CATEGORY

Lab Equipment and Supplies

Equment and supplies used in a R&D discovery and analysis lab.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Lab Equipment and Supplies.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

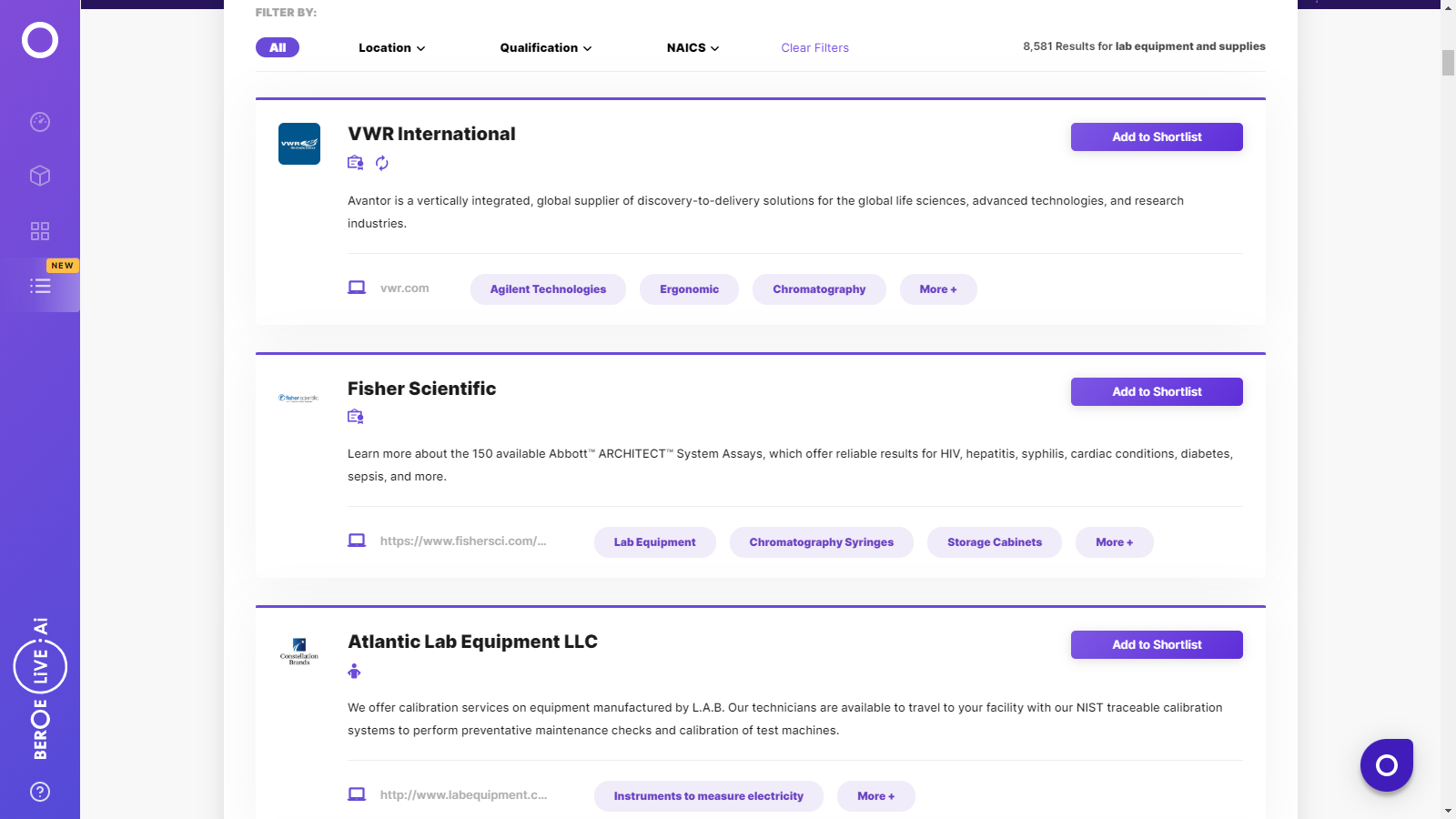

Lab Equipment and Supplies Suppliers

Find the right-fit lab equipment and supplies supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Lab Equipment and Supplies market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLab Equipment and Supplies market report transcript

Economic Stagnancy in Established Markets

- In 2016, the US and Europe contributed 48 percent and 32 percent respectively to the global lab supplies and equipment market

- Moderate speed of economic recovery of the US would continue to influence the lab supplies purchases by academic, research, and federal institutions

Economic Slowdown in Emerging Markets

- During 2011–2014, the lab products industry (consumables, chemicals, and equipment) performed well in India and China and witnessed yearly growth of around 12 percent and 9 percent respectively

- During 2015 - 16, the economic slowdown in China and India impacted the growth rate of lab consumables industry

End-user Segmentation

Suppliers view the pharmaceutical industry buyers as core accounts with whom they are willing to engage in a strategic partnership and offer better options for technology updates and equipment replacement

Buyer Segment Trends

- Pharmaceutical companies are the primary buyers of lab equipment and the suppliers are keen on meeting buyer's interest

- Pharmaceutical end-user often look up for new hybrid technologies, such as UHPLC, HILIC, SFC, LC-MS, LC-NMR, and LC-FTIR

- High growth potential of demand from CROs make them an attractive buyer for suppliers along with biotechnology and food and beverage industry

- Financial crisis and high acquisition cost decelerated the adoption rate of advanced technology and automation

Regional Demand

- In 2016, stronger dollar negated the growth of many regional markets. Suppliers have reported double digit negative effects on revenue post the currency conversion from European and LATAM markets

- In 2017, it is expected that stronger dollar would be a challenge for suppliers, as most of them are based out of the US

- Rebalancing of Indian and Chinese economy along with stabilizing the US economy would drive the growth in market

Technology Trends

Sustainability

- Energy efficiency, minimizing operating cost, increasing researchers' productivity and decreasing waste productions, would continue as focus points of lab equipment buyers in future

IP Protection

- Increasing popularity of cloud computing and mobiles in analytical and quality laboratories is demanding the organizations to redefine the information access protocols

Automation

- Lab equipment automation would be more focused towards enabling the continuous flow and decreasing the batching requirements during experiments

Focus on High Resolution

- Super resolution is the focus of imaging equipment future, which would be more living-cell-friendly and allow the researchers to image whole organisms through development

3-D Printing

- 3-D printers are expected to provide cost-effective ways to customize costly equipment in future

Integrated Systems

- Waters introduced ionkey/MS system. This device integrates the UPLC separation into the source of a mass spectrometer and delivered enhanced sensitivity, performance, and ease of use

Portability of Devices

- Suppliers are focusing on developing the portable equipment, which can work as a supplement to the primary lab equipment that makes things easier for field scientists. It is cost-effective, as all samples would not be required to send to labs

Increased Focus on Data Integrity

- Demand for efficient software for managing clinical workflow, in terms of regulatory compliance and data security, is increasing. Life science, healthcare industry contributed to the major share in the overall laboratory informatics (LIMS, CDS and others) market. TetraScience developed a data-integration platform that connects disparate types of lab equipment and software systems, in-house and outsourced drug developers and manufacturers. It then unites the data from all these sources in the cloud for speedy and more accurate research, cost savings, and other benefits

Related Categories:

Lab Equipment Maintenance Market Intelligence

Lab Equipment and Supplies -Trends, Pricing and Contract Analysis Market Intelligence

Freezer Lab Equipment Market Intelligence

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now