CATEGORY

Microcontrollers

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Microcontrollers.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoMicrocontrollers Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Microcontrollers category is 6.57%

Payment Terms

(in days)

The industry average payment terms in Microcontrollers category for the current quarter is 74.2 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

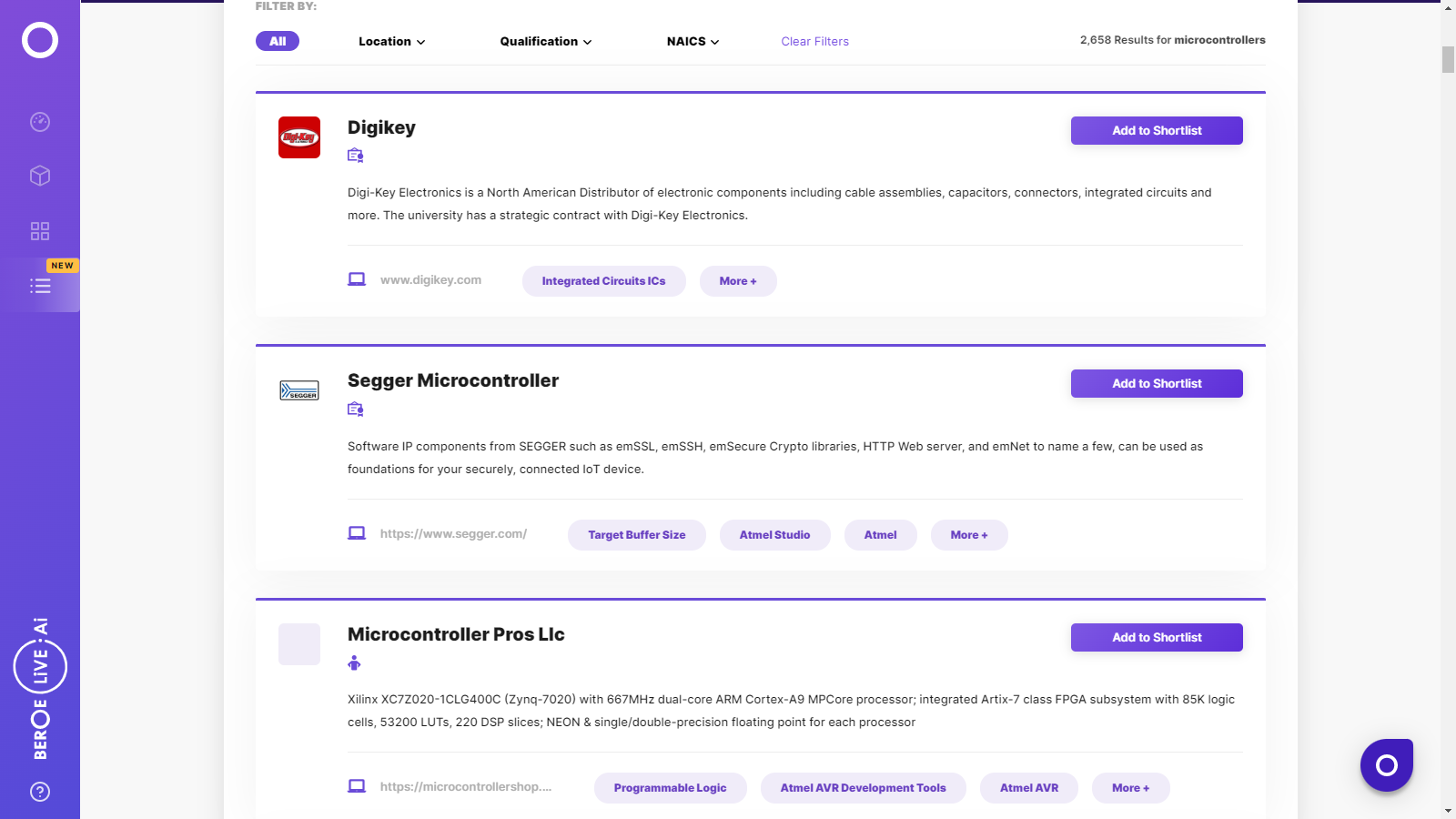

Microcontrollers Suppliers

Find the right-fit microcontrollers supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Microcontrollers market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMicrocontrollers market report transcript

Microcontrollers Global Market Outlook

-

APAC consolidates the demand share of the global MCU market accounting for almost ~66 percent share supported by domestic consumption of demand from high volume sectors like automotive, consumer, communication peripherals etc.,

-

Higher the advancements in technology nodes for all less than 10nm; supply is being concentrated towards Taiwan and South Korea

Impact of COVID-19 on Microcontrollers Industry

-

Post Pandemic situation has created contradiction in supply demand state and has majorly affected the sourcing of MCU. This has led to lead time and price increases. Uncertainties surrounding the spread of Omicron variant is expected to further intensify the supply demand dynamics. However, players are involving in adding inventories to sustain the production operations.

-

Partial lockdowns and travel restrictions has already been imposed on certain geographies and for non vaccinated groups. However, considering the transmissibility of Omicron variants, regulations or lockdowns shall be strictly imposed to control the virus spread. Hence if the spread becomes intense, many of the electronics components can go into allocation mode.

Global Microcontrollers Market: Drivers and Constraints

Industry Drivers

-

Technology Innovation: External OEMs pressure to introduce new products in the market on account of intense competition is driving technological innovation and thus in turn expanding the MCU market and further driving intense competition between suppliers

-

Growing end use demand: Computer, Communication and Consumer sector are the key sectors driving the Microcontrollers market. Majorly the demand from Automotive, Off-Highway vehicles and Safety Required Applications in Automotive, Industrial, IoT and Consumer applications are primarily accelerating the demand.

-

Electrification of vehicles: Increasing features in Automotive industry is driving the need for microcontrollers for performing various functions in Automotive. Some of the applications are airbags, adaptive cruise control, navigations etc., Usage of embedded processors are extending to other markets like medical, aerospace, military etc., Electrification of vehicles increases the consumption of MCU by 50% more supporting the expansion of market.

-

Embedded processors: The growing trends towards smart application and IoT in various end segments such as Consumer, Industrial, medical etc., are driving the need for Embedded processor that typically uses 32bit MCU’s and supports sensor communication, wireless and IP communications and thereby performing tasks at a higher precisions. Predominantly, the new generation of 32-bit MCUs provides robust protection for a range of embedded system applications.

Constraints

-

Extended Lead times: As there exists strong demand from varied end markets and as the added supply couldn’t able to meet the elevated demand, lead times are extending which is mainly attributed due to wafer shortage. Hence securing the supply of wafers is crucial to mitigate the lead time risk and regulating the price and supply of MCUs.

-

Extreme working environment: New innovations in Microcontrollers are constructed to perform various functions in harsh working environments such as high temperature, vibration, moisture etc., Hence, they might be prone to some kind of accidents in extreme working conditions.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now