CATEGORY

Liquefied Natural Gas

Across regions, the demand for natural gas increased across the commercial, industrial, and residential segments. The demand for LNG has increased globally, due to the increased demand for heating in winter. The ongoing conflict in Europe has put a strain on the supply of LNG.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Liquefied Natural Gas.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

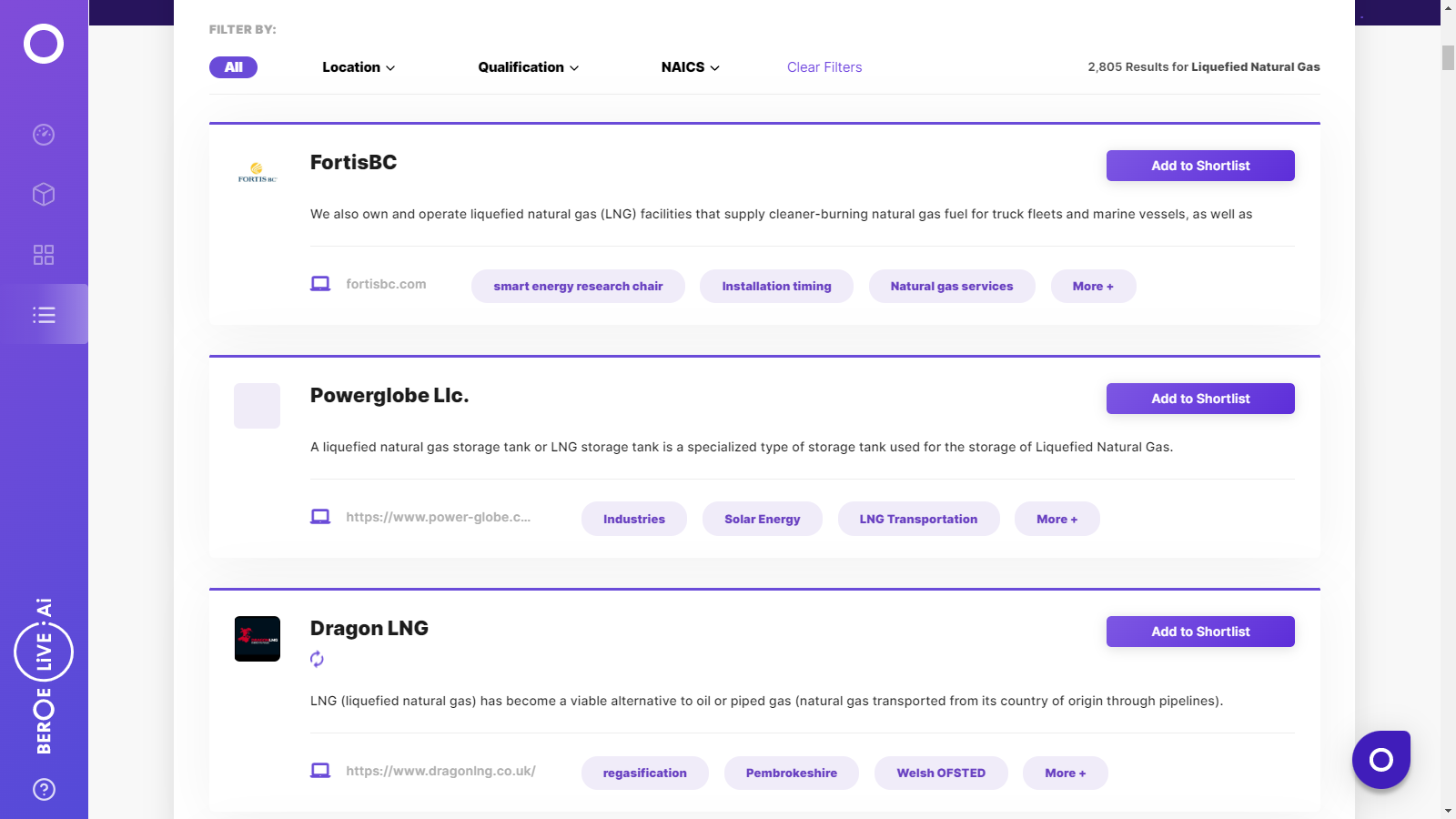

Liquefied Natural Gas Suppliers

Find the right-fit liquefied natural gas supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Liquefied Natural Gas market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLiquefied Natural Gas market report transcript

Liquefied Natural Gas Global Market Outlook

-

The global LNG market growth is expected to be driven by the increasing demand for natural gas in Europe looking to replace piped natural gas supply from Russia

-

The market for LNG is fragmented with large global players and high competition, the top five exporting countries supply about 74.34 percent of the total annual LNG supply globally

LNG Global Trade

-

The LNG trade is expected to increase drastically in 2023, as the conflict between Russia and Ukraine has resulted in Europe refusing to buy Russian natural gas. This has increased LNG shipments from the US, Qatar, and Australia to Europe

-

The US and Australia have increased their export by 34.3 BCM and 2.1 BCM capacity, driven by the demand from Europe and China, respectively

-

China, South Korea, Brazil, and Taiwan have increased their import capacity in 2021 by commissioning new terminals and expansions

-

In 2022, Asian LNG imports are expected to increase but the amount of growth could be impeded by the reduced demand from China

-

China imported majority of its LNG from Australia (43.6 BCM) and US (12.4 BCM) in 2021

Porter’s Five Forces Analysis on LNG

The LNG market is at the start of a strong expansion, where the supplier power is increasing, as the demand for LNG is growing significantly, supported by multiple factors, such as energy transition, LNG as transportation fuel (shipping and trucking)

Supplier Power

-

The supply market of LNG is fairly concentrated, however, the competition is fairly high, as the suppliers are large integrated players with the large export markets

-

The LNG market required significant capital investments for the upstream activities and liquefaction infrastructure

-

Due to the strong barriers to new entrants, existing supplier power is typically high

Barriers to New Entrants

-

The barriers for new participants are generally high in the market, as the LNG infrastructure requires significant upfront cost and expertise, which acts as a strong barriers to enter

-

The expansions of markets of LNG require reliable supply of natural gas and the customer base with long-term contracts to sustain the high operating costs

Intensity of Rivalry

-

The intensity of rivalry is medium in the LNG markets, as the large LNG players are well established in their markets

-

The suppliers have low pricing power, due to the inability to scale production to large scale in the short term

-

The clientele for LNG is growing, as the demand for LNG, hence, the large established players may begin to see rivalry as an effect of market expansion

Threat of Substitutes

-

Although the drop in oil prices, globally, there is a threat to natural gas as an alternative fuel, the policies in the country supporting clean fuel and the low price still gives an upper hand to natural gas

-

The Federal Decision to promote the use of renewable energy and co-generation pose a threat to natural gas

Buyer Power

-

Majority of the LNG buying contracts are typically in long-term contracts with guarantee buying clauses

-

With the market dynamics changing to short term and spot contracts, driven by the demand, the buyer power reduces

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now