CATEGORY

Oil Field Chemicals

The oilfield chemicals market is expected to grow at a CAGR of 5% driven by increasing demand for petroleum-based fuel from the transportation industry.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Oil Field Chemicals.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

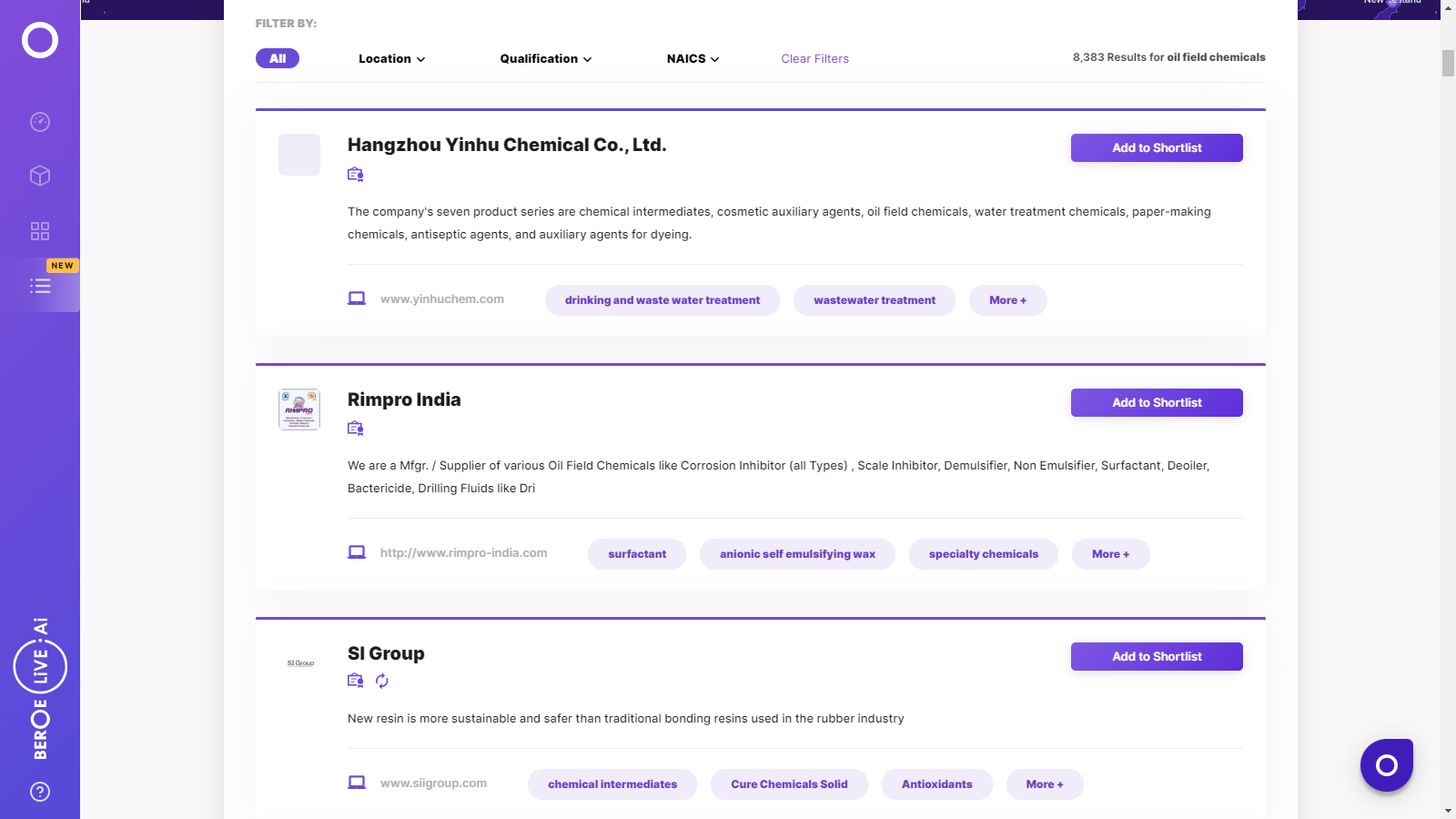

Oil Field Chemicals Suppliers

Find the right-fit oil field chemicals supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Oil Field Chemicals market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOil Field Chemicals market report transcript

