CATEGORY

Sand Castings

Sand Casting is the process that is used to make complex metal parts using sand mold. The metal is melted in the furnace and then poured into the cavity of the sand mold by gravity or by force which solidifies to form the shape. The sand mold is then separated from the part by braking the mold.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Sand Castings.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Neutec/Rio GrandeTM and Schultheiss GmbH together to form a partnership

March 07, 2023GF Casting Solutions with a New Show Car

January 09, 2023R?mheld & Moelle to mention carbon footprint on all quotations and proposals

November 25, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Sand Castings

Schedule a DemoSand Castings Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoSand Castings Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Sand Castings category is 3.10%

Payment Terms

(in days)

The industry average payment terms in Sand Castings category for the current quarter is 55.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Sand Castings Suppliers

Find the right-fit sand castings supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Sand Castings market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoSand Castings market frequently asked questions

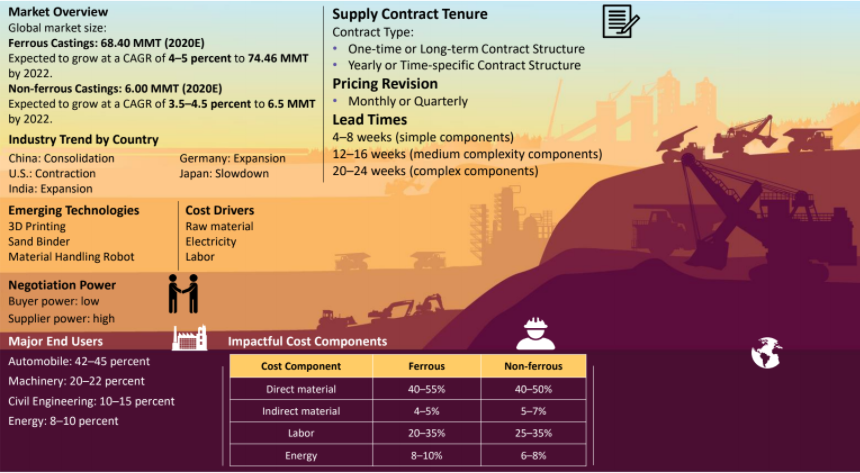

According to Beroe's analysis, the ferrous casting market valuation stands at 59.38 MMT and is expected to grow at a CAGR of 2 -3 percent to touch a valuation of 62.44 MMT. Similarly, non-ferrous casting will grow at a CAGR of 1 ' 2 percent to reach a valuation of 51.12 MMT from 49.06 MMT.

The top five sand-casting producing countries include ' China, India, the USA, Japan, and Germany.

Automobiles: 42 ' 45 percent Machinery: 20 ' 22 percent Civil Engineering: 10 ' 15 percent Energy: 8 ' 10 percent

As per the insights shared in the Beroe report, the top global suppliers of the casting market include: FAW Foundry Weichai Power Waupaca Foundry Grede Holdings Hinduja Foundries Jayaswal Neco India Ltd. Hitachi Metals Nemak

The developed nations follow a strict policy when it comes to safeguarding the environment. Since the regulations are quite stringent, the foundries need to adhere to the rules and invest in practices like recycling of sand, usage of silicate binder, etc.

The decline in the number of iron and steel foundries, stability of ferrous foundries, medium and small-scale enterprises dominating the supplier landscape majorly influenced the procurement in the casting industry. Consistent rise in demand from the automotive, construction, energy sectors further contributed to the increase in demand throughout these years.

Three primary factors that influence the cost of the casting market are ' raw materials (direct & indirect), electricity, and labor (wage rate). The bifurcation of each component is as follows: Cost Component Ferrous Non-ferrous Direct material 26 ' 44% 50 ' 75% Indirect material 11 ' 20% 11 ' 20% Labor 5 ' 24% 5 ' 15% Energy 9 ' 15% 12 ' 20%

Coke or charcoal, and iron ore are the two primary raw materials which are used in the production of pig iron. Any price change in these materials will also impact the price of pig iron.

The primary factors that drive the price of different components include: End-user demand Taxes Contract terms The overall cost

As per the metal casting industry outlook report shared by Beroe, the emerging technologies include: Additive manufacturing 3D printing Sand binder Casting simulation software Advancement in binders

Sand Castings market report transcript

Global Market Outlook on Sand Casting

-

The global castings market is highly fragmented with the major supply bases spread across the US, China, India, Japan, and Germany

-

The demand from major end uses at a global level has increased, due to the resumption of major OEM industries.

