CATEGORY

Patient Recruitment

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Patient Recruitment.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoPatient Recruitment Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Patient Recruitment category is 8.17%

Payment Terms

(in days)

The industry average payment terms in Patient Recruitment category for the current quarter is 68.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

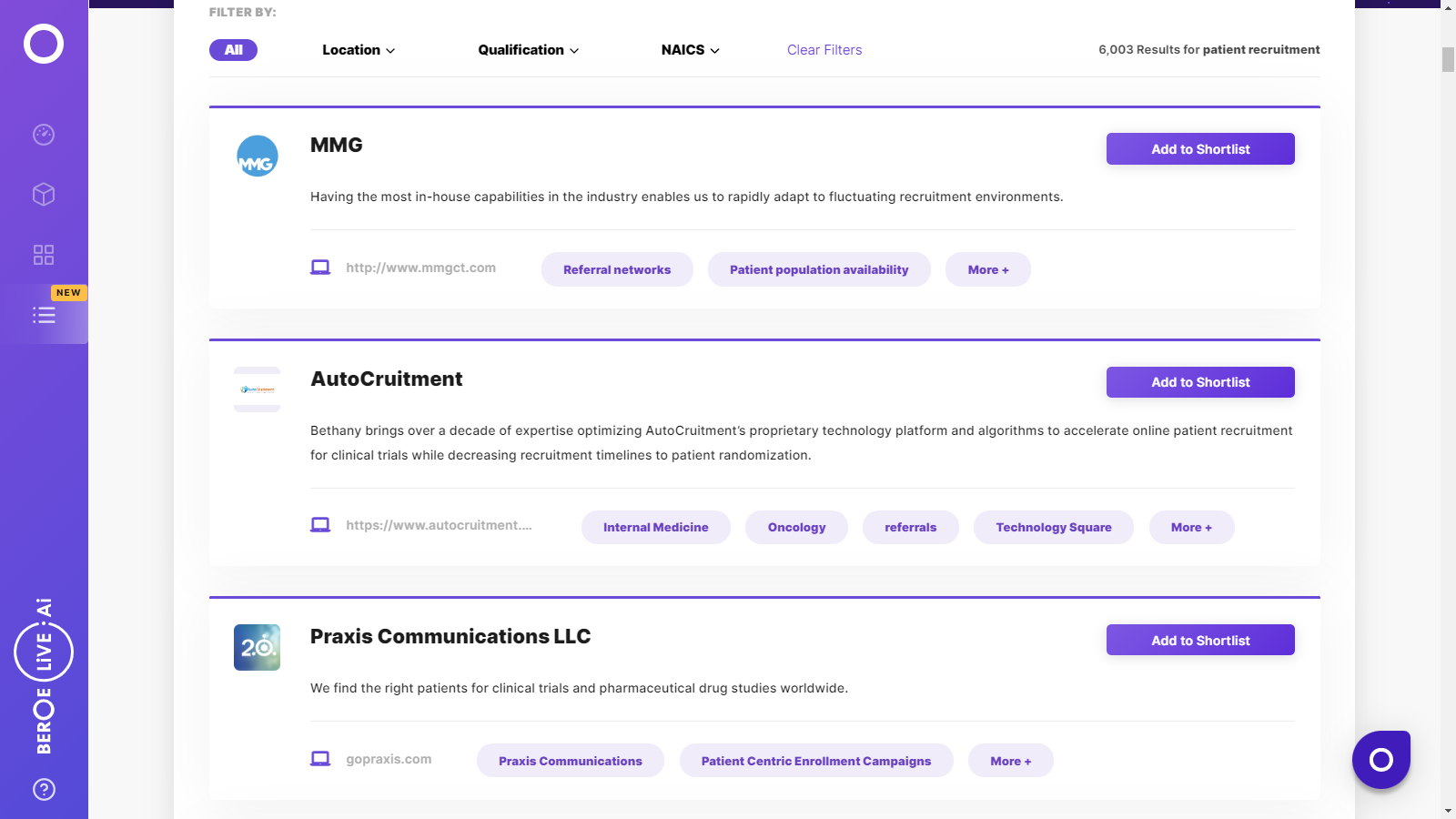

Patient Recruitment Suppliers

Find the right-fit patient recruitment supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Patient Recruitment market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPatient Recruitment market report transcript

