CATEGORY

PVC With Focus On Cable Industry India and China

Polyvinyl Chloride (PVC) is predominantly used in construction industries followed by automobiles and packaging. Globally, naphtha based PVC would remain competitive than carbide based even at increased crude levels due to the high fixed costs involved for a carbide based producer.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like PVC With Focus On Cable Industry India and China.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

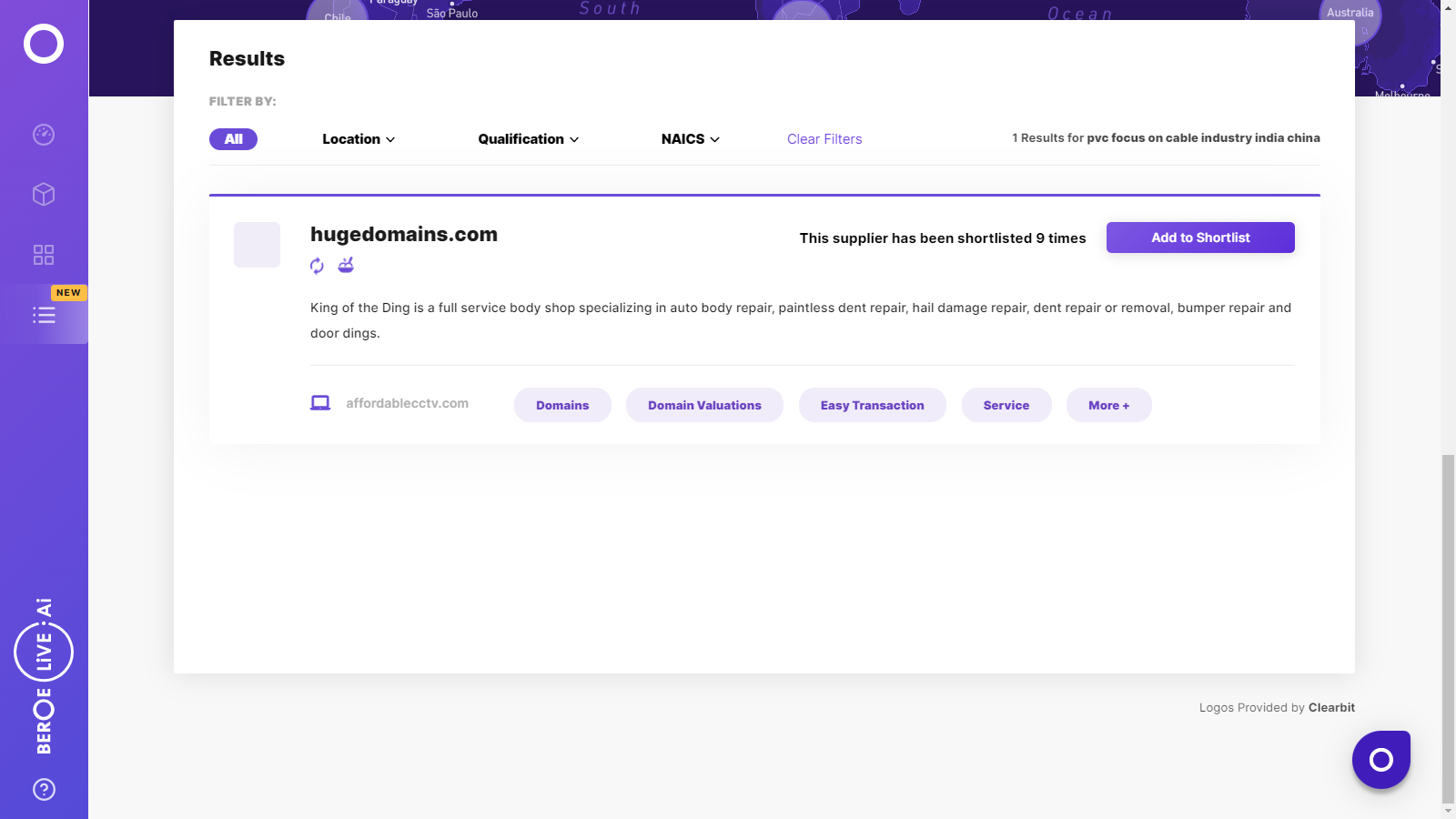

PVC With Focus On Cable Industry India and China Suppliers

Find the right-fit pvc with focus on cable industry india and china supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the PVC With Focus On Cable Industry India and China market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPVC With Focus On Cable Industry India and China market report transcript

Regional Market Outlook on PVC With Focus On Cable Industry in India and China

The US PVC producers are anticipated to use their low-cost feedstock position from natural gas to become global suppliers. Self-sufficiency in the ethylene front would enable North American PVC suppliers to run their plants at such high rates.

