CATEGORY

Natural Gas

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Natural Gas.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoNatural Gas Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Natural Gas category is 8.90%

Payment Terms

(in days)

The industry average payment terms in Natural Gas category for the current quarter is 18.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

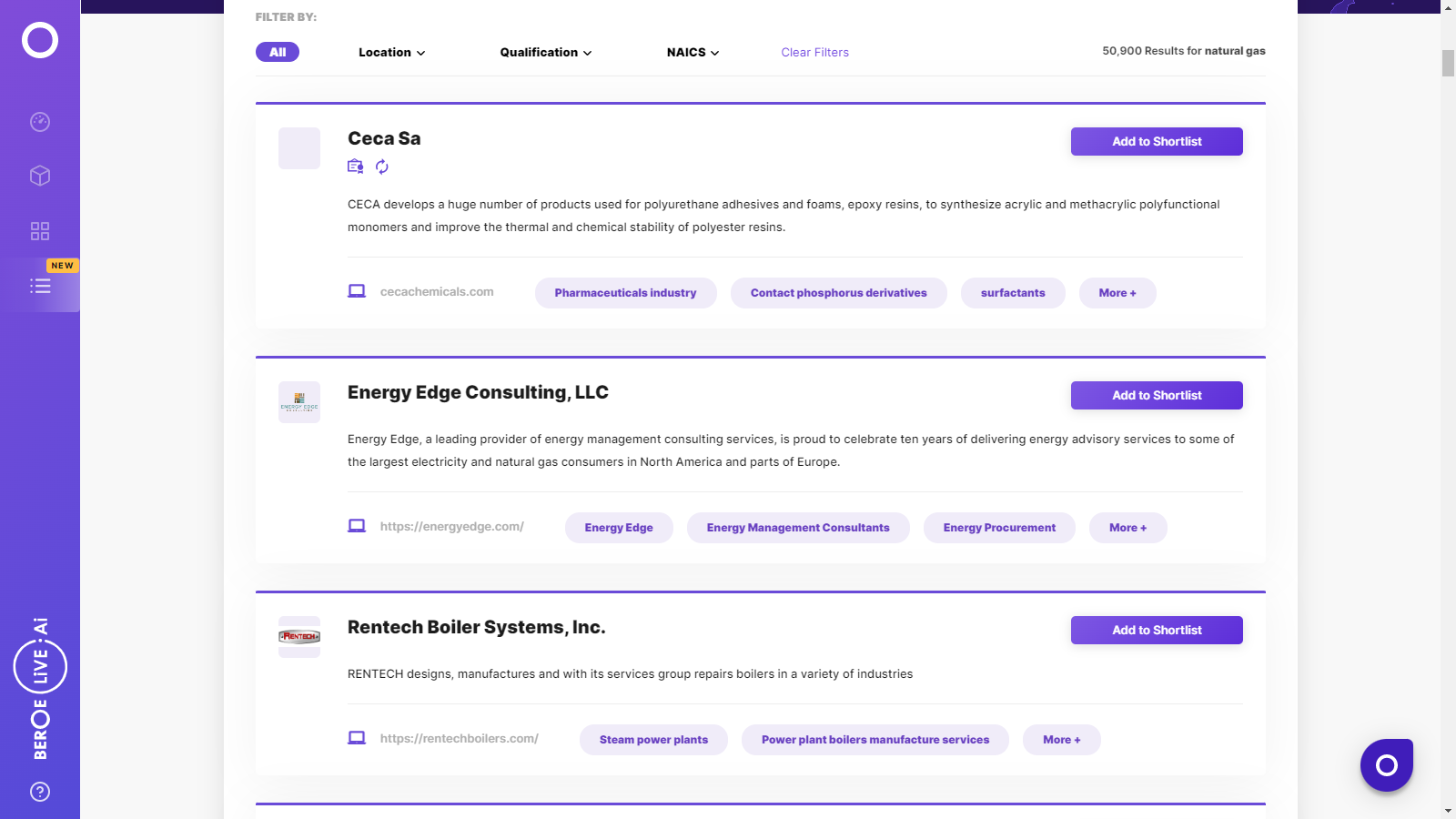

Natural Gas Suppliers

Find the right-fit natural gas supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Natural Gas market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoNatural Gas market report transcript

Natural Gas Global Market Outlook

-

The US is a net exporter of natural gas and depends mainly on domestic production to meet the demand. Natural gas production is expected to increase by 0–1 percent in 2021 from the production levels in 2020

-

Natural gas consumption in the US declined by 2 to 3 percent in 2020 vs 2019. Demand declined in 2020, with the major decline coming from commercial and industrial segments

-

The US contributes to 82 percent and 23 percent of the North American natural gas production and global gas production, respectively

Impact of COVID-19 on Natural Gas Industry

- Natural gas demand increased in Q3 2021 vs. Q2 2021, due to increase in consumption in power plants and rise in industrial segment demand. Power sector demand increased with a rise in electricity demand in the summer months. With the demand recovering from COVID-19 peak levels and relatively lower gas storage, prices are likely to increase further.

Porter’s Five Forces Analysis on Natural Gas Industry

-

Natural gas market in the US is decentralized and is highly competitive in all the sectors of the value chain

-

The buyer has an option of choosing the supplier in the deregulated states, while in the regulated states, the state LDCs are the sole suppliers

Supplier Power

-

There are thousands of large and small-scale exploration companies involved in the exploration and production of natural gas in the US, which shows the competitive environment, thereby breaking monopoly and power

-

The natural gas price in the US market is majorly dependent on domestic demand and global prices, thus reducing producer power on pricing

-

The North America Free Trade Agreement hasopened access to cheap and a larger naturalgas market across North America

Barriers to New Entrants

-

The barriers for new participants are generally low in the deregulated states, as the policies support competition, and high concentration natural gas producers in the country is an advantage

-

With more states already in the pilot phase of deregulation, or planning to deregulate the energy market, will help in opening up a new arena for participants

Intensity of Rivalry

-

The intensity of rivalry is high in those markets, where open access is allowed for the energy sector

-

The rest of the states have more state-owned LDCs servicing clients

Threat of Substitutes

-

The Federal decision to promote the use of renewable energy and co-generation poses a threat to natural gas

-

Renewable natural gas produced from biogas, which can be injected to gas pipeline, is a direct substitute to natural gas. Certificates associated with renewable natural gas is a suitable option to decarbonize natural gas. However, penetration of RNG is low. Although RNG source is different from natural gas, chemically both are methane

Buyer Power

-

Buyers have a choice of supplier switching in few states of the US, where the market is deregulated and prices are competitive

-

In the rest of the states, the buyer will have to depend on regulated state distributors for natural gas purchase

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now