CATEGORY

Drug Development Biometrics Services

Use of IT tools and technology to enhance quality of data from clinical trials.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Drug Development Biometrics Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Drug Development Biometrics Services Suppliers

Find the right-fit drug development biometrics services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Drug Development Biometrics Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDrug Development Biometrics Services market report transcript

Drug Development Biometrics Services Market Outlook

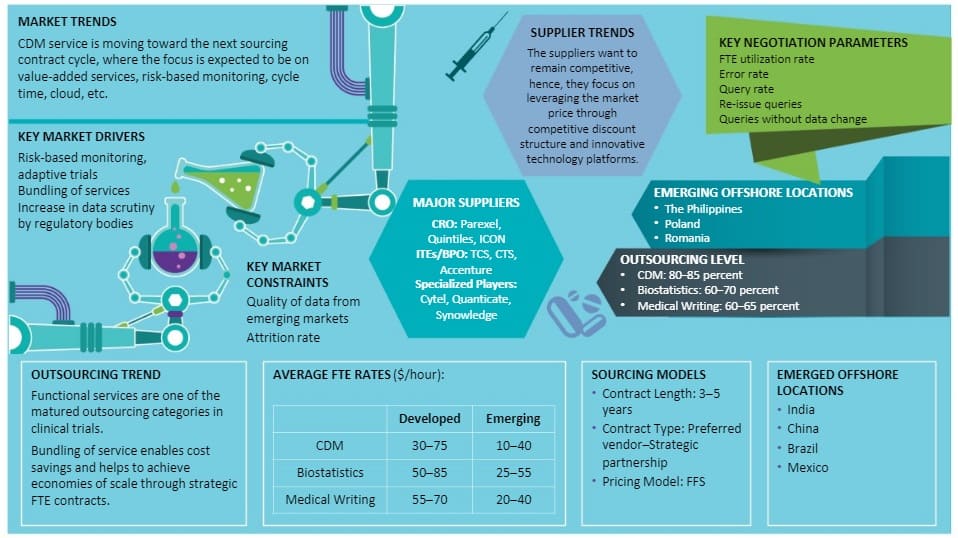

CDM

- The future growth would be driven by the increasing demand for adaptive trials, which, in turn, will increase the data points and use of EDC

- The increased outsourcing by pharma has resulted in the highest revenue generation of 50–60 percent to the CDM market, followed by biotech companies (20–30 percent)

- CDM service is moving toward the next sourcing contract cycle, where the focus is expected to be on value-added services, risk-based monitoring, cycle time, cloud, etc.

- Risk-based monitoring, adaptive trials, bundling of services and integration of Big Data analytics and application of AI are key market drivers.

- The suppliers want to remain competitive, hence, they focus on leveraging the market price through competitive discount structure and innovative technology platforms.

- The key market constraints are the quality of data from emerging markets and attrition rate.

Biostatistics

- On an average, large pharmaceuticals spend 5–7 percent of the overall clinical trials budget for biostatistics function

- Due to the increased data scrutiny by the USFDA, the Biostatistics market is expected to grow at 14–15 percent for the next 3–5 years

SAS Programming

- SAS Programming has been bundled with the biostatistics. Large number of institutions have been opened in Southern India to cater to the increasing outsourced demand

Medical Writing

- Medical writing is bundled with Biostatistics and is performed largely, based on the specific skill required per project. Large CROs have third-party network to sub-contract services

- This is a highly fragmented market, with the entrant of new players, as pharmaceutical companies have been outsourcing their non-core activities

Market Share by Trial Phases and Therapeutic Area

- Phase II and III constitute the major part of the biostatistics services, as voluminous data are analyzed in these stages. This is expected to be the same, as the USFDA requirements are increasing

- Biometrics outsourcing has become a trend. Novartis has signed a deal with Covance for preclinical and CDM services. This will further strengthen the biometrics outsourcing market

- Data management services have witnessed a positive trend, due to the increased adoption of phase IV trials across the globe

- The therapeutic area constitutes a minor portion of outsourcing biostatistics services. The only change noticed in the therapeutic area is the volume of data analyzed from Oncology, which has increased from 11 percent to 27 percent, and other major therapeutic areas have not seen much changes

Outsourcing Peneteration

CDM

- Buyers off-shore CDM to India, due to cost-saving opportunities and large number of skilled resources

- Increase in e-CRF complexities, demand for adaptive trials, and increased data points during the clinical trials leads to further outsourcing of CDM

Biostatistics

- Increased biostatistics outsourcing adoption and manpower rationalization by large pharma to low-cost countries

- Bundling of biostatistics services with CDM to leverage further cost savings

- Increased data scrutiny by regulators lead to increase in in-house FTEs and technology cost, resulting in further outsourcing

SAS Programming

- Among the biometrics outsourcing, statistical programming requires niche skill for service delivery

- More reliance on data from clinical and real world will drive the market

Medical writing

- Fourth most frequently outsourced clinical study function. It has seen a change from near shoring to offshoring in the past few years

- CROs have been the prime preference, due to the niche clinical knowledge. CROs still hold 70 percent of the market

- Lack of quality resources in emerging markets is still a concern for large pharma, which requires rework

- Crowd sourcing is one of the alternatives being followed through medical writing expert networks

Market Overview

- The FTE distribution of 800–1,200 in India mainly comprises of entry-level and mid-level roles, such as SAS programmers, senior SAS programmers, who are needed in a greater number to carry out biostatistics compared to that of statisticians, senior bio-statisticians, who are needed on a lesser volume and are extensively available in Western countries.

- India is the largest market for statistical service providers overtaking the North American and European suppliers.

- ITES/BPOs have the largest presence in India and large pharma have partnerships with them for CDM, this partnership could be leveraged across clinical biostatistics as well.

- Due to high demand, large pharmaceutical companies outsource majority of their services to large ITEs/BPOs in India and China.

- Typical bundling of biostatics with EDC development and CDM, sometimes medical writing is seen for appropriate management of critical data variables.

- In certain scenarios, biostatistics is kept in-house, due to the analysis of clinical trial data being presumed as core activity or due dissatisfaction arising from previous bio statistics outsourcing experiences.

Why You Should Buy This Report

Information about the drug development biometrics service market size, overview, share, benefits, major suppliers, bio statistics outsourcing, medical writing, etc. Regional analysis, market trends, drug development biometric services procurement intelligence and Porter’s five force analysis Pricing models and billing rates for biostatistics and medical writing.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now