-

Zero-COVID policy and energy crisis across European countries have created impact on the supply market; thereby causing lead time delays and price increase

Global Sand Castings Market Maturity

-

China contributes to nearly 44–48 percent of the global sand castings production. In case of ferrous castings, China is followed by India, whereas the US takes the second position in producing non-ferrous castings

-

In general, the sand casters are small and medium-sized enterprises

-

Automobile and industrial machinery are the two major end-use industries, which serve as key demand drivers for the sand castings production

Global Sand Castings Industry Trends

-

The global Sand castings market is fragmented, and the foundries compete by offering various additional services and differentiate themselves amongst peers on cost and product quality

-

The developed nations, such as the US, Germany have stringent environmental regulations, and hence, the foundries are likely to invest more on environment friendly practices like recycling of sand, usage of silicate binder, etc.

Industry Drivers and Constraints : Sand Casting

Drivers

Outsourcing Trends

-

Suppliers from traditional manufacturing hubs, such as the US and Western Europe, are setting up manufacturing plants in low-cost regions, such as Eastern Europe, Mexico, and South East Asia, driving the market in the developing regions

Level of Integration

-

Level of integration (both vertical and horizontal) at the tier I and II of major OEM industries is gaining attraction among the buyers as a one-stop solution for reducing lead times and providing cost/volume advantage

Emerging Economies

-

In emerging economies, factors, such as low cost of labor, growing supply base concentration, etc., are expected to attract OEMs to engage with suppliers in these regions, thereby driving the demand for castings segment

Constraints

Zero-COVID policy in China

-

The Zero-COVID policy in China has significantly impacted the casting supply market; thereby leading to lead time delays and supply chain constraints

Energy Crisis

-

Energy crisis across European countries has led to increase in manufacturing cost of the products. This in turn has impacted the operating capacity of both OEMs and contract manufacturers.

Raw Material

-

Suppliers are susceptible to commodity price fluctuations (especially for high-mix, low-volume industries), against which they cannot hedge, due to their relatively lower volume of raw material purchase. These are expected to impact supplier margins and the final price of a product

Cost Structure: Global

Cost Component

Raw Materials

-

Raw material is the major demand driver for castings category. Raw Material cost includes cost of both direct raw materials, such as pig iron, aluminum, etc., and indirect materials, such as sand, resins, etc.

-

Prices of raw materials are predominantly determined by exchanges, like LME, SHFE, and COMEX. Raw material price fluctuations within a particular range are typically absorbed by the supplier, which is mutually agreed by both parties as a part of long-term contracts

-

Design and complexity of the product, process requirements, wastages, material availability are other key factors influencing the cost structure

Labor

-

Most of the casting processes being dependent on manual labor, labor cost becomes the next major cost component in the cost structure. Wages in countries, like the US, Germany, Japan, are higher compared to China, India, and ASEAN countries

-

Due to inability to standardize the customer requirements, any increase in the wages is expected to impact the product cost, in turn, impacting the price of the casted product

-

Relatively lower labor cost is a key factor supporting emerging sourcing countries, such as Indonesia, Vietnam, Taiwan, etc.

Energy

-

Increase in energy cost does not impact the prices drastically and may only show minor regional differences

-

In the casting process, the energy cost varies according to the metal used and the type of molding method

Overheads

-

Overheads primarily are machinery maintenance cost, administrative cost, transportation cost, packaging cost, duties, etc.

Emerging Trends : Sand Casting

Additive Manufacturing

-

An emerging trend in the field of pattern making is the use of 3D printing technology for making the mold, Despite this technology is gaining traction in the developed countries in the West, a majority of the developing economies are yet to catch up. The advantages of adopting this technology would relatively reduce the operational cost. However, still research is being conducted to improve the quality of the mold patterns in terms of surface finish.

Casting Simulation Software

-

Development of casting design simulation software’s such as Quickcast, ProCast, Flow 3D cast, etc., has resulted in the reduction of casting defects like shrinkage, cold shut, porosity, blowholes, etc., Simulation based castings is a modern casting technique which is implemented in the design phase to improve the quality of the casted product by suitably designing the mold shape, runner and riser assembly.

Advancements in Binders

-

Few sand mixing binders in the market such as ECOLOTEC, GMBOND, etc., are used in the core making process. ECOLOTEC is a odorless binder suitable for Steel/Sand castings which improves the strength of the mold, prevents the emission of hazardous pollutants thereby creating a clean and a safer core making process.

Why You Should Buy This Report

The report gives a regional market outlook of China, Germany, Japan, US and India. It shows the global sand casting market trends and gives the service portfolio and

SWOT analysis of key players such as Hinduja Foundries, Weichai Holding Group Co., Ltd., Hitachi Metals, etc. It breaks down the cost structure and analyzes the price and price drivers. The report gives information about the typical contract structure of the sand casting industry.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now