CATEGORY

Early Phase Clinical Trials

First phase of a clinical trial where the focus is on safety.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Early Phase Clinical Trials.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Early Phase Clinical Trials Suppliers

Find the right-fit early phase clinical trials supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Early Phase Clinical Trials market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEarly Phase Clinical Trials market report transcript

Global Market Outlook on Early Phase Clinical Trials

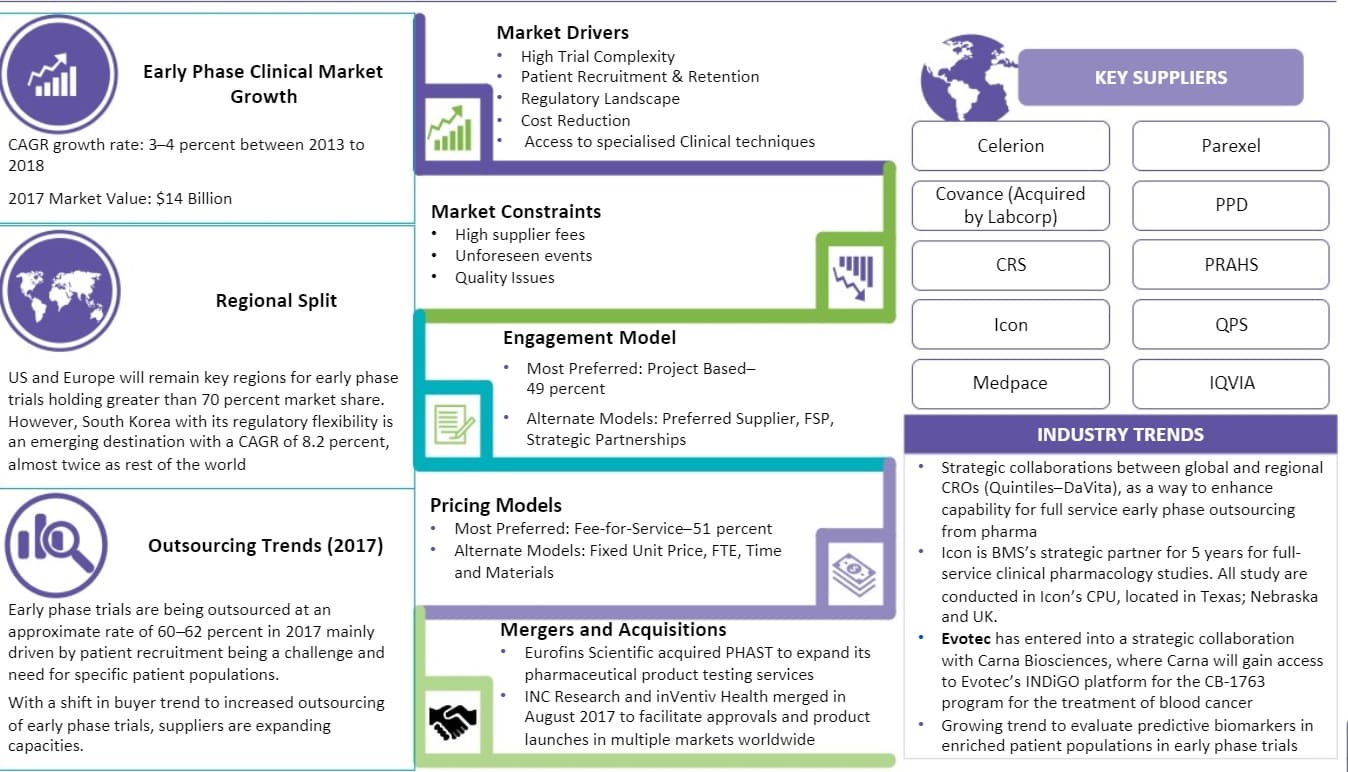

- The current phase I clinical trial market is valued at $14 billion and is expected to grow at a CAGR of 3–4 percent until 2018. The comparatively slow growth rate is a result of trials being conducted on a smaller population (20 -40) of volunteers, unlike late stage trials

- The FDA and other local regulatory bodies are providing further guidance and revisions for data and safe monitoring for early phase trials as a result of trial failures. The average per study cost for a Phase I trial is valued at $4 million with clinical procedure costs being the highest at $476,000 which contributes to 22.2 percent of the overall trial cost as of 2015