Global demand position

- The global demand for PVC stood at 39.4 MMT during 2017 and is projected to grow at a CAGR of 3.6%

- Asia is the largest consumer of PVC as of 2017, accounting for about 57% of the total demand, followed by Europe accounting for about 15%

Capacity additions

- Asia holds majority of the capacity (48%), followed by North America (13%)

- Net capacity of about 0.17 MMT is expected to be added during the forecast period with capacity additions in Asia, the Middle East, the US, and Europe

- Producers are expected to operate at 64–74%, as the market gets more balanced

Engagement Outlook

- Ethane-based production in North America is expected to remain cost competitive compared to carbide-based and naphtha-based method in Asia and Europe, respectively, during 2018

- Engaging with North American PVC supplier would be beneficial in the long run

PVC Resin Capacity–Demand Analysis: China

Around 80% of Chinese production is carbide-based PVC (derived from coal), and therefore, closely tied to environment-related regulations. China would continue to be a supply surplus region for PVC

Tariffs by China on US Resins

- PVC from the US, which was in the list of retaliatory tariffs announced by China from June 15, 2018, has now been dropped from the list based on the recent revision. However, the intermediate EDC is still under the tariff list facing around 25% from August 23, 2018

Capacity additions

- Carbide production causes air pollution as well as mercury emissions through the use of mercury-based catalysts. The government is not offering any new approvals

- Therefore, no major capacity additions expected during the forecast period

Engagement outlook

- China has also posed a ban on plastic scrap import from January 2018, which is expected to boost the demand of virgin-grade resins during 2018–2020

- Even though imports from North America, especially the US, would continue to cater to buyers, who are dependent on ethylene-based PVC, China, would continue to be a supply surplus region for PVC

PVC Resin Capacity–Demand Analysis: India

India would continue to be a net importer with no major capacity additions expected during the forecast period. Buyers are recommended to go for importing options from Europe, China or US in the future.

Supply scenario

Imports cater to 42% of Indian demand as of 2017. Japan and Taiwan were observed to be major suppliers for the Indian marketDomestic demand is expected to witness a CAGR of 7%

Demand scenario

- PVC capacity growth in India has been and would continue to significantly lag behind demand growth

- There is a strong demand in the construction sector in India with planned investments in infrastructure projects, spending of Public Sector Development Program, etc.

Engagement outlook

- Buyers may look into import options from China, Taiwan, and Europe in the future

- Also, engaging with North American PVC suppliers using ethane as feedstock would be beneficial in the long term

Cost Structure and Drivers – PVC Resin

Ethane-based production in North America is expected to remain cost competitive compared to carbide-based and naphtha-based method in Asia and Europe, respectively, during 2018.

- Raw Materials : The fall in oil prices levelled the playing field to some extent, yet North America continued to have cost advantage on raw material front. Naphtha-based PVC is expected to remain competitive only at $40/bbl oil, competitive position of Chinese carbide-based vinyl looks questionable.

- Utilities Cost: Utilities cost include electricity and water. It contributes to approximately to 2–7% of the total cost. The Middle East and the US have the highest cost compared to other regions, due to lower raw material cost. The impact of utilities cost is observed to be low to medium in the final resin cost.

- Labor Cost: Labor cost is highest in the US and Europe, due to higher hourly wages. Asia has the lowest labor cost compared to other regions. Asian capacity additions could be supported by lower investment cost (hourly wages).

- Fixed Cost: Depreciation and SG&A are considered in other cost, which contributes to 14–17% of the total cost. Depreciation will alone contribute to about 5–7% and the rest will be contributed by Selling General and Administrative expenses (SG&A). .

PVC Resin: Price Trend and Forecast (India)

Short Term

- Demand for PVC in India weakened, as the monsoons continue. PVC prices rolled over during July 2018

- End of monsoon would signal the onset of demand from downstream agriculture and irrigation sectors. Thus, prices are expected to increase during August and September 2018

Medium Term

- Ethylene prices expected to impact PVC prices during the period. Ethylene supply is expected to recover in Q4 2018, as the crackers which went offline in September to resume operations. However, PVC demand from the construction sector to support prices during the period

Long Term

- The demand is expected to be soft, due to limited buying activities, ahead of Chinese lunar holidays. This coupled with a drop in crude oil prices and stable demand to exert downward pressure on PVC prices

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now