CATEGORY

Clinical Research Organizations

Outsourced Market for Patient trials.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Clinical Research Organizations.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Clinical Research Organizations Suppliers

Find the right-fit clinical research organizations supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Clinical Research Organizations market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoClinical Research Organizations market report transcript

Global Market Outlook on Clinical Research Organizations

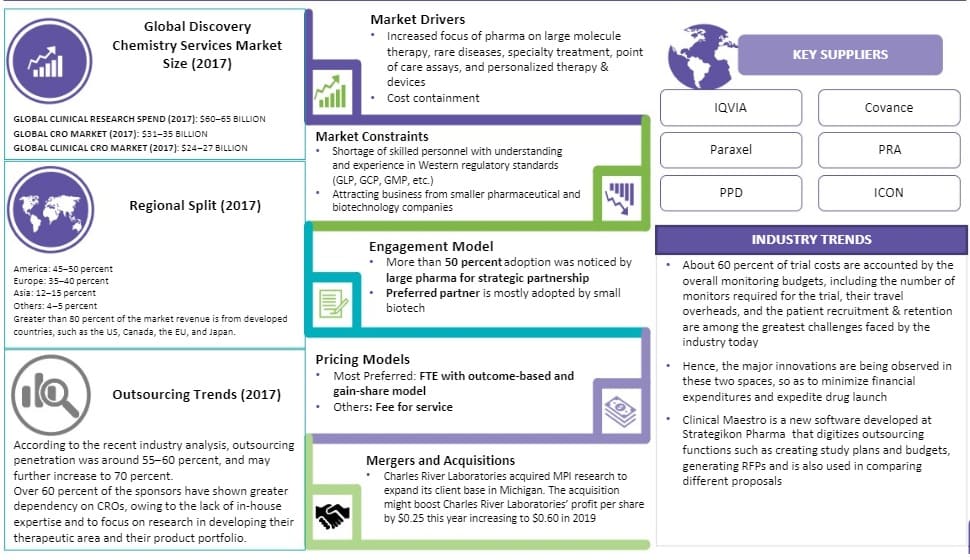

The global CRO market was estimated at $31.6 billion in 2018, and it is expected to grow at a CAGR of 12 percent to reach $45.2 billion by 2022

This is due to the increased outsourcing (>50 percent) seen from the pharmaceutical and biotechnology companies, with 85 percent comprised by the clinical segment

- Drug discovery is the largest segment by service type and accounts for approximately 33%,of the total CRO market

- Although spend on specialty focus, such as rare diseases, personalized medicines, and specialty oncology, has increased, the larger portfolio by spend size would continue to drive the programmatic CRO market

- The clinical segment of the CRO market is valued at $30.6 billion in 2017 and is expected to grow at a CAGR of 7 percent. Almost 85 percent of the global CRO market revenue comes from the clinical CRO market. This is directly related to about 50 percent of Phase II–IV activities already being outsourced by pharma companies

- On the other hand, the preclinical segment was valued at $2.8-3 billion in 2017 and is expected to grow at a CAGR 10 percent, as more in-house preclinical activities such as discovery and early phase studies are beginning to be outsourced by pharma companies at a range of 38-40 percent

- The CRO market is split regionally as America: 45–50 percent, Europe: 35–40 percent, Asia: 12–15 percent, Others: 4–5 percent. Greater than 80 percent of the market revenue is from developed countries, such as the US, Canada, the EU, and Japan.

- The top CROs are IQVIA, Paraxel, PPD, Covance, and PRAICON.

- Constraints in the contract research organization market include shortage of skilled personnel with understanding and experience in western regulatory standards (GLP, GCP, GMP, etc.) and challenges in attracting business from smaller pharmaceutical and biotechnology companies.

Regional Analysis

North America and Europe hold greater than 80 percent of the CRO market, as pharma spend ~70 percent and 18 percent of their clinical trial R&D spending in these regions, respectively

- Though the cost of conducting clinical trials in emerging countries will be 60 percent less than that of developed countries, greater than 80 percent of the market revenue is from developed countries - US, Canada, the EU, Japan

- APAC contributes to 10 –15 percent of the overall CRO revenue, which makes this region the third largest market share holder with increased trials being seen in China, Russia and South Korea

- Increased outsourcing of clinical services such as Clinical Data Management, Biostatistics, Pharmacovigilance, etc., by large pharma to emerging market of India is being seen. The reason being low cost labor availability, which will further drive up the revenue of Asia-Pacific region in the future

CRO Market Drivers

- Pharma companies have increased outsourcing their in-house R&D activities to CROs

- Large molecule development outsourcing has increased from ~35 percent to 45 percent, due to more supply and availability of reliable single use technology

Cost Containment

- Pharmaceutical companies one of the major factors is to reduce costs, by lowering their internal capacities in manufacturing and R&D. This leads to expenses being diverted toward outsourcing, making CROs play an integral part of pharma to increase their productivity, access new capabilities, shift fixed to variable costs, and improve their global reach

Real World –Data and Analytics

- As regulators and payers place increasing importance on RWD, pharma is seen to partner with CRO, to support with predictive modeling, analytics, etc. This is driving CROs to either acquire or partner with specialists in this area

- E.g., PPD is working to expand its expertise for RWD by joining forces with a division of insurance giant Anthem

Emerging Markets

- The emerging markets of Brazil, China, Russia are witnessing increased trials, creating demand for regional CROs, with strong regulatory knowledge. For example, OCT, Intrials, etc.

- Examples: Offshoring of HEOR, pharmacovigilance services to India offer cost saving of ~30–45 percent. The acquisition of Quantum Solutions India by Parexel is an example of this growing trend. South Korea is emerging as the next early phase destinations, with a 8.22 percent CAGR between 2012 and 2016

New Areas of Research and Regulations

- The increased focus of pharma on large molecule therapy, rare diseases, specialty treatment, point of care assays, and personalized therapy & devices will require clinical trial testing and submission of data to the relevant regulatory authorities. For example, >80 percent of CRAs of INC Research are principally focused on one therapeutic area

- Also, the depth of regulatory scrutiny has increased, such as early RWD collection and reporting every adverse events, driving increased clinical trials

Clinical Research Organizations Market Overview

Currently, EDC and CTMS are the most commonly used data sources for clinical data management market, however, with the growing adoption of RBM, majority of the companies will move to more sophisticated technologies for clinical research organization.

60 percent of trial costs are accounted by the overall monitoring budgets, including the number of monitors required for the trial, their travel overheads, and the patient recruitment & retention. Hence, the major innovations are being observed in these two spaces, so as to minimize financial expenditures and expedite drug launch.

The fragmented contract research organizations market witnessed continuous mergers and acquisitions from 2012 to 2017. This has, in turn, resulted in continued consolidation of the contract research organization market, with the top 10 suppliers, holding >55 percent of the market share.

Why You Should Buy This Report

- The Beroe analysis report gives the CRO market drivers, technology trends and innovations and outsourcing penetration analysis.

- The report lists out the market share of the top contract research organizations, key mergers and acquisitions, recent trends and innovations and best industry practices.

- It lists the major suppliers in the clinical data management market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now