CATEGORY

Clinical Trial Supply (CTS)

Shipment of materials for clinical trial studies.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Clinical Trial Supply (CTS).

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Clinical Trial Supply (CTS) Suppliers

Find the right-fit clinical trial supply (cts) supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Clinical Trial Supply (CTS) market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoClinical Trial Supply (CTS) market frequently asked questions

According to Beroe's report, the clinical trial supply market will be driven by the following factors: Growth in biologics pipeline Growth of clinical trials footprint in the emerging markets (Brazil, China, Russia, India, South Korea) Increase in adoption of comparator studies

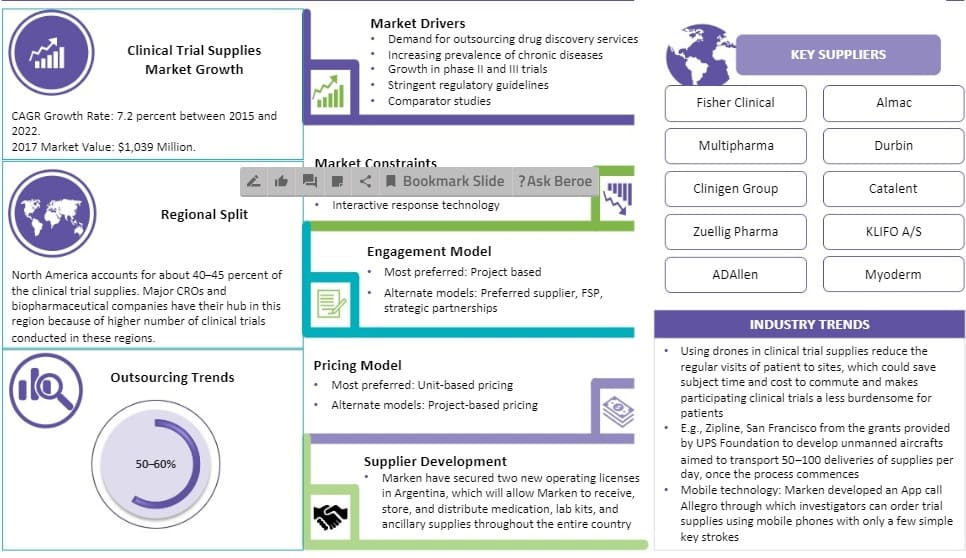

As per Beroe's analysis, the global market for clinical trial supplies is expected to grow at a CAGR of 7.2 percent and reach a valuation of $1.2 billion by 2020 escalating from $904.3 million in 2015.

As per reports, North America accounts for nearly 40 ' 45 percent shares of the total CTS market.

Major CROs, biopharmaceutical companies, and clinical research organizations prefer having their hubs in North America because a high number of clinical trials are performed in these regions.

According to the insights of Beroe's report, the main suppliers of the CTS market are: Fisher Clinical Almac Multipharma Durbin Clinigen Group Catalent KLIFO A/S Zuellig Pharma ADAllen Myoderm

The most preferred engagement model in the CTS market offering are alternatives like ' preferred supplier, FSP, and strategic partnerships. Similarly, w.r.t pricing, the most preferred model is the unit-based pricing model offering an alternative to ' project-based pricing.

Following the insights from Beroe's report, the pharma sector can seamlessly run clinical trials by leveraging an import broker to overcome regional difficulties like compliance with import/export regulations for shipments of CTS.

EMA developed a new European One Health Action Plan against AMR to cater to initiatives like: Making the E.U. the best practice region when it comes to fighting Antimicrobial Resistance (AMR) growth Boosting research, development, and innovation Shaping the global agenda by making the E.U. more influential on AMR internationally

As per Beroe, the globalization of clinical trials is encouraging pharma companies to conduct phase III clinical trials across different and fast-growing geographies namely, Eastern Europe, China, Korea, and Taiwan which is contributing to an increase in planning and sourcing ancillary materials.

Clinical Trial Supply (CTS) market report transcript

Global Clinical Trial Supply Market Outlook

- Clinical trial management systems (CTMS) are significantly important in the pharma R&D sector. Clinical research organizations (CRO) are involved in carrying out trials of new drugs in the market. A CRO is a Clinical Services company that offers trial management services to pharma companies. Outsourcing is beneficial for pharma companies that can organize Large Scale Clinical trials.

