CATEGORY

Drug Development Core Lab

Field labs that focus on specific areas of assays such as ECG or sprometry.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Drug Development Core Lab.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Drug Development Core Lab Suppliers

Find the right-fit drug development core lab supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Drug Development Core Lab market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDrug Development Core Lab market frequently asked questions

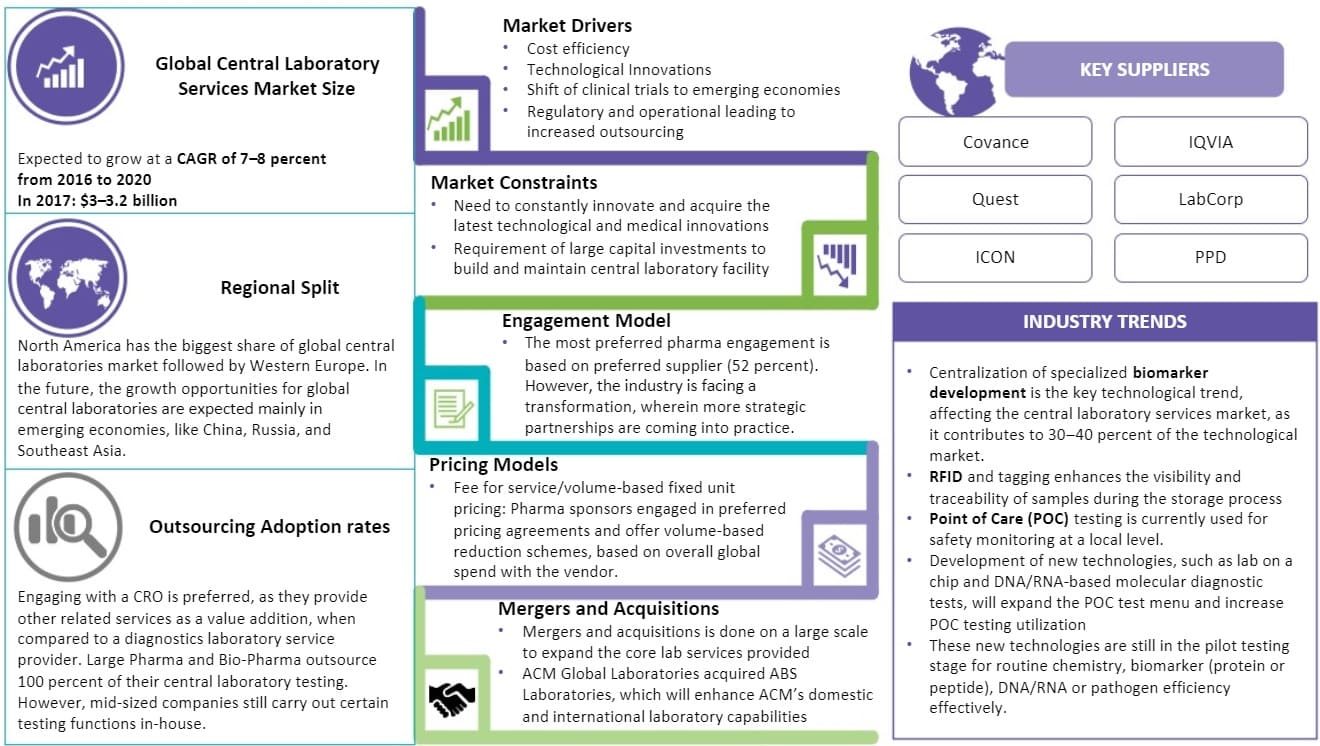

According to Beroe's market analysis reports, the global central laboratory services market size is expected to grow at a CAGR of 7-8 percent from 2016-2020.

From the 2017 reports from Beroe, the global central laboratory services market was valued at around $3-3.2 billion.

Cost efficiency, technological innovations, shift or clinical trials to emerging economies, regulatory and operational leading to increased outsourcing are the factors driving the global central lab services market.

