CATEGORY

Jet Fuel

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Jet Fuel.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoJet Fuel Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoJet Fuel Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Jet Fuel category is 6.31%

Payment Terms

(in days)

The industry average payment terms in Jet Fuel category for the current quarter is 49.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

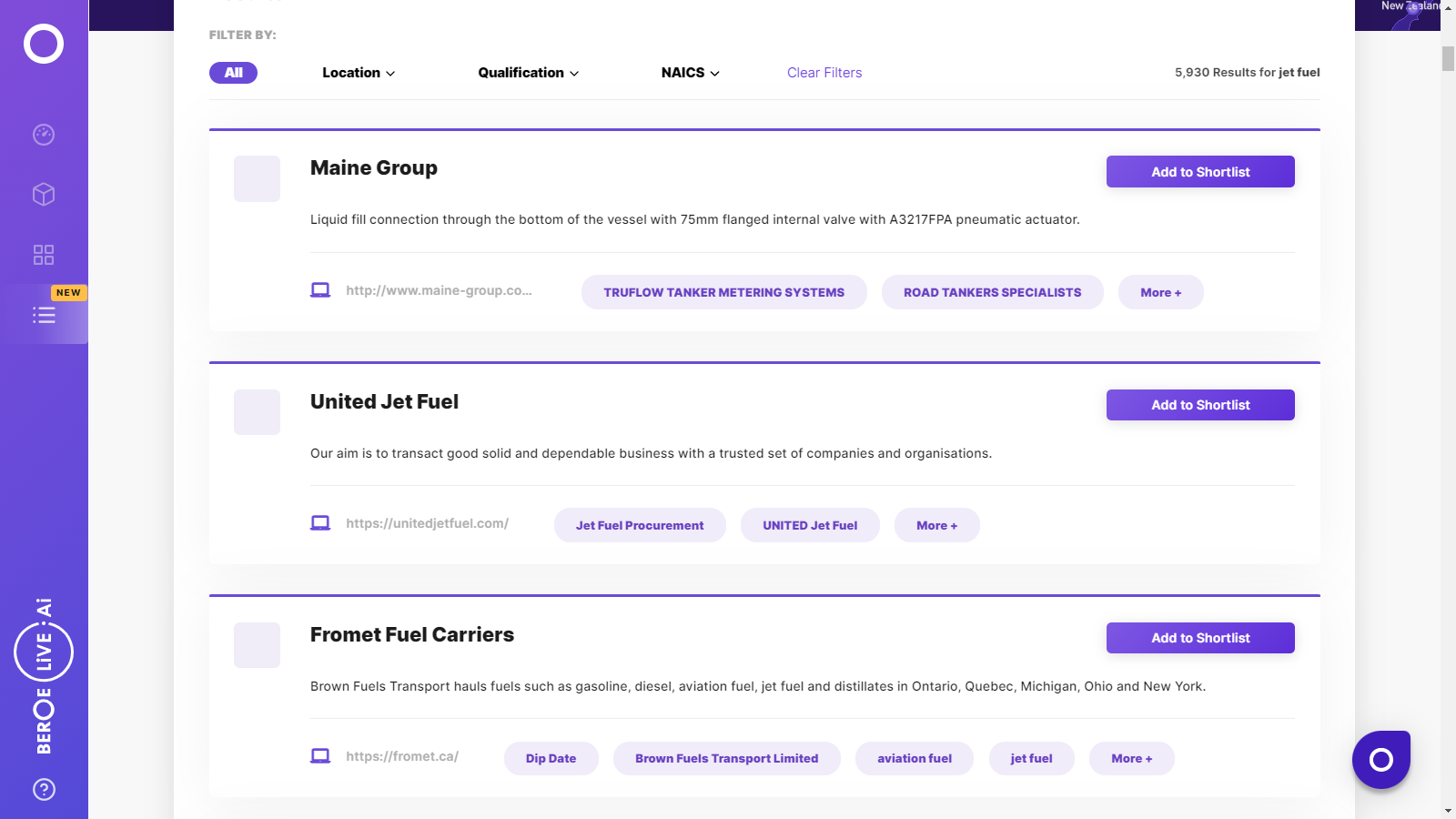

Jet Fuel Suppliers

Find the right-fit jet fuel supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Jet Fuel market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoJet Fuel market report transcript

Jet Fuel Global Market Outlook

-

The global demand for liquid fuel in 2020 was at 91 Mbpd, about 10 percent lower than 2019. It is expected to grow by 6 percent in 2021 and reach 96.5 Mbpd*

-

The global product demand for Jet Fuel during 2020 was 23.7 Mbpd, and it is forecasted to reach ~25.4 Mbpd by 2021

-

The demand for fuel in 2021 is likely to show some stagnancy during H1 2022, as rise in infections from the newly detected variant is expected to hinder airline industry demand

Impact of COVID-19 on Jet Fuel Industry

-

The expectation of a fresh spread in infection is expected to loom over the demand for jet fuel for the coming 1-2 months

-

The jet fuel demand is expected to stay low in the coming months over the concern of omicron variant induced infections

-

Strict guidelines on international flight have impacted the jet fuel demand and prices, which is likely to continue for 1-2 months

Porter’s Five Forces Analysis on Jet Fuel Industry

Supplier Power

-

Large oil companies have direct impact on the crude oil and refined product pricings as most of the large players are vertically integrated with presence in Upstream to downstream operations

-

Oil cartel like OPEC and large producers like the U.S. and Russia have significant bargaining power over the prices of oil and its derived products like gasoline, diesel, jet fuel and kerosene, etc.

Barriers to New Entrants

-

Huge investment in setting up plants as well as in acquiring resources

-

Most of the major oil and gas companies are state owned enterprises

-

Regulatory restrictions made by Governments

-

High geopolitical influence

Intensity of Rivalry

-

Intensity of rivalry is significantly high among the top global suppliers especially among the suppliers who are in both upstream and downstream business

-

E.g., the increased output of OPEC and the U.S. led to over supply of oil and subsequently the major price fall of oil products

Threat of Substitutes

-

Aviation gasoline is an alternate jet fuel to jet kerosene.

-

However, the impact of aviation gasoline on jet fuel is low as both the fuels are used in different models of aircraft

-

The higher blends of SAF and other innovative energy technologies like hydrogen, are still under infancy stage pose a threat to jet fuel

Buyer Power

-

Bargaining power of aviation fuel buyers is usually on the low-medium side

-

Large fuel consuming airlines have direct contract with Oil marketing Companies and have volume based negotiations

-

Location of the airport and supplier presence too impacts the jet fuel buyers power, especially for low volume consumers

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now