CATEGORY

Metal Stamping And Fabrication

Metal Stamping and fabrication category involves cutting, bending, forming, pressing, blanking, embossing, flanging, coining and assembling of materials such as steel, stainless steel, iron, aluminum, copper, gold, magnesium

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Metal Stamping And Fabrication.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Big Rapid Products Expands its Production Facility

March 20, 2023Larsen Manufacturing acquires Tella LLC

January 23, 2023Schivo acquires APN Global

November 18, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Metal Stamping And Fabrication

Schedule a DemoMetal Stamping And Fabrication Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoMetal Stamping And Fabrication Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Metal Stamping And Fabrication category is 14.00%

Payment Terms

(in days)

The industry average payment terms in Metal Stamping And Fabrication category for the current quarter is 51.1 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Metal Stamping And Fabrication Suppliers

Find the right-fit metal stamping and fabrication supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Metal Stamping And Fabrication market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMetal Stamping And Fabrication market report transcript

Global Market Outlook on Metal Stamping and Fabrication

-

The global metal fabrication market is highly fragmented with the major supply bases spread across China, India, Germany, the US, Japan, South Korea, etc.

-

The demand from major end uses at the global level has relatively increased during H2-2022 due to the resumption of major OEM industries. Zero COVID policy and Russia–Ukraine war have created an impact on the supply market, thereby causing lead time delays and price increase.

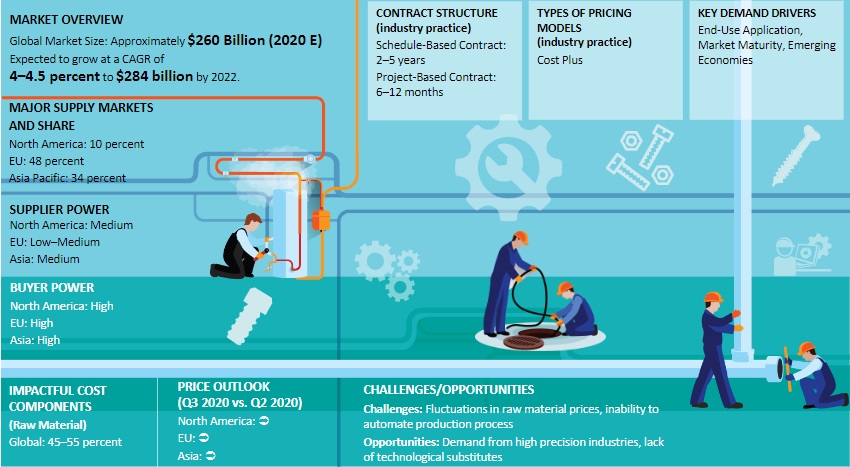

Market Overview: Metal Fabrication

-

The global metal fabrication market is expected to grow from $278 Billion in 2022 to reach $302 billion in 2024 at a CAGR of 3.5–4.5 percent

-

The global metal fabrication market is highly fragmented with the major supply bases spread across China, India, Germany, US, Japan, South Korea, etc.

-

Supply base is categorized based on industry requirement, in terms of product tolerance levels. Industries, like aerospace, defense, and medical typically require high tolerance levels and thereby, high-end technologies. Steel and aluminum account for the major portion of the materials processed using the fabrication services at the global level

-

Increasing demand for Electric Vehicle in the automotive sector is expected to boost the metal fabrication market globally.

-

Fabricators will benefit from a growing demand from Construction, Electronics, Aerospace and Defense, Medical, Energy, Technology sectors as well corporate spending on machinery and automation.

Global Metal Fabrication Drivers and Constraints

Drivers

Demand from High Precision Industries

-

Demand from automotive, aerospace and defense industries, which typically have tight tolerance levels for components, is expected to support the metal fabrication market during 2022-2025

End-use Market

-

Major end-use from construction and building/piping and architecture is expected to drive the market growth. Metal Fabricators are focusing on end use applications to design the products accordingly

Demand for APAC Region

-

Due to increasing demand from Asia Pacific countries, many companies are shifting their manufacturing base to APAC, and this is expected to drive the regions Metal Fabrication services market growth.

Constraints

Impact, due to Russia–Ukraine war

-

The Russia–Ukraine war has impacted the raw material supply (copper, aluminum, etc.), as Russia accounts for ~6 percent of global aluminum production and ~4 percent of global copper production

Inability to Automate Production Process

-

Metal fabrication is a customized process, based on project-based orders that constraints the standardization of the manufacturing process beyond a certain level

-

This constraint keeps the manufacturing costs high and increases pressure to reduce costs in a competitive market

Cost Structure: Metal Fabrication

-

The major cost factors involved are raw materials and labor which account for about 75 percent of the total cost.

-

Production of metal fabrication in high-cost countries, like the U.S., Germany, and in regions of Europe and North America, has a higher share of labor and raw material in the cost structure, when compared to low-cost countries, like China or India.

-

Despite, higher electricity prices in countries such as Germany, U.K, etc., the impact on the overall cost of production is minimal, as the electricity cost constitutes a smaller share on the overall cost structure.

Why You Should Buy This Report

Information about metal stamping industry analysis, global and regional market size, maturity and overview, drivers and constraints, etc. Porter’s five force analysis of the global metal fabrication market. Supplier profile and SWOT analysis of major players like Anhui Honglu Steel Construction (Group) Co.,Ltd, Thyssenkrupp Steel Europe, WEC Group, etc. Cost structure, price driver analysis, price trend and forecast. Best engagement models and contract terms in the global metal fabrication market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now