In the central laboratory services, there is a constant need to innovate and acquire the latest technological and medical innovations and drug development laboratory equipment acting as a market constraint. The other factor is the need for large capital investments to build and maintain a central laboratory facility.

Covance, Quest, ICON, IQVIA, LabCorp, and PPD are the key suppliers in the global central laboratory services market.

North America has the largest share of the global central laboratories market followed by Western Europe. However, the drug development market regions with emerging economies like China, Russia, and Southeast Asia seem to have good growth opportunities in the future.

Pricing, specialty testing, global reach, logistics management, flexibility, proactive communication, extensive customer base, and industry reputation are some of the critical parameters which are taken into consideration to decide on a vendor.

Some of the major reasons for the consolidation and integration of central laboratory services through acquisitions and collaborations are ' ' Expansion beyond the core services ' Catering to the growing client demands for one-stop drug development lab equipment and solutions ' Need for specialized core labs because of project-based outsourcing from pharma companies

Centralization of specialized biomarker development is the major technological trend contributing to 30-40 percent of the technological market and having a significant impact on the central laboratory services market.

By 2020, the market for robotics and automated liquid handling is expected to reach about $5.1 billion. It enables space optimization, provides cost efficiency, and ensures quality in central lab operations.

Drug Development Core Lab market report transcript

Global Market Outlook on Drug Development Core Lab

-

The market is moving toward consolidation through mergers and acquisitions. Currently, around 60-65 percent of the market share is being held by the top six service providers, where Covance and Q2 solutions are considered the leaders, contributing to 35–40 percent of the overall central lab market

-

The dynamics of outsourcing of this category by large pharma has shifted to a more consolidated base, with two or three preferred vendors to support their global central lab operations. The leading service providers include large CROs, like IQVIA, as well as specialized central laboratory service providers BARC. Acquisition of Covance by LabCorp by has allowed pharma companies to venture into new options of comprehensive outsourcing of central laboratory work

Outsourcing Adoption Rate

- Currently, large pharma engages with three or more global central laboratory service providers as preferred service providers on a fee for service basis

- This relationship is shifting to strategic partnerships (up to 10 years) with one or two full service providers (Covance, PPD) with a global in-house capacity and value or milestone- based pricing models

- Engaging with a CRO is preferred, as they provide other related services as a value addition, when compared to a diagnostics laboratory service provider

- Pricing, specialty testing, global reach, logistics management, flexibility, proactive communication, extensive customer base, and industry reputation are some of the critical parameters to decide on a vendor

Market Trends–Consolidation of Core labs

Current major trend in the Central laboratory market is the horizontal integration via consolidation and integration of services through acquisitions and collaborations.

Major reasons for such collaborations and acquisitions:

- To expand beyond core services

- To meet the increasing demand of clients by providing one-stop shop solution to their clients

- Need for specialized and experienced core labs because of project-based outsourcing from pharma companies

Technology & Innovation Trends - Central Laboratory Services

- Centralization of the specialized biomarker development using digital pathology results in cost and testing time reduction

- It is the key technological trend, affecting the central laboratory services market, as it is one of the fastest growing technologies, contributing up to 30–40 percent of the technological market

- RFID and tagging enhances the visibility and traceability of samples during the storage process

- Adoption of dry blood spot testing technologies (CAGR 8–9 percent) resulted in process optimization as well as high cost efficiency

- Point of Care (POC) testing is currently used for safety monitoring at a local level

–Centralization and integration of the results locally generated would be a challenge to the central laboratory services

–It is expected to be leveraged in the future by engaging with alliance partners at local and regional levels by the global central lab providers

- The market for robotics & automated liquid handling (e.g., dry vapor shipping), which enables space optimization, provides cost efficiency and ensures quality in central lab operations are expected to reach about $5.1 billion by 2020

Centralization of specialized biomarker development is the key technological trend, affecting the central laboratory services market, as it contributes to 30–40 percent of the technological market

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now