CATEGORY

Renewable Energy Market Analysis Brazil

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for Brazil Renewable Energy Market

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Renewable Energy Market Analysis Brazil.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

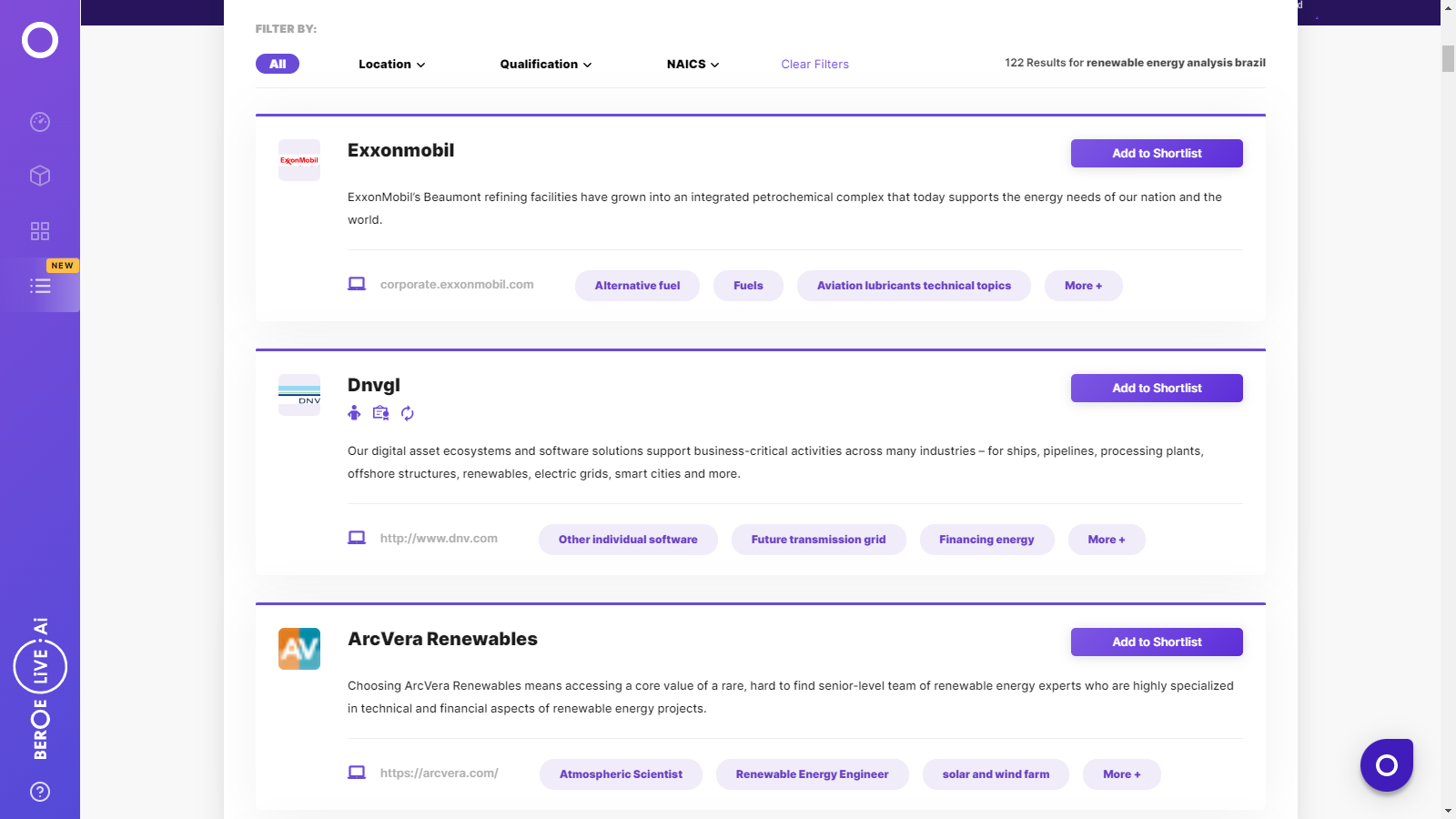

Renewable Energy Market Analysis Brazil Suppliers

Find the right-fit renewable energy market analysis brazil supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Renewable Energy Market Analysis Brazil market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoRenewable Energy Market Analysis Brazil market report transcript

Regional Market Outlook on Renewable Energy Market Analysis

In Southern part of Brazil, biomass is the most preferred, owing to high availability of sugarcane residue feedstock, while higher solar intensity makes solar PV preferable for industry in the Northern region of Brazil.

