CATEGORY

Lab Equipment and Supplies -Trends, Pricing and Contract Analysis

Equment and supplies used in a R&D discovery and analysis lab.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Lab Equipment and Supplies -Trends, Pricing and Contract Analysis.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

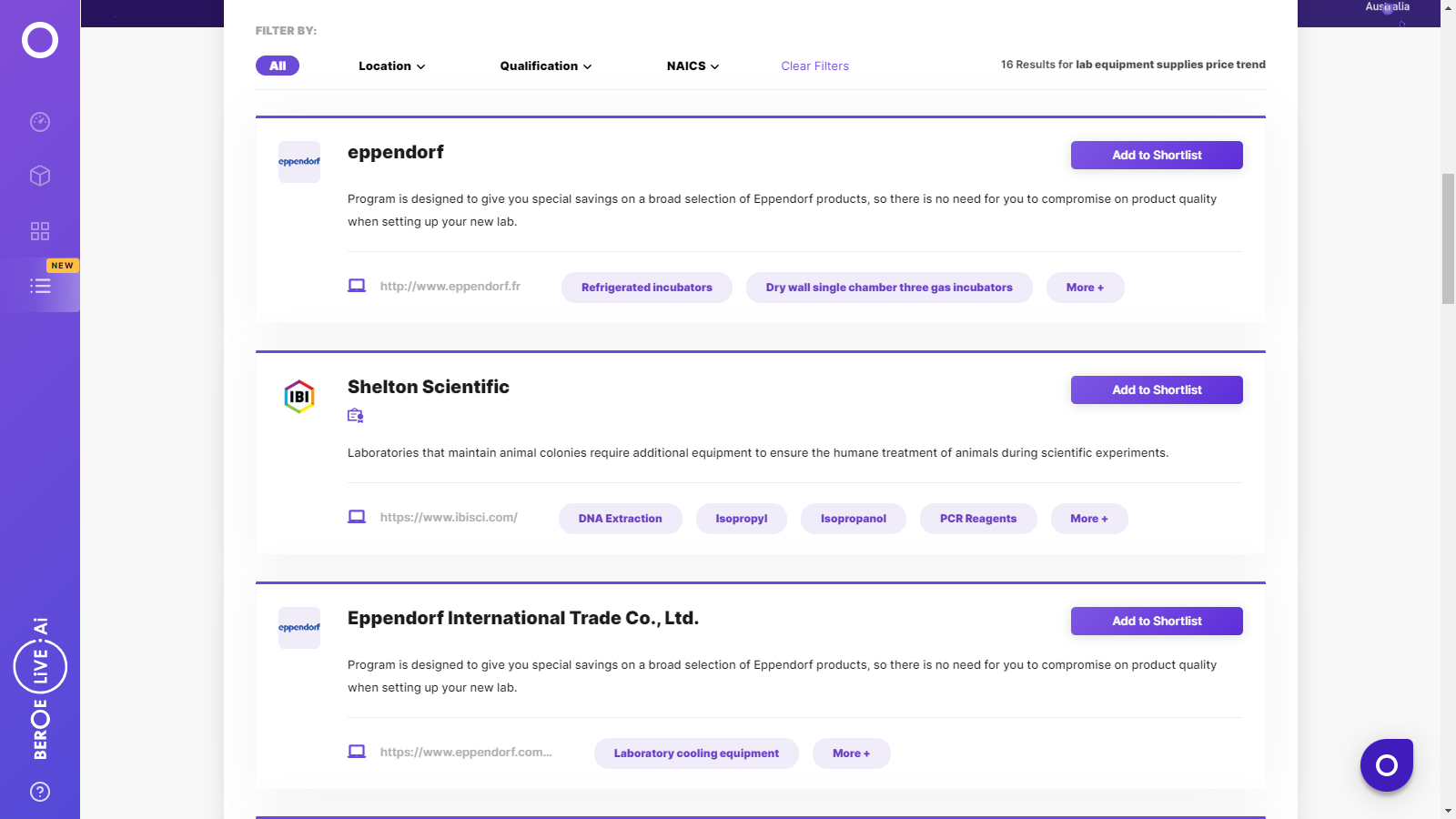

Lab Equipment and Supplies -Trends, Pricing and Contract Analysis Suppliers

Find the right-fit lab equipment and supplies -trends, pricing and contract analysis supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Lab Equipment and Supplies -Trends, Pricing and Contract Analysis market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLab Equipment and Supplies -Trends, Pricing and Contract Analysis market report transcript

