CATEGORY

Printed Circuit Boards (PCBs)

Printed circuit boards which enables physical support and electrically connects components. PCBs were extensively used in Industrial, Electrical & Electronics industries, Automotive. PCBs were made out of fiber glass

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Printed Circuit Boards (PCBs).

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoPrinted Circuit Boards (PCBs) Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPrinted Circuit Boards (PCBs) Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Printed Circuit Boards (PCBs) category is 3.50%

Payment Terms

(in days)

The industry average payment terms in Printed Circuit Boards (PCBs) category for the current quarter is 93.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Printed Circuit Boards (PCBs) Suppliers

Find the right-fit printed circuit boards (pcbs) supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Printed Circuit Boards (PCBs) market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPrinted Circuit Boards (PCBs) market report transcript

Printed Circuit Boards (PCBs) Global Market Outlook

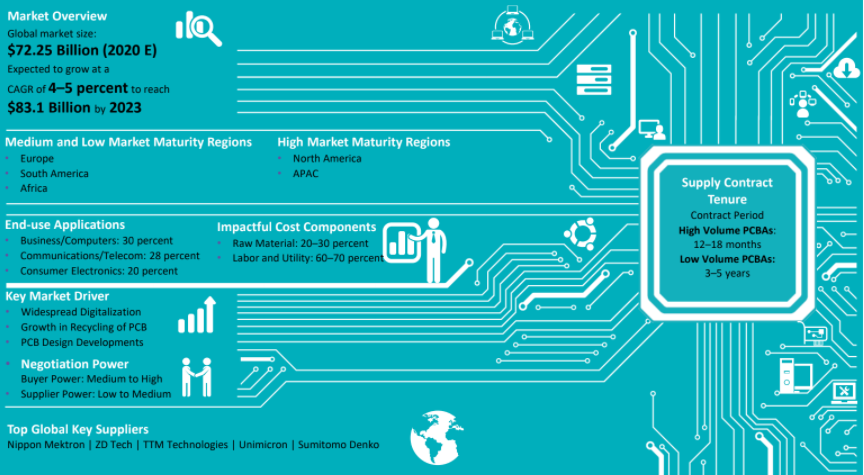

Market Overview

Global market size: $64.1 Billion (2022 E)

Expected to grow at a CAGR of 4–6 percent to reach $74.2 Billion by 2025

-

Shift in the manufacturing base of major electronic and communication manufacturers to low-cost countries, like Vietnam, Taiwan, and South Korea, is expected to support the demand for PCBs and PCBAs in APAC

-

Environmental rules and laws set by the governments of various countries are expected to support the growth in recycling of PCBs until 2025

Global PCB Demand by Application

-

Consumer electronics, computer and telecom, together, account for approx. 70 percent of the global PCB market and are expected to retain the dominance, considering the technological innovations and growing demand for these products in the emerging economies

-

Continuous technological advancements and changing consumer preference to the latest technologies in the end-use segments, such as consumer and computer verticals, are expected to further expand their share during the forecast period. Substrates are expected to experience the highest CAGR during the forecast period, considering the accelerated demand for high-end processor modules for applications. Demand explosion from energy vehicles has altered the supply–demand scenario in the recent time and is further expected to make rapid expansion of the automotive PCB market in the coming quarters

Industry Drivers and Constraints : Printed Circuit Boards (PCBs)

Drivers

-

Technology Innovation: External OEMs pressure to introduce new products in the market on account of intense competition is driving technological innovation and thus in turn expanding the market opportunities. Emerging applications such as IoT, 5G, AI, Cloud Computing and Networking, Automation etc., are expected to swiftly drive the market. Also, These technologies demand for Powerful processor Modules that can be supported by High end PCB products. PCB being the Heart of EMS assembly is likely to absorb those opportunities and the rapidly growing EMS market further lifts up the demand for PCB products.

-

End use demand: Growing trend towards smart devices and electronics integration in Automotive i.e., Autonomous vehicles are expected to bolster the growth of PCB market. Also, increasing usage of cloud servers, data center applications are expected to accelerate the market growth.

-

Miniaturization: Demand for the miniaturization trend in consumer electronics sector specifically for smartphones, laptop and other consumer devices is constantly triggering the demand for miniaturized PCB construction.

-

PCB Design Developments: Development of PCB designs, which can maximize the utilization and minimize cost, including replacement of base materials (shift from traditional FR4 to BT-epoxy and polymides), are expected to support competition and growth in the global PCB market.

Constraints

-

Covid-19: Due to pandemic, PCB production had been affected due to factory shutdown, labor unavailability and raw material availability. Global weakness in demand from the major end uses such as Consumer, Communication, Automotive, Industrial has primarily attributed to the declining sales.

-

The US Restrictions on External Sourcing: President Trump has imposed a restriction on manufacturers in the US to source from domestic suppliers, thereby providing job opportunities in the country. Considering the fact that more than 90 percent of the global PCB production is concentrated in APAC, this restriction is likely to be a key challenge

-

Rising Labor and Utility Cost: Labor and utility cost accounts for 65–80 percent of the total production cost of PCB, depending on the layers, size, and other specifications. Rising cost of labor and electricity is a factor of high concern for PCB manufacturers, as it might affect their margin and profitability

Cost Structure Analysis: PCB

Material

-

Copper Clad Laminates account for the major portion of the raw material of PCBs. FR-Flame Retardant is a glass fiber epoxy laminate used in PCB production

-

Major raw materials are FR1, FR2, FR3, FR4, CEM1, and CEM3

Labor and Utility

-

Fabrication of PCBs account for a major portion of the production cost. It ranges from 60 percent to 70 percent, depending on the layers

-

Includes processes, like drilling, plating and finishing, photo etching, etc., which are electricity driven, thereby are the key drivers of production cost

Other Overheads

-

Other overhead expenses include depreciation on non-current assets and other administrative expenses, which together account for 3 percent of the production cost of PCBs

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now