CATEGORY

LPG

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like LPG.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoLPG Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoLPG Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in LPG category is 6.31%

Payment Terms

(in days)

The industry average payment terms in LPG category for the current quarter is 49.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

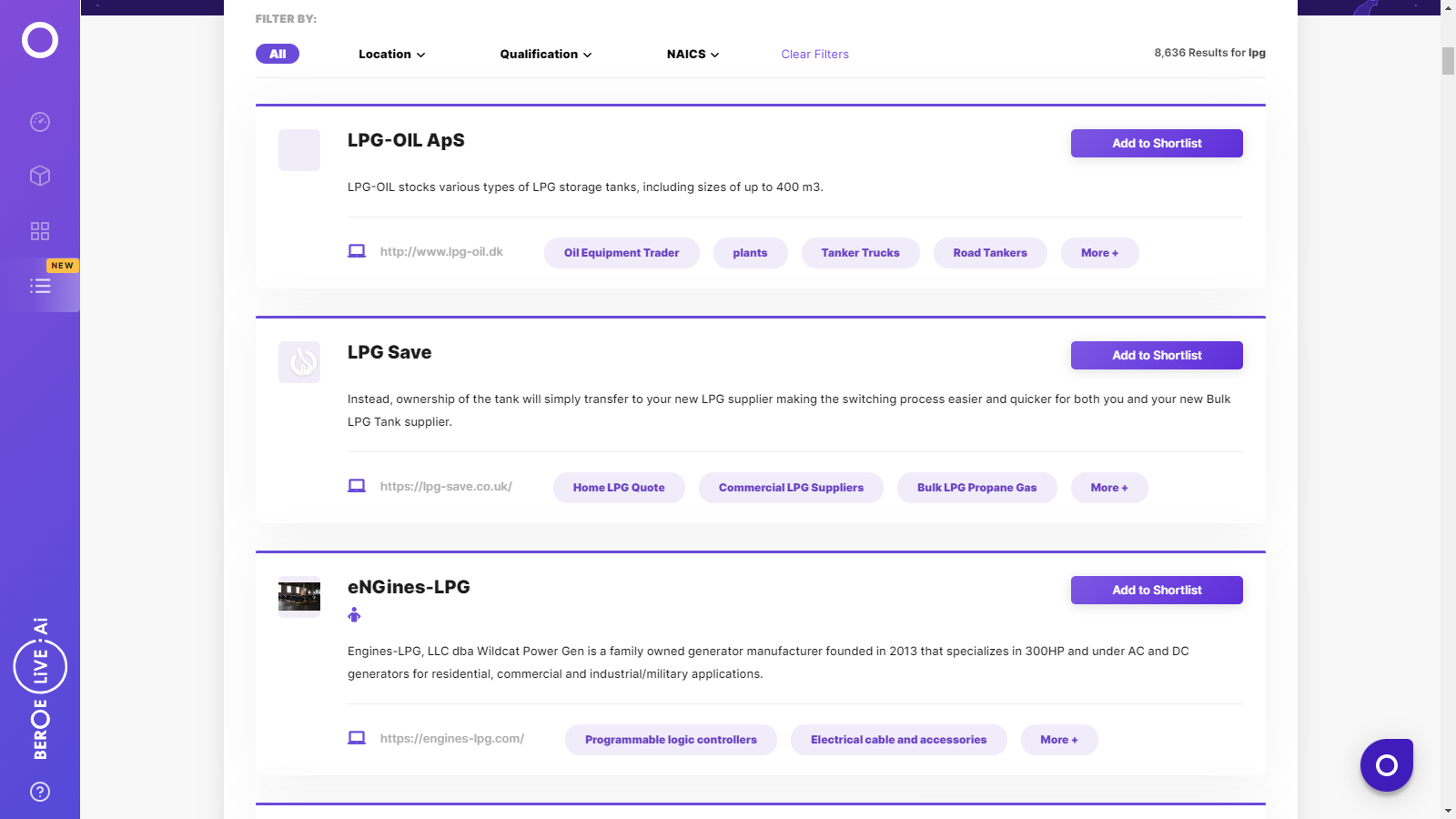

LPG Suppliers

Find the right-fit lpg supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the LPG market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLPG market report transcript

LPG Global Market Outlook

-

The global production of LPG is expected to increase by 1–3 percent in 2022, to reach around 334 million tons

-

The increase in demand for LPG’s substitute naphtha for the industrial sector application can keep the production growth rate to a minimum level

-

The restored commercial and transport activities after the lifting of lockdown impositions will help in the demand of LPG compared to previous year

Impact of COVID-19 on LPG Industry

-

The LPG category has recovered from a significant impact, as industrial demand has recovered. The expected winter demand, increasing gas usage for heating applications, also acts as a relief for the sector.

-

The oil & gas companies have faced problems, due to supply chain disruption, with travel impositions and reduced industrial output globally, due to the lockdown effect.

-

The demand for LPG has reduced in 2020 and partly in 2021, amid COVID-19 pandemic

-

The reduced demand is mainly due to the less industrial activities, amid COVID-19, due to the lockdown impositions that came in to force to restrict the spread of virus

Porter’s Five Forces Analysis on LPG Industry

Supplier Power

-

Supplier Base: The oil & gas industry has a considerable supplier base, ranging from private companies to state run national oil companies

-

The vertical integration of oil & gas companies is similar to that of its major competitors. This makes the bargaining power of supplier to be medium

Barriers to New Entrants

-

Capital-intensive Industry: The oil & gas industry requires huge capitals for building its infrastructure, which includes pipelines, machinery, drilling wells, acquiring land, etc.

-

Considering the cost of market entry, the barriers to new entry is high

Intensity of Rivalry

-

Consolidated market : The oil & gas sector is dominated by vertical integration companies that produce a number of low differentiated products, like LPG, petrol, etc.

-

The key competitors are also established well with significant client base. This coupled with threat of new entrants to be low, makes the intensity of rivalry to be high

Threat of Substitutes

-

Feedstock for petrochemical sector: Propane and naphtha are used to crack by petrochemical companies to produce Ethylene. The companies tend to lean towards naphtha, as it also produces other products, like propylene, benzene, etc.

-

When the propane-naphtha spread dips below -$60/ton, it is more economical for the industry to crack Propane, which makes threat of substitute to be medium

Buyer Power

-

Similar products: The products offered by the oil & gas companies are similar to that of those supplied by their competitors. This enables buyers to choose companies selling the products with lower prices or better terms

-

On a flip side, due to the presence of huge number of buyers, the supplier’s operations would not be impacted greatly if buyers opt for the competitor. Hence, it can be treated as medium

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now