Lab Equipment Supplies Market Trends

Healthy Demand Expected from Diverse End-User Segment

- With expected rebound in commodities markets especially oil and metal in 2018, the lab equipment market is expected to witness high demand from heavy industries

- Food Industry is expected to witness a healthy sales growth of around 5 percent in 2018 . Due to easy-to-use, efficient, and quick results, equipment based on rapid and multifunctional technologies are getting more popular among

- Life science industry, especially biopharma and CROs would be the lead buyer for lab equipment. The demand from the industry is expected to increase by around 6-7% in 2018

Increasing Demand for Aftermarket Services

- With acquisitions of Phenomenex, Bioo Scientific and Affymetrix by Danaher, PerkinElmer and Thermo Fisher Scientific respectively, the race to capture more market share in aftermarket segment is continuously increasing

- To take advantage of growing demand in consumables market, companies such as Thermo Fisher, continued to refine their solutions-based product development and marketing

- Vendors are tightly coupling their instrument and consumables segments. For example, Agilent's Intuvo GC and BD Biosciences' flow cytometers

Currency fluctuation would be a challenge

- Currency valuations will again be difficult to predict in 2018 because of political transitions in the US, South Asia and Europe. However, given a modestly improved economic growth outlook and proposed interest rate hikes in the US, coupled with anticipated quantitative easing measures in Europe and Japan, the dollar should continue to strengthen. This would help major lab equipment and consumables manufacturers as most of them are US based

Focus on Diagnostic Equipment

- The market is witnessing an increase in focus on point-of-care technologies and companion diagnostics

- POCT (Point-of-Care Testing) brings diagnostic testing closer to patients, which provides faster diagnosis and treatment. In addition, the centralized laboratory model used in POCT enables buyers to analyze multiple samples at a relatively lower cost. Hence, with the rising demand for POCT and associated diagnostics, it has driven the demand for lab consumables that are required for various tests.

Increased Focus on Data Integrity

- Demand for efficient software for managing clinical workflow in terms of regulatory compliance and data security, is increasing. Life science, healthcare industry contributed to the major share in the overall laboratory informatics (LIMS, CDS and others) market

- TetraScience has developed a data-integration platform that connects disparate types of lab equipment and software systems, in-house and at outsourced drug developers and manufacturers. It then unites the data from all these sources in the cloud for speedier and more accurate research, cost savings, and other benefits

Increased Focus on New Product Launches in NGS segment

- The boom in Next Generation Sequencing (NGS) has strongly impacted nucleic acid analysis and the life science industry as a whole and expected to grow at around 9 percent in 2018

- Illumina and QIAGEN are the biggest players in the sequencing and nucleic acid sample preparation arenas, respectively, while Thermo Fisher Scientific remains a strong contender in both

- Companies such as Perkin Elmer and Roche have launched more new products in consumables segment as compare to instrument segment. Bruker has rolled out new service offerings, and Miltenyi has launched a new line of antibodies

Cost Components-Lab Chemicals

The demand for good quality chemicals and lab wares have lead to vendors increasing their budget to cater to needs of the buyers. Automation in manufacturing and installing process improvement strategies would bring the cost of consumables down.

- Raw materials and utilities are the major contributors to the cost structure of any lab consumables followed by utilities. Thus procuring near-shore avoids issue related to logistics, saves time and cost.

- Disposable items usually add up to lesser operational costs and help in preventing manual errors. Also, enables buyers to save on sterilization costs and reduce the chances of cross-contamination of samples

Raw Material

The key raw material used for manufacturing lab consumables are high end derivatives of crude oil. It is expected that raw material prices would increase due to increasing crude oil prices

Utilities

Utilities comprises of electricity, water and others used for manufacturing and maintaining stocks of lab consumables

Wages

It includes the labor wages involved in manufacturing and selling the lab consumables. Growing wages in developing countries and requirement of marketing the product would increase the cost for manufacturers

Depreciation

It accounts for the annual depreciation of the capital machineries and equipment used in manufacturing of lab consumables

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now