- South Korea is found to be the most attractive early phase destination based on the availability of global and regional suppliers, patient pool and regulatory scenario of the country

US and Europe will remain key regions for early phase trials holding greater than 70 percent market share. However, South Korea with its regulatory flexibility is an emerging destination with a CAGR of 8.2 percent, almost twice as rest of the world

Early PhaseCRO Market and Spend by Therapeutic Area

- The outsourced phase I market is estimated at $8 Billion and is growing at a CAGR of 3-4 percent. This market is comprised by CROs, Research Centers, Academic Institutes etc

- From the entire outsourced Phase I spend of $8 billion, pharma spends approximately $5.5billion with CROs for carrying out their early phase studies while the rest is carried out in-house or in collaboration with academic institutions

- The FDA and other local regulatory bodies are providing further guidance and revisions for data and safe monitoring for early phase trials, i.e. phase I trial, as a result of trial failures. The average per study cost for a phase I trial is valued at $4 million with clinical procedure costs being the highest at $476,000 which contributes to 22.2 percent of the overall trial cost

Growth Drivers and Constraints

Drivers

High Trial Complexity:

- Early phase trials has the highest protocol complexity (14 percent) and a high work burden of 9.5 percent, since it involves healthy volunteers and patients. In-house facilities needs to have sufficient beds, equipment's and access to patient to carry out these trials.

Patient Recruitment & Regulations

- Country-specific regulations and access to patient populations can be managed efficiently by suppliers as they have local presence and have dedicated patient database

Cost reduction

- Due to loss of patents for many drugs in the upcoming years and increase in R&D spend, pharma are looking to reduce costs. Reduction in fixed costs over the long run of the Phase I Unit can be obtained through outsourcing

Constraints

High Supplier Fees

- High short-term R&D costs due to high supplier fees can be a problem over a short-term period; however, can result in savings over the long term.

Unforeseen Events

- Provisions for unforeseen events (early termination of a project) could cause a sudden pause in trials creating a major delay in trial conduct.

Quality Issues

- If a supplier with the right operational capability is not selected, they will be unable to deliver; resulting in increased need for pharma to oversee supplier operations

Complexity of early phase trials, involving both patient and healthy volunteers studies, is the main driver of outsourcing. Though cost reduction is seen over the longer term, high supplier fees initially and quality issues is still a challenge.

Market Trends

Changing regulatory scenario, CRO dynamics, risk sharing models, technologies are the key areas impacting early phase trial conduct. Buyers have to ensure suppliers have regional regulatory expertise, therapeutic, operational capability and innovative technologies to handle the complex trials. Upon assurance, a full-service strategic partnership could be formed.

- Large CROs were seen cutting down on their in-house facilities (e.g.: Parexel, INC Research, IQVIA) due to a slip in early development revenues in 2012. As a result of increased need for specialized population, Phase I CRO businesses saw an upturn (e.g. PPD’s new 24 bed unit in Las Vegas) to expand early development service offering

- They open up or acquire specialized Phase I units based on therapeutic areas to match up the competency of these niche players and drive revenues

- Regulations are revised frequently. These revisions are result of either a trial failure adding more stringency or relaxation to improve recruitment rates.

- Contribution of trials from Russia, South Korea etc., will increase in the future due to competitive price and patient availability. This has caused suppliers to expand in these regions

- A new rule states that clinical trials which test drugs for Indian market must include Indian subjects in their trial . This will affect the recruitment procedures by CROs for drug trials that are intended for the Indian market.

- Adaptive trials leads to increased flexibility of clinical trials enabling parameters such as sample size, patient population, dosing to be adjusted as the trial progresses.

- Early terminations of clinical trials futility or sample size estimation could help in saving a sponsor between $100-200 million on the aggregate costs

- Outsourcing on a full-service basis based on therapeutic area and functions, by having a risk sharing model between CRO–Pharma is emerging at an adoption rate of 15 percent

- The clinical research market has a growing trend to evaluate predictive biomarkers in enriched patient populations in early phase trials (Phase I–IIa)

- Rapid evaluation of drugs, validate multiple predictive biomarkers, minimized exposure of patients to ineffective therapies, accelerated drug approval in molecularly defined populations (E.g. Personalized Medicine)

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now