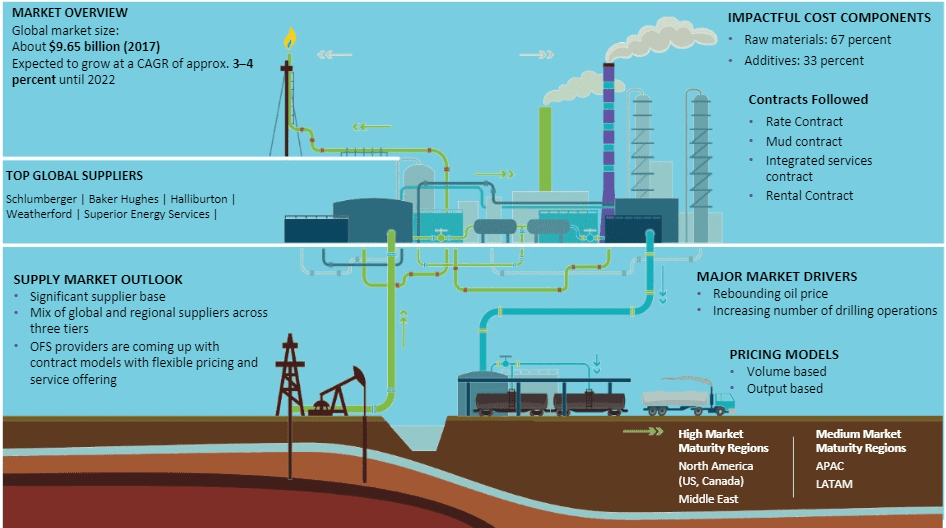

Global Market Outlook on Oil Field Chemicals

- The drilling fluid market is expected to reach $11 billion in 2021, growing at a CAGR of 2–3 percent. Due to decrease in crude oil prices, drilling fluid prices have come down drastically in the last two years

- Rig count is the major price driver of drilling fluids. In the US, from mid 2015, 350 wells have been shut and 200 wells havenot started operations, which has reduced the demand

- Australia witnessed a mild increase in rig count during the last two years, as explorations were flourishing the market, which led to increased demand

Xanthan Gum: Market Dynamics

Xanthan gum is used as a water viscosity reducer in varied applications. The demand is expected to grow at a rapid CAGR of above 6 percent during 2017–2021, mainly due to its application in the food and oil & gas industries

- Positive regulatory support from the European and US administration for the usage of Xanthan gum as stabiliser, emulsifier, thickener and gelling agent is expected to keep the demand from food industries robust

- In the oil and gas industry, it is used as drilling fluids as well as in EOR methods to reduce the mobility of water. Recently, after the oil price crash, many EOR schemes have been shelved and reduced the growth for demand, however, any firming up of oil price will rapidly increase the demand for Xanthan gum

- Guar gum, a substitute for Xanthan gum, is likely to impact the demand growth; however, the production of Guar gum is highly uncertain, as the output depends mainly upon the yield of Guar beans from the Indian market

Barite: Market Dynamics

The supply of Barite is highly correlated to the price of oil and gas, since usage of Barite in drilling fluid is the single largest consuming sector. With stabilising oil prices and shale gas drilling in the US, the demand for Barite is expected to grow at a CAGR of around 3.7 percent

- China produces approx. 3 million tonnes of Barite that account for about 40 percent of global production. The current production is way lower than the production during 2010–2011, when the prices of oil were in peak

- China has set an aggressive goal of producing 30 BCM of gas by 2020 by drilling more shale gas wells. This, in turn, is expected to increase the domestic consumption and reduce the amount of Barite available for exports

- If the current lowering Barite output from China persists, by 2020, China is expected to become a net importer of Barite. As a result, supply is expected to become tight

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now