CATEGORY

Lab Animals

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Lab Animals.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoLab Animals Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Lab Animals category is 8.17%

Payment Terms

(in days)

The industry average payment terms in Lab Animals category for the current quarter is 68.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

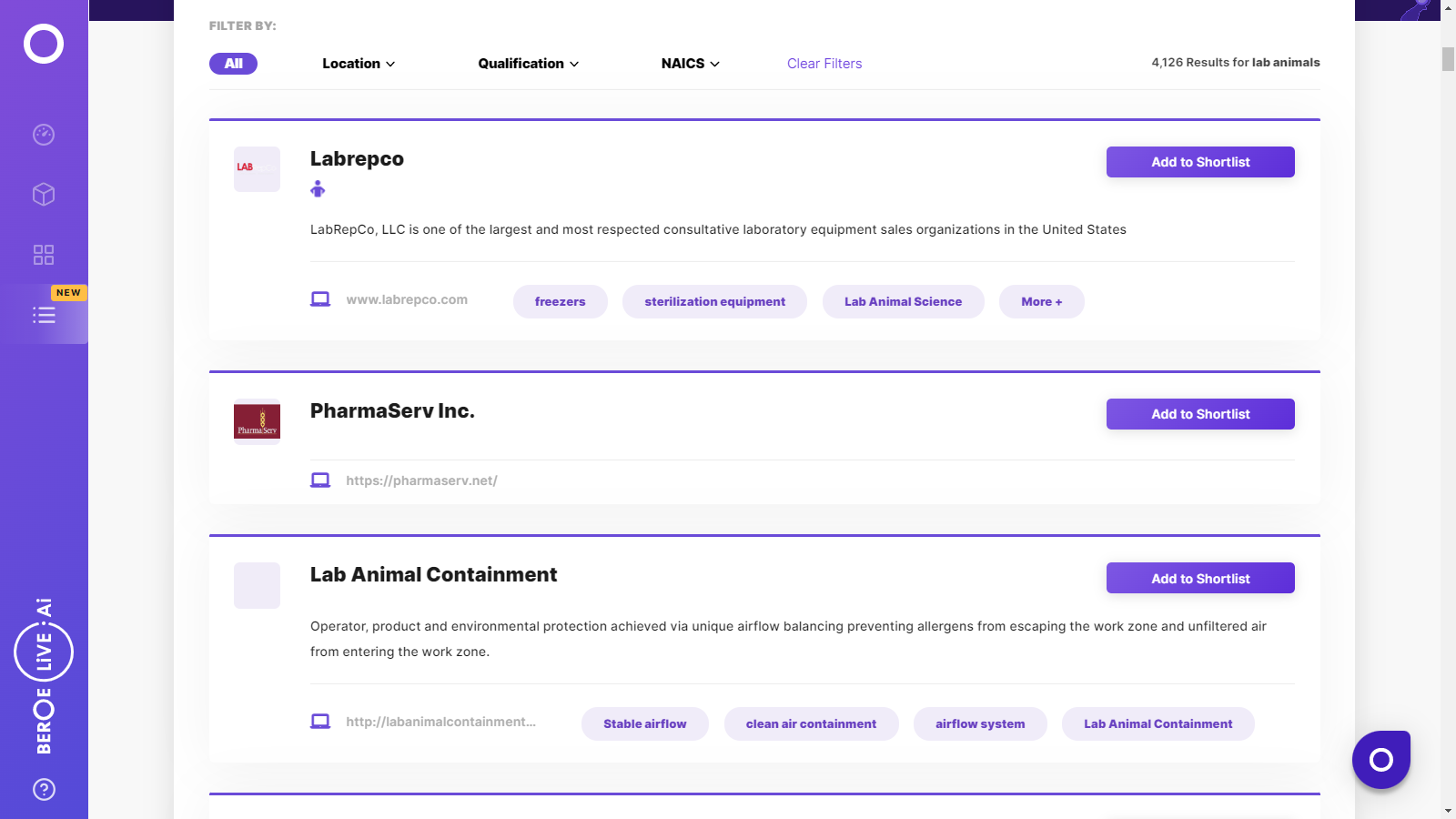

Lab Animals Suppliers

Find the right-fit lab animals supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Lab Animals market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLab Animals market report transcript

Lab Animals Global Market Outlook

-

There is an Increase in demand for effective animal model to validate efficacy and non toxicity of drugs and vaccines in the pipeline

-

Large pharmaceuticals are outsourcing the service to two or three suppliers and using niche players wherever necessary based on their study requirements

-

The focus is on 3R (Replace, Reduce, Refine) principle and pushing towards novel technology therapeutic models, and alternatives to non-animal models

Impact of COVID-19 on Lab Animals Industry

-

The COVID-19 pandemic has created an unprecedented global public health challenge. It has also expressed a favorable influence on the animal model market for vaccine and antiviral medication research and development. Since early 2021, post pandemic recovery is highly prevalent in the animal market and is likely to provide CROs with additional prospects.

-

Modified Mouse Models: COVID-19 rodent models, particularly humanised ACE2 (hACE2) mice, which express humanised ACE2 in the airway and other epithelia and develop a deadly SARS-CoV infection, are in high demand. This model is currently used for vaccine toxicity and efficacy evaluation and also to tests drugs to combat the pandemic

-

Increased Funding and Investment: Many governments and scientific research institutions are likely to expand research funding for vaccines and therapies for contagious diseases, like COVID-19

-

Demand of Suppliers: Demand of cell therapy and immuno-oncology screening Models have increased in the APAC region, due to expanding R&D facilities in the low cost regions

Procurement-Centric Five Forces Analysis on Lab Animals Industry

The lab animals market is a highly fragmented supply chain, giving sponsors high bargaining power. Service providers, on the other hand, provide services and collaborative work environment to stand out.

Supplier Power

-

The number of raw material suppliers and their product quality have significantly been increasing

-

With the increase in outsourcing penetration rates by big pharmaceutical players, supplier power would increase from the currently low-to-medium level in the next few years

-

Suppliers tend to have moderate product differentiation and distribution channels

Barriers to New Entrants

-

The entry barrier would remain high, due to high economics of scale, investment cost, and stringent government regulatory mandate and legal barriers

Intensity of Rivalry

-

Industrial competition is expected to further increase, with new players and improved product differentiation inflow into the market

-

Supplier capabilities, strategies and innovations are growing with the demand of animals for testing

Threat of Substitutes

-

Threat of substitutes is moderately high in the market, as alternate testing methods are gaining traction, due to ethical and animal rights regulations in many European countries to replace in-vivo testing methodologies. Product differentiation and ease of substitution are extremely high

Buyer Power

-

Pharma’s buying power will remain moderately high, as the number of buyers is steadily increasing with increased purchase quantity

-

CROs are also expecting a good volume of business from small Biotech companies in the next 1–2 years, due to the increase in venture funding for small Biotechs

-

Product dependency and backward integration are moderate on the buyer’s side

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now