrastructure

-

Electrification, industrialization, and urbanization in developing countries

-

Replacement of aged grid infrastructure to increase reliability, capacity & loss reduction

-

Rise in deployment of Smart cities & IoT adoption in power infrastructure

-

Increasing demand from data center and increasing investment in infrastructure supported by various recovery packages

-

Upcoming capital reinvestment wave in oil & gas sector and increasing captive power plant installations in the mining sector

Constraints

-

Volatility in steel, copper and crude oil prices is expected to restrain the growth of switchgear globally. Such volatility in raw material prices have created pressure on the manufacturers’ profit margin, due to which, some of the global suppliers in the industry have shifted their production facilities to regions that facilitate lower cost of manufacturing as well as, have a higher demand, like China, India etc.

-

Intense price based competition, especially in the emerging economies between local suppliers and established multinationals puts immense pressure on the revenue stream of switchgear manufacturers

-

Furthermore, with the lack of substantial product differentiation, price becomes an important criterion for winning contracts

Porter’s Five Forces Analysis (Global)

Supplier Power

-

The global switchgear market is raw material intensive, with the raw materials contributing to around 20 percent of the total switchgear cost

-

Copper, aluminum and steel are the major raw materials and are abundantly available which makes the supplier power low

Barriers to New Entrants

-

Medium and high voltage switchgear segment has high barriers to entry as the segment is capital intensive and is required to comply with regulations

-

For low voltage switchgears the barriers to entry is relatively low

-

Presence of global suppliers who have technical expertise, highly automated plants and wide product portfolio, this makes it difficult for the newer suppliers to compete against them

Intensity of Rivalry

-

The market for switchgears is highly competitive, with manufacturers competing on price as well as various after sale services

-

The intensity of rivalry is significantly high in the low and medium voltage switchgear market, due to the large number of suppliers operating in the segment. However, the high voltage switchgear market is largely consolidated with fewer suppliers operating in this segment

Threat of Substitutes

-

Currently, there is no technology or product which provides an alternative to switchgear from the end use/application point of view

Buyer Power

-

Buyer power is high supported by the large number of suppliers in the industry which gives the buyer higher options

-

However, the switching cost is relatively higher, as majority of the switchgears to be replaced are more than 30 years old and require significant upgradation of the support infrastructure in order to install/replace a new switchgear

Supply Market Outlook : Switchgears

Supply market Overview

-

Switchgear market supply base is moderately fragmented with key global players, like ABB, Siemens, Schneider, Hyundai, Eaton, etc., holding the major share

-

Key winning strategies implemented by top players are new product launches and strategic acquisitions

Technology Outlook

-

Major electrical companies like Siemens, GE & ABB are involved in wide range of research, development and commercialization of medium & high voltage SF-6 free switchgears. Key technologies under development include use of vacuum switching (commonly used for medium voltage application) in high voltage application, development of non-SF6 gases or mixture of gases for high voltage switching application, etc. Other advancements in the segment include smart switchgears, solid state breakers, hybrid switchgears, etc.

Engagement Trends

-

Contract: There are generally two types of annual contracts for procurement of switchgears - fixed price contracts and variable price contracts

-

One-time Orders: This refers to one-time non-contractual purchase of products. However, a long-term relationship with the supplier (contractual) enables better negotiation on prices and shorter lead times

-

Contract Length: Fixed price (24–26 weeks with a maximum of a year), variable price (2–5 years)

Cost and Pricing Analysis

This section of the switchgear market report provides the cost and pricing analysis of the different aspects of the market. The pricing analysis includes the switchgear components as well as consumables. It also includes the forecast for the future pricing trends for the same. The pricing of switchgears is driven not only by the input components and materials but also by labor and electricity costs. The cost and pricing analysis of the price drivers for switchgears in the US, Europe, and China markets are studied individually. The price trends of electricity and labor are detailed with the projected pricing change forecast.

Procurement Best Practices

The procurement best practices section of this report details the different channels of procurement in the global switchgear industry. It helps one better understand the process flow of procurement through the suppliers both local and global. The procurement process for switchgears also depends on the contract model and their parameters. The different aspects of the typical contract models and their details are also illustrated in this section of the report.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now