Patient Recruitment Global Market Outlook

-

The global demand is expected to be $8.2–8.6 Billion in 2021 and will grow at approx. 12—15 percent CAGR through 2020–2026

-

Focus on biologics, personalized medicine, and increasing complexity, in terms of protocol, study procedures, trial design, and globalization of clinical trials demanding regional regulatory compliance are the major factors driving the market

-

Availability of a large patient pool, coupled with cost-saving opportunity, due to reduced labor wage, is shifting the focus to the emerging nations

-

Large CROs have been continuously expanding their supply base through acquisitions and partnerships to provide integrated services

-

Of the site investigators, 52 percent expect a change in site models that is more inclusive of pharmacies and local or pop-up clinics

Impact of COVID-19 on Patient Recruitment Industry

-

Implementation of patient-centric approaches and decentralized trials increased, owing to pandemic necessitating use of new technologies for trial success.

-

Diversity in clinical trials surfaced, owing to vaccine trials and now has become integral part of patient recruitment processes

-

Use of technologies, like eConsent/eCOA, ePRO, mobile devices, wearables, insertables, telemedicine has increased to enable DCT trials.

-

CROs are converting approx. 60 percent of their visits to remote monitoring

-

Approaches, like online recruitment, home nursing, and direct-to patient trial supply have been adopted to ensure patient safety and trial continuity

-

75 percent of the organizations are in some stage of implementing virtual trials

Procurement Centric Five Forces Analysis on Patient Recruitment Industry

Suppliers–Established and emerging currently view large pharma as a key account. The attractiveness of a pharma client is high, as they bring in high purchase orders, good payment terms, and greater brand visibility. This acts as an enabler to move the accounts into a supplier's core business area.

Supplier Power

-

Along with CROs and PROs suppliers in this industry comprises of hospitals and physicians, patient advocacy groups and focus groups, who directly communicate to the patients about the clinical trials. Patients are increasingly dependent on these means to enroll in clinical trials

-

Focus on rare disease and precision medicine have created more challenges to recruit patients and hence, digital players with access to wide patient data are gaining traction compared to traditional suppliers, thus keeping overall supplier power medium

Barriers to New Entrants

-

Increased regulatory demand, varying regional regulatory compliance, as well as the cost associated with advertisement campaigns, database management, site management, clinical procedure and central lab make it more difficult for suppliers to pose competition to large suppliers

-

Advancement in AI and ML techniques has paved the way for new era of digital suppliers

Intensity of Rivalry

-

The patient recruitment market is a highly fragmented market with CROs, PROs and niche players trying to gain market share

-

As the industry is trying to move towards digital trial recruitment, suppliers are trying to acquire tech oriented niche players to expand their capabilities in the digital field

Threat of Substitutes

-

With the increase in adoption of Real world Evidence data, demand for supplier with access to advanced technology and access to patient data is increasing. Hence, suppliers focusing on newer tactics are emerging and posing competition to traditional players

-

With the increase in PoCs, wearables and direct-to-patient initiatives, including patient communities voluntary trial selection by patients might be feasible

-

This will cause instability among the suppliers in the market

Buyer Power

-

There is intense competition among sponsors to recruit appropriate quality patients on time

-

The supplier market is fragmented with multiple suppliers, who cater to several big pharmaceutical companies and provide a range of services associated with patient recruitment and retention

-

Pharma companies have a greater choice and ability to switch between suppliers, however, the intense demand for patients keeps the power moderate to high especially in rare therapeutic areas and oncology

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now