What are the considerations for industry's RE sourcing?

Supportive Policies

Supportive polices would help industry in reducing the capital investments and/or receiving monetary benefits for sale of excess energy.Currently, Brazil has strong RE policy, coupled with monetary benefits, such as tax exemptions and net metering mechanism.

PPA Contract Models

PPA contract models would allow industry to source renewable energy at per unit cost without installing the power plant on its own. Presently, the number of PPA-based projects is less and this is expected to grow in the coming years.

Potential

The industry could decide on the renewable energy type according to the potential of source in its region. The lack of strong grid connection and PPA structure limits the installation to industry's premises.

Market Maturity

The market maturity of a renewable energy source is a prime important factor to be considered, as the high market maturity would make the project price competitive.

The electricity supply in Brazil is mainly met by domestic generation (about 94%) and the rest from imports. In 2017, the renewable energy contributed to 15.20% of the fuel mix.

- The electricity supply mix in Brazil is dominated by the hydro-based power generation; about 64 percent of the total installed capacity of 15.7 GW as of March 2018. Renewable energy capacity was recorded to be at 13.21 GW at the end of 2017

- Renewable electricity generation was 501.93 TWh, which is considered to be a record high, due to increased generation share from wind

- Thermal power growth is expected to have 3.1 percent CAGR in the next three years, especially in natural gas powered plants with low fossil fuel prices adding to the cost attractiveness of thermal power plants. Mauá 3 Thermal Power Plant 590 MW under construction in the city of Manaus adds to thermal installed capacity in 2017

Brazil Renewable Energy Scenario

Overall energy production in Brazil has increased due to the rise in bioenergy, wind and solar power. Hydro energy has the highest installations in Brazil, about 64%, however due to lower rainfall and draught conditions the government is aiming to reduce the share of hydro power share as it leads to price fluctuations

- There has been a decrease in renewable share from 81.7 percent in 2016 to 80.4 percent in 2017. The decrease is due to the fall in hydrogenation, but rise in generation from wind made up for the decrease

- The overall share of hydro energy in fuel mix is expected to decline by 5–6 percent by 2019, as Brazil is aiming to balance the lopsided fuel mix of the country

- Renewable energy share is expected to increase at an average growth rate of 5–6 percent annually, especially because of the strong expansion of wind and solar power capacity

Solar Energy Potential in Brazil

Brazil's north part of the country is blessed with radiation levels greater than 6 kWh/m2/day. Majority of industry's operation in Brazil falls under a low to medium solar intensity region, however, it is still considered to be feasible for installations.

Solar Energy in Brazil

- The country has crossed 1 GW mark of installed PV capacity in 2017 and out of this, 85 percent is represented by large-scale plants, while the rest by distributed generation (up to 5 MW)

- The majority of the distributed generation through solar PV units is concentrated in the Southeast and South, as the demand centers are focused in these regions

Potential at industry Locations

- Industry prominent brewery locations in Brazil SaoPaulo, Rio Grande do Sul is based in the regions that falls under low to medium intensity of solar radiations, while locations such as Recife, Bahia falls under medium solar radiation intensity

- Even the low to medium intensity regions have solar radiation energy of about 4.5 kWh/m2/day, which is still feasible for solar PV installations

Wind Energy Potential in Brazil

Brazil has wind energy speed ranging from 2.5 m/s to above 6 m/s, and roughly, 50 percent of the country has a significantly good potential for wind energy generation. Most of the industry's brewery location are located in high wind energy potential location.

Onshore Wind

- Brazil has high potential for onshore wind generation with wind potential greater than 500 GW

- Brazil has installed capacity of 12 GW of wind installations with majority of the projects in northern region of the country

Offshore Wind

- Offshore wind energy in Brazil is yet to be explored, as more investment is needed in comparison to onshore project

- At present only 1 project has been developed, which has a capacity of 5 MW

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now