CATEGORY

Cell Therapies

Cell therapies is a fast growing biologic drug category where cellular material is used in the treatment process

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cell Therapies.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Cell Therapies Suppliers

Find the right-fit cell therapies supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Cell Therapies market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCell Therapies market report transcript

Cell Therapies Supplier Market Overview

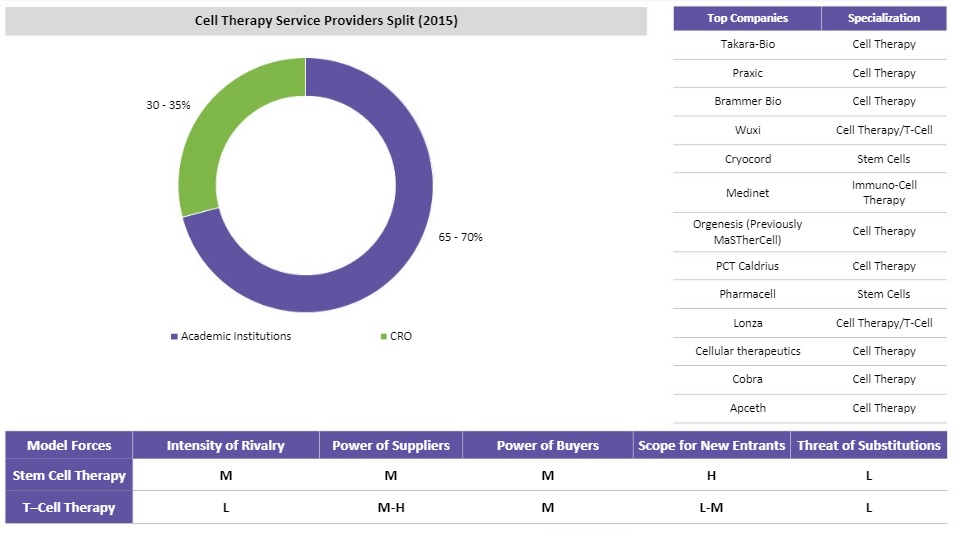

- The supplier market is fragmented and developing. Academic institutions are the major supply base for this market due to the access to skilled labor and government funded research programs.

- 70 percent of the clinical trials were sponsored by the academic institutions (with public funds) and 30 percent by CROs for cell therapy in 2015

- The US and Canada are the leading markets for cell therapy and most of the suppliers, CROs, as well as academia are populated in this region. Europe is the second leading market with several universities focusing on cell therapy

- Academia will continue to be the key supply base due to the complexity of trials, safety concerns and the relatively lower business risk inclination of CROs for cell therapy trials

- Preliminary results in Phase I and II of such trials, which have minor benefits in extensive Phase III research (due to population heterogeneity), and limited evidence of efficacy of these trials makes it a technically challenging service line

Technology Overview

Supply Chain Concerns

- For individual supply chains, the number of suppliers available are few

- To mitigate risk, companies prefer manufacturing these materials in-house at this stage

Open Innovation in Stem Cells

The industry is practicing open innovation in this category

- Stem cells are available for development, to researchers, by Luna, California Institute for Regenerative Medicine and the European Biobank

- Such banks are estimated to save up to six months and $50,000–100,000 per patient

- Cellsartis AB has been asked to share its cell lines

- Lonza has publicly released documents regarding its GMP approved stem cell manufacturing technology encouraging further innovation

Cell Therapies-Market Trends

Drivers

- T-cell research conducted by non-pharmaceutical organizations is more advanced than pharmaceutical organizations

- As T-ell therapies are receiving priority reviews, outsourcing research activities to organizations focusing on different types of T-cell therapies can provide market advantages

- Open innovation in the stem cells industry is encouraging research in development of therapies and manufacturing practices

- This is a result of allowing public use of private cell banks and advanced manufacturing practices

- As standardized manufacturing techniques are developed, the market is expected to expand

Constraints

- Stem cells can differentiate into more than 200 lines

- As manufacturing practices for stable cell lines have not been established, outsourcing manufacturing capabilities is a concern

- For autologous cell therapies, which are the most common therapies, involves cells from individual patients; the concept of commercial batch manufacturing is difficult to establish

- This will also involve location constraints

- Existing centrifugal and filtration techniques are not feasible to harvest and recover live cells

- The supply chains established by non-pharmaceutical organizations have high levels of risk

- As a lot of small suppliers own the IP for various technologies contributing to the supply chain, organizations are forced to rely heavily on these suppliers for their internal processes leaving their supply chains vulnerable to risk

Cell Therapy Market Overview

- Due to the lack of many upstream suppliers, the supply chain risk is much higher for T-cells.

- The spend for stem cells is higher owing to the higher maturity of the stem cell therapy market.

- The stem cell therapy market is more mature and attracts a higher investment value from pharmaceutical companies and research institutes.

- T-cells is expected to move to a similar position in the next few years.

- In the T-cells category, the number of suppliers and customers are low due to low maturity and research progress.

- For T-cells, it is difficult to implement a supplier relationship due to the intricate supply chain balance in the previous tiers.

- The stem cell therapy market has reached an advanced stage with increased commercialization prospects.

- To establish low risk, a stable supply chain, long term strategic relationships can be used.

- The intensity of rivalry is medium among pharmaceutical companies as this is a high risk segment and few companies are investing directly (or) indirectly in stem cell technologies.

- The technology has still not achieved maturity.

- However, multiple CROs are still conducting research in the stem cell therapy market.

- As the technology is maturing, more pharmaceutical companies are investing in this technology.

- As the technology matures and regulations are standardized, it becomes easier for suppliers to enter the industry.

- Substitutes for regenerative medicine is low.

- Major biopharmaceutical companies are expressing increasing interest in advanced therapies, generally through collaboration and co-development type agreements.

- Pharmaceutical companies are key stakeholders in both directly developing, acquiring, and sponsoring and supporting smaller biotech companies.

Why You Should Buy This Report

- Information about cell therapy market size, technology and supplier overview, cell therapy market analysis, market trends, drivers and constraints, etc.

- Porter’s five force analysis of the stem cell therapy market and T-cell therapy market.

- Supplier profiling, analysis and best industry practices.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now