CATEGORY

Industrial Gases

The report covers in detail the market supply demand dynamics, supplier landscape, pricing analysis and procurement best practices across the industries for Industrial Gas

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Industrial Gases.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

India to advance large-scale green hydrogen production

July 04, 2022India to advance large-scale green hydrogen production

July 04, 2022India to advance large-scale green hydrogen production

July 04, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Industrial Gases

Schedule a DemoIndustrial Gases Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoIndustrial Gases Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Industrial Gases category is 7.20%

Payment Terms

(in days)

The industry average payment terms in Industrial Gases category for the current quarter is 55.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Industrial Gases Suppliers

Find the right-fit industrial gases supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Industrial Gases market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIndustrial Gases market report transcript

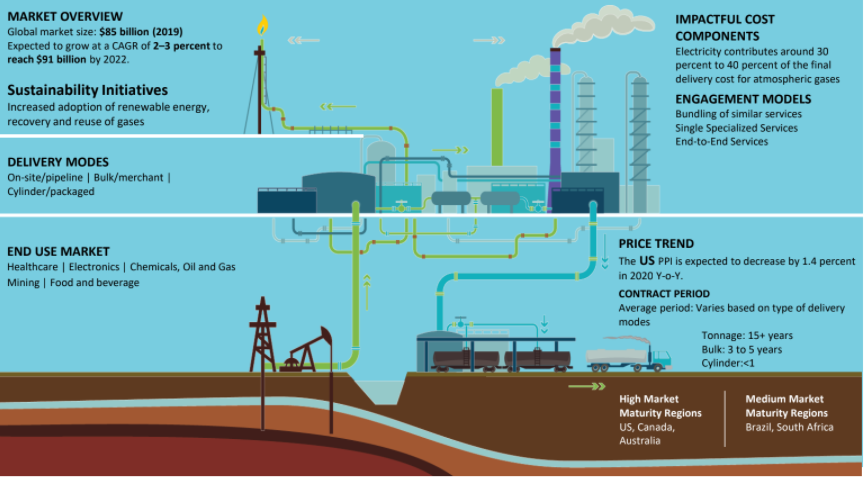

Global Market Outlook On Industrial Gases

-

The global industrial gas market was around $88 billion in 2022, which is expected to grow at a CAGR of 2–4 percent between 2022 and 2024

-

The market witnessed a contraction in 2020, due to the COVID-19 outbreak and lower industrial demand. The market witnessed recovery in 2021 with end-use industries, including chemicals & refining, food & beverage, electronic, healthcare, etc., showing increase in demand

Global Market Size - Industrial Gas

-

The industrial gas market is estimated to have grown to 88 billion USD in 2022, driven by Asian economies and demand from the US. Industrial gas is expected to see growth in market size in 2023 by around 3 percent from 2022 levels.

-

The global industrial gas market was estimated to be around US$88 billion in 2022, rising from US$ 85 billion in 2021. Demand increased in energy and manufacturing sector due to recovery from COVID-19 pandemic

-

The major drivers for growth would be emerging economies, including China and India. In 2022, rare gases, such as krypton and xenon, faced tight supply, due to supply bottlenecks, amid recovery in demand. Fire in Amur plant in Russia could further delay stable supply from Russia and this could result in tight helium market as the demand recovers

-

North America, North Pacific rim (China, Japan, etc.), and Western Europe are the biggest markets contributing more than 75 percent of global market

Global Demand by Application

-

The overall growth outlook for the end-user industries in the mid-term future is moderate. Healthcare, electronics, etc., are major growth drivers. Chemical and refining segments are witnessing a recovery after declining in 2020, due to the COVID-19 pandemic.

Key Trends

-

Manufacturing sector was affected due to COVID-19 resulting in lower sales volume for larger suppliers in Americas and Europe. The sector is witnessing recovery because of reduced restrictions and increased economic activity

-

Regulations for cleaner energy fuel and innovations in renewable space are driving the demand for hydrogen and on-site hydrogen market

-

Increased use of digital devices and the growth of semiconductor industry has made electronics market a leading consumer of industrial & specialty gas

-

Healthcare needs and aging population have driven the demand for pure and complex gases. COVID-19 has increased the demand from healthcare segment since 2020. Increased medical oxygen demand also helped to increase share of healthcare market

-

Food and beverage sector also witnessed growth in 2021 and 2022 although CO2 shortages affected some sectors in the US and Europe

Industrial Gas Cost Structure

-

High electricity requirement, in separation of industrial gases, makes it a primary cost factor and accounts for 50 percent of the overall production cost.

-

Electricity cost accounts for around 50 percent of the cost of generation and hence, the cost of production fluctuates with electricity prices. The weightage of cost factors could vary based on price change of individual parameters in each country

-

Recovery in crude oil price is likely to exert upward pressure on distribution cost. Electricity price is also expected to increase moderately, resulting in surge in production cost

-

Large-scale operation provides lower production cost per unit of gas as compared to small independent ASUs for producing industrial gases separately

-

High capital costs associated with ASUs require large industrial consumers to opt for long-term gas purchase contracts (3 years for bulk liquid and 15 years for tonnage)

Industrial Gas Price Drivers

Energy Cost

-

Electricity is the main source of energy in separation of air and drives the cost of production of industrial gases

-

Large scale production has advantage over small units as smaller units have higher specific electricity consumption

Labor Cost

-

Impact of labor is relatively lower for industrial gas production and has very little effect on the overall cost of production of different grades of gases

Logistic Cost

-

Fluctuations in fuel prices have a direct impact on the overall logistic costs of transporting cylinders or bulk liquid trucking

-

Companies are optimizing routes and establishing filling centers to reduce cost associated with long distance transportation of gases

Oil & Natural Gas Price Fluctuation

-

For gases like hydrogen and helium, feedstock cost fluctuations have large impact on production cost and hence companies are forward contracting to manage price risks

-

It is directly linked to the raw material price hikes. It is also highly affected by indirect transportation cost

Quality/Special Gas

-

If the composition of gas requirement is proprietary, it generally costs very high and requirement of high quality gas also drives cost. Low quality gas and general gases carry lesser cost due to availability of multiple sources of supply

Gas Purity

-

Industrial gas companies price gases based on purity level and high purity gas requirements drive prices

Frequency of Purchase

-

Non frequent purchase of gases will drive prices and hence industrial gas customers are optimizing usage volume and frequency for consistent purchase of gases

Customized Products

-

Complex design, specific gas products are tailor-made, which involves high value of production

-

This drives the prices of such products as their availability is through select channels

Volume of Purchase

-

Volume of purchase remains a key factor in determining prices as this can impact overall logistic costs and company’s margins

-

High volume of purchase suitable of FTL transportation can gather high discounts

Delivery Location

-

Industrial gas companies price differently to different delivery locations based on their availability of infrastructure

-

Delivery at locations where supplier has no presence would require new infrastructure and could drive prices

Industrial Gas Sourcing Best Practices

-

An individual site, preferably, should source nitrogen, hydrogen and oxygen from the same supplier

-

Volume driven lower pricing is possible with a site when the same supplier is chosen for one site, the reason being that, the supplier would be able to achieve economies of scale and volumes due to output of nitrogen and oxygen, that are dependent on the ASU

-

The suitability of supply options moves from cylinder to on-site generation based on quantity

-

The supply mode for a particular site should be based on a careful estimate of projected demand

The report on the industrial gas market contains the quantitative and qualitative assessments of multiple factors such as the major industry drivers and restraints that will impact the revenue growth. In addition, the research study offers information about the regional industrial gas industries contributing to the global market growth.

It consists of the competitive landscape that incorporates the leading and emerging market players and the strategies adopted by them including new product launches and collaborations. Moreover, the analysts at Beroe have leveraged various research methodologies such as Porter’s Five Forces analysis to pull out insights into the existing industry trends and developments that will drive the market revenue during the forecast time frame.

Methodology for Writing This Report

Beroe gathers intelligence through primary sources that include industry experts, researchers, and consultants, as well as current suppliers, producers and distributors. Secondary sources include business journals, newsletters, magazines, market research data, company sources, and industry associations. Following data collation, analysis, and strategic review, the Final Research Report is published on Beroe LiVE.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now