- A site management organization (SMO) helps CROs or pharma companies in conducting Phase II-III trials. These companies need supplies to effectively carry out clinical trials. This clinical trial supply market report can help them understand the market effectively. This would help them plan and manage clinical trial activities in an effective way.

- The global clinical trial support services market is expected to grow at a CAGR of 7.2% during 2015-2022. This will be driven by the growth in the biologics pipeline, growth of clinical trial footprint in the emerging markets (Brazil, China, India, Russia, South Korea), and increase in adoption of comparator studies.

- The global clinical support services market was estimated at $14.84 Bn in 2016 and is expected to be valued at $21.5 Bn in 2021.

- The market was estimated to reach $1.2 Bn by 2020 from $904.3 Mn in 2015. By 2025, it is estimated that the clinical trial supplies market would reach $2.5 Bn.

- The clinical trial supplies market is driven by the growth in pharma R&D expenditure in pharmaceutical and biopharmaceutical companies. The clinical trial supplies market has become globalized because of better regulations.

- North America accounts for about 40–45% of the clinical trial supplies. Major CROs and biopharmaceutical companies have their hub in this region because of a higher number of large-scale pharma R&D clinical trials conducted in these regions.

- Moreover, given the presence of tech giants, usage of clinical IT services (eClinical) and eCROs is gradually increasing to provide electronic patient-reported outcomes (ePRO). Clinical trial management systems (CTMS) in the developed region provide the data using electronic data capture (EDC) software.

- The clinical trial supply market has different segments like logistics, packaging, labeling, manufacturing, and solutions. Of these different segments, the logistics segment would dominate the market. The globalization of clinical trials and the requirement for temperature-sensitive shipping of products has resulted in a greater requirement for logistics in clinical supply.

- Clinical trials are carried out in different phases. Phase III trials are expected to grow at the highest rate. Since this phase of the trial takes the most time and involves the most expenses, the need for supplies is the highest here.

Clinical Trial Supplies Market Trends

- Clinical trials are studies to test a drug or a medical intervention on people as a part of drug or treatment development. This is the main means of finding out if the new development is safe and effective by testing it on actual people. It is also used to determine if there are side effects from any of the treatments.

- These clinical trials are usually performed by outsourcing to CRO. Clinical trials usually start with Phase I trials on a small group to determine the safety and required dosage. This is usually in-house or tested locally.

- The Phase II- III trials are usually large scale clinical trials. Phase II is usually to test the effectiveness, safety, and side effects. Phase II uses 100-300 participants. Phase III is on a larger scale up to around 3000 participants and tests the drug on different populations, with other drug combinations in addition to safety and efficacy. Phase III also takes a longer period of time to study the drug.

- Phase IV of clinical trials is a period after the approval of the treatment when it continues to be monitored for long-term side effects and other safety issues.

- The clinical trial supplies industry is growing internationally and clinical trials are increasingly being performed across country borders as the safety laws that govern them are becoming more homogenous worldwide. They are managed by SMOs. Trials are monitored by independent safety monitors (ISM).

- Adopting direct-from-patient (DFP)/ direct-to-patient (DTP) services can eliminate COVID-19-induced challenges such as travel bans, quarantines, site shutdowns, and protecting patients and staff.

- Such services keep clinical trials in action and patients safe by making diagnostic tests and treatment kits shipped straight to them at their homes. Through these services, healthcare professionals can collect biological samples from patients’ homes and send them to laboratories for testing.

Drivers and Constraints

Drivers

- Stringent Regulatory Environment: The US Food and Drug Administration (FDA) and other regulatory authorities have become stringent in terms of quality of good clinical research practice (GCP), storage, packaging and labeling, distribution, and recall of ancillary products. Companies now source ancillary products at different levels such as central sourcing and regional sourcing.

- Globalization of Clinical Trials: Due to the globalization of clinical trials, pharma companies are conducting clinical trials, especially phase III clinical trials, in distinct geographies including the fast-growing Eastern Europe, China, Korea, and Taiwan. This has led to an increase in planning and sourcing ancillary materials.

- R&D Investments: Increase in R&D investments and government support increased the scope to conduct more research.

- North America has well-established CROs. The increasing investments in R&D by pharmaceutical and biopharmaceutical companies are the major factors responsible for North America’s share in the clinical trial supplies industry.

- The Asia Pacific clinical trial supply management market has a larger patient population. The rules and regulations that govern patient recruitment are less strict and this is driving the upward clinical trial supplies market trends.

- The clinical trial supply market has seen rapid growth due to the COVID-19 situation. The demand for a vaccine for the coronavirus has seen a spurt in clinical trials across the world. Millions of people across the world need to be vaccinated, prior to which trials have to be completed. The clinical trial supply trends have seen a boost due to this situation.

- Clinical trials are being carried out not just for vaccines but even for medicines to treat COVID-19 and associated symptoms. This is going to be a major driver for the clinical trial market.

Constrains

- High Waste and Overage: Clinical trials are experiencing a very high level, approximately 150–200 percent of clinical supply waste leads to unwanted cost escalation and high inventory. This impacts the use of internal resources within pharma and biotech companies.

- Interactive Response Technology: Regulatory environment in many countries is very dynamic for some time and change comes very fast. This, along with a high initial cost for installing IRT, proves to be an obstacle in the path of integrating Clinical Ancillaries with Interactive Response Technology (IRT), and most of the work is done on a manual basis using excel sheets.

- North America has well-established CROs. The increasing investments in R&D by pharmaceutical and biopharmaceutical companies are the major factors responsible for North America’s share in the clinical trial supplies industry.

- The Asia Pacific CTS market has a larger patient population. The rules and regulations that govern patient recruitment are less strict and this is driving the upward clinical trial supplies market trends.

Regulatory Trends

Continuous change in regulations and regional governing bodies will affect the importing of clinical trial supplies. Utilizing an import broker to overcome regional difficulties like compliance with import/export regulations for shipments of clinical trial supplies will benefit pharma in the smooth running of clinical trials.

BREXIT

With the lack of regulatory clarity between the UK and the rest of EU, it is inevitable for pharma to plan and execute long-term clinical strategies till the European Medicines Agency (EMA) re-establishes its base.

EMA has developed A European One Health Action Plan against AMR which contains initiatives like:

- Making the EU the best practice region in terms of fighting Antimicrobial Resistance (AMR) growth

- Boosting research, development, and innovation

- Shaping the global agenda by making the EU more influential on AMR internationally

Regulation 536/2014 (CTR)

Clinical Trial Regulation (Regulation 536/2014, CTR), which can provide a centralized database and entry point for information related to EU clinical trial data submissions was not available before 2019 due to delay in establishing the IT infrastructure because of no clarity in EMA shift from the UK.

Clinical trial authorization for investigator-initiated studies

Additional Clinical Trial Authorization (CTA) should be submitted for Investigator-Initiated Clinical Studies (IIS) - Investigational Medicinal Product Dossier (IMPD) information, Summary of Product Characteristics (SPC) for marketed drugs and if non-authorized products are used, Cross-reference-letter by the manufacturer referencing to an existing IMPD available from the Health Authorities should be submitted.

Competitive Landscape

Strategic partnership with features such as price benchmarking, spend consolidation, and demand forecasting will bring the buyer and supplier in the clinical trial supply market to equilibrium in the next 2-3 years.

The core providers of clinical trial drug supplies including Fisher, Marken, Parexel, and Catalent deliver the most comprehensive range of services dedicated to the pharmaceutical industry.

The information on clinical trial procurement shows that the majority of clinical trial supply services are outsourced. Secondary packaging, shipping, and distribution account for a larger portion of the outsourced services.

The comparator sourcing for clinical trials has a market share as follows: Myoderm + Clinigen + Fisher Clinical - 35% and Others - 65%.

Most suppliers of comparator trial drugs are relatively small and tend to be nationally focused or part of larger organizations (usually wholesalers). The margin charged by the suppliers can vary based on the complexity of the supply chain. Supply market consolidation can increase the market share of top suppliers.

The key players in the clinical trial supply market are Thermo Fisher Scientific Inc., Sharp Packaging Services, Biocair, O&M Movianto, Parexel International Corporation, Almac Group, and KLIFO A/S.

Why You Should Buy This Report

The clinical trial supplies market report provides you with the CTS market overview, drivers and constraints, regulatory and technological trends. It offers Porter’s five forces analysis of the global clinical trial supplies market. The clinical trial procurement and supply report gives information about comparator sourcing for clinical trials, CTS supplier analysis, supplier profiling, etc. It gives an insight into the clinical trial services market (digitization, logistics, etc.)

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now