CATEGORY

Gasoline

Increasing concerns over carbon dioxide emissions and fuel efficiency have resulted in stricter regulation on fuels. Ability of the gasoline fuel to reduce emissions as well as improve fuel efficiency is resulting in its higher demand

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Gasoline.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoGasoline Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

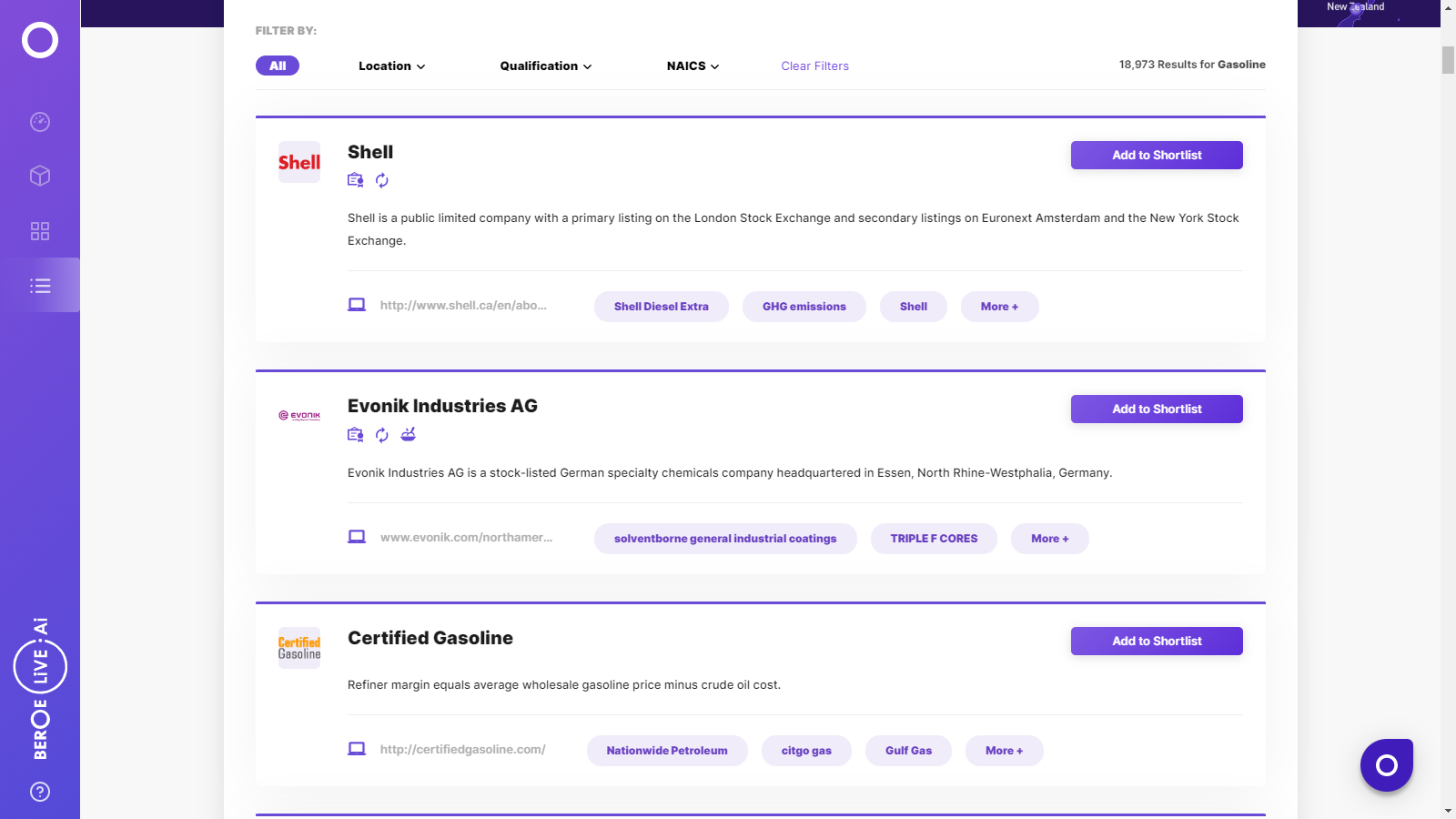

Gasoline Suppliers

Find the right-fit gasoline supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Gasoline market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoGasoline market report transcript

Gasoline Global Market Outlook

-

The global product demand for motor and aviation gasoline during 2022 was estimated to be 235.89 Mbpd, and it is forecasted to reach ~250 Mbpd by 2023

-

The demand for fuel in 2022 has increased from Q1 2022, owing to the ease in COVID restrictions, rapid economic revival actions, and Russia–Ukraine war, which is expected to create a supply deficit. This, in turn, is anticipated to increase oil prices. Hence, the prices of oil derivatives are also expected to be volatile in Q2 and Q3 2023

Gasoline Regional Market Outlook : North America

Market Trends

-

The US and Canada together are estimated to have a demand of 113 Mbpd during 2021*, in which the US accounts to approx. 92.6 percent

-

The oil & gas market is in oversupply, and the refineries in the North American region (especially, the US) must look beyond the region to exports

Drivers and Constraints for Gasoline

Drivers

Energy Efficiency

- Having high-energy density per unit volume, diesel and gasoline is preferred in the markets, such as commercial heavy-duty vehicles, power generation, and in various other industrial applications for its high energy/thermal efficiency

Heavy Transport Sector

- Growing demand for the heavy transport sector, especially in the emerging economies, like China, India, Brazil, and Indonesia, drives the demand for diesel and gasoline fuel

Constraints

Environmental Policies

- Stringent emission standards on diesel and gasoline lowering sulfur emissions. By imposing “Clean Air Zones”, the governments around the world have put some restrictions to drive diesel and gasoline vehicles

Geopolitical Tensions

- Geopolitical tensions over the Russia–Ukraine front and lack of production clarity between the US and Russia and OPEC countries impact the oil and underlying refined product market and prices

Alternative Fuel Vehicles

- Increasing usage of alternative fuel vehicles, such as Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG) vehicles, could hamper the diesel and gasoline fuel market though the penetration level is low. Countries, like the US and China, are creating dense network of natural gas refueling stations

Gasoline Supply Trends and Insights

Oil Demand Outlook

-

Oil Demand: Global oil demand in 2022 is estimated to have grown by 2.5 mb/d, y-o-y, supported by solid economic activity from OECD and non-OECD countries other than China, which saw a decline in its yearly oil requirements. However, the lifting of China’s zero-COVID-19 policy in December 2022 is expected to support its oil demand in 2023. Meanwhile, the OECD is forecast to see somewhat slower oil demand increases this year, leading to forecast global oil demand growth in 2023 at 2.3 mb/d, y-o-y

-

Outlook: In 2022, OECD oil demand increased by about 1.3 mb/d, y-o-y, led by OECD Americas, which increased by about 0.7 mb/d, y-o-y. In OECD Europe, oil demand grew by 0.5 mb/d, y-o-y, while OECD Asia Pacific saw minor growth of 0.1 mb/d, y-o-y

Refinery Impact

-

Capacity Drops and Closures: The refinery sector is likely to witness a significant impact, in terms of capacity closures and idling. About 2.5 mbpd of capacity is expected to go offline by 2025, and by 2045, an additional 6 mbpd would go offline. This trend is expected to bring out a balance between demand and supply, and to bring back a healthy utilization rate, which is about 80 percent from the current 73 percent

-

Capacity Additions: In January, refinery margins reversed trend and strengthened substantially in all main trading hubs, with sizeable margin gains registered, particularly in the Atlantic Basin, vastly backed by a solid recovery in gasoline performance

Engagement Trends

-

Most Adopted Model Globally: Engage with OMC or dealer

-

Why: Engaging with OMC directly would help in avoiding additional dealer costs and more likely help in stabilizing the prices, as OMCs are usually backward integrated up to refining or even exploration stages

-

Contract Length